The Strong and Simple regime is expected to be a simplified prudential framework which will apply to banks and building societies with are neither systemically important nor internationally active. The Strong and Simple regime will seek to address concerns that the regulatory framework for smaller banks and building societies has become too complex and disproportionate as a result of post financial crisis reform measures.

The intention is that this will increase competition and innovation in the UK banking sector. The regime is intended to be flexible enough to cater for a range of business models and will continue to meet the PRA’s primary objective of ensuring that regulated firms operate in a safe and sound of manner.

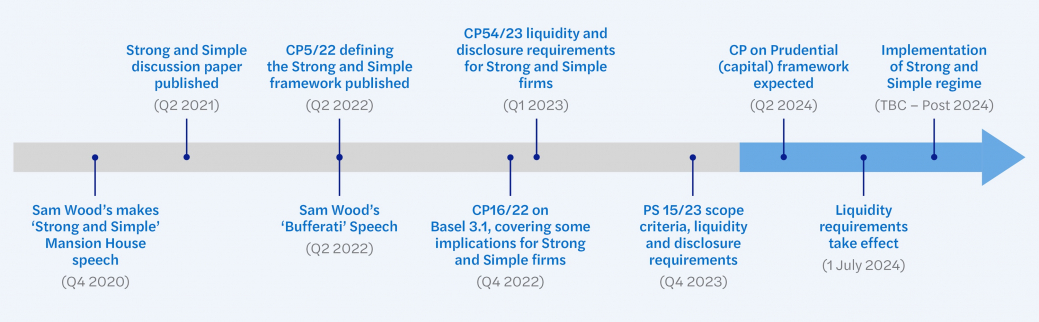

After a slow start, a consultation paper was published by the PRA in April 2022. This sought to define a ‘Simpler-regime Firm’. Further detail has been promised on how this will work in practice from a capital (expected 2024) and non-capital (expected 2023) perspective, prior to implementation of the regime.

We will be able to provide the following:

- Training to ensure firms are up to date with the new regime.

- Advise on implementation, including timelines.

- Support updating of internal procedures and processes.

- Provide review and gap analysis against the new regulatory expectations.

- Regulatory Reporting support.

- Capital and Liquidity analysis and support.