Strong and Simple – Does this apply to your firm?

Strong and Simple – Does this apply to your firm?

Criteria

1. Total Assets

A firm’s average total assets will need to be below £20 billion, defined under Financial Reporting Standards (FINREP) and calculated using the mean of total assets reported during the previous 36 months.

If a firm does not have 36 months of data to calculate total assets, it can use the available data previously submitted from authorisation. Furthermore, if a firm has not yet been required to report its total assets, thereby having no available data to use, it can reasonably forecast its total assets and use this figure against the requirement.

2. Geography of Firm Assets

At least 75% of the firm’s total relevant credit exposures, defined under the C 09.04 (Common Reporting Standards) COREP template, should be in the UK, determined mean of the previous 36 months where the firm was required to report the geographical location of its relevant credit exposures using template C 09.04. For example, many subsidiaries of foreign firms with a large portion of their lending book outside the UK would not qualify for the Strong and Simple Regime.

If a firm has not reported over 36 months, the relevant credit exposures should be treated the same as the method outlined in ‘Total Assets’. However, the requirement changes so that at least 85% of the firm’s total relevant credit exposures should be located in the UK, as defined under C 09.04 COREP.

3. Trading Book Business

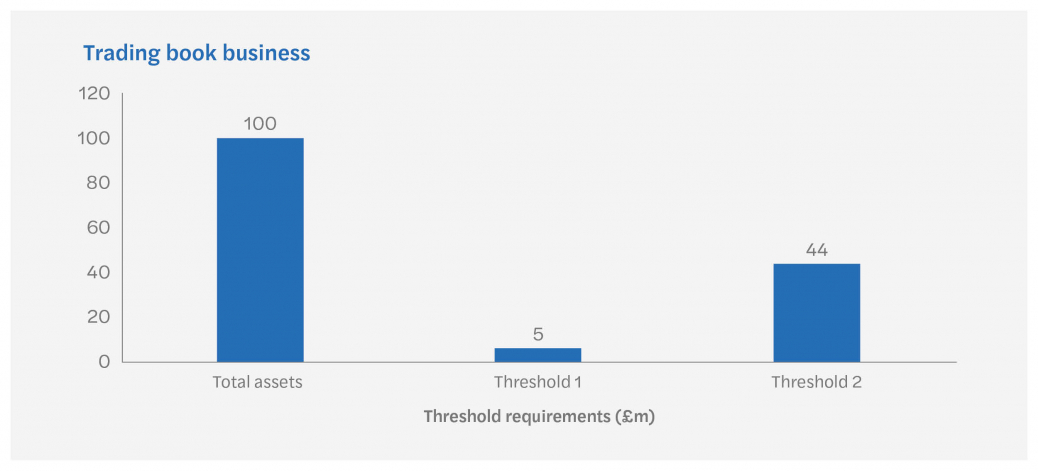

The current size of the firm’s on- and off-balance-sheet trading book business should be less than (or equal to) both 5% of the firm’s total assets and £44 million, as assessed based on Article 94(3) of Chapter 3 of Trading Book (CRR) Part. This assessment should be met on the last day of at least one of the preceding three months and on the last day of at least six of the preceding twelve months. Banks that use financial instruments to hedge against different forms of risk are likely to have large exposures and, therefore, would not qualify for the Strong and Simple Regime.

For example, if a firm’s total assets were equivalent to £100m, then the Trading Book requirements would be £5m or less as this satisfies both conditions to become a Simpler-regime firm.

4. Net Foreign Exchange Position

The firm’s overall net foreign-exchange position, calculated according to the method specified in Article 352 of CRR, should not exceed 3.5% of its Own Funds. Additionally, on average, it should not exceed 2% of its Own Funds in at least one of the preceding three months, and in at least six of the preceding twelve months.

5. Certain clearing, settlement, and custody services.

The firm should not provide clearing, transaction settlement, custody, or correspondent banking services to a UK bank, a building society, or a non-UK credit institution. This includes acting as an intermediary to access the facilities or services of:

- A payment system, CSD, third-country CSD, SSS, or central counterparty in which the firm is a direct or indirect participant or member.

- An exchange, other trading facility, clearing house or any other financial market utility or infrastructure, either directly or indirectly.

A firm may provide clearing, transaction settlement, custody, or correspondent banking services in sterling to a UK bank, building society or non-UK credit institution that is a member of the firm’s immediate group.

There are several other requirements that firms will need to meet to be classed as Simpler-regime firms. These are:

6. No holdings of commodities or commodities derivatives.

7. No IRB approvals.

8. The firm is not an operator of a payment system.

9. Any undertaking of which the firm is a subsidiary is a UK undertaking.

Consolidated vs Single Entity

Single entity firms that are authorised by the PRA need to pass all the requirements laid out in this article to become a Simpler-regime firm. These requirements would be the same for member entities within a UK consolidated group, providing that each UK Bank and Building Society within the group is willing to consent to the regime simultaneously.

PRA authorised banking subsidiaries firms can apply to become a Simpler-regime firm if they can satisfy the criteria set out in points (1) to (4) and (6) to (7). Additionally, this includes the criteria for (3) and (4) only being met on the last day of at least one of the preceding three months.

The criteria outlined in points (5) and (8) need to be met for each UK banking subsidiary within the consolidated group.