CJRS – What’s the latest position?

CJRS compliance

The Coronavirus Job Retention Scheme (CJRS) was used to help protect businesses and over 11.5m jobs with c. £70bn paid out between March 2020 – September 2021. Given this, it is no surprise that HMRC are seeking to recover money from incorrect CJRS claims, whether they are deliberate or not.

While HMRC has been fairly understanding of those businesses that have made CJRS claims in genuine error, it is quite surprising, and indeed a little unsettling for business, to cope with the hard line stance that HMRC have adopted in certain circumstances.

We refer to Luca Delivery Limited v HMRC [2023] UKFTT 00278 (TC), where a First Tier Tax Tribunal upheld HMRC’s decision that Luca’s furlough claim was invalid on the grounds that their employee’s Real Time Information (RTI) was not submitted to HMRC before 20 March 2020, despite being later amended to reflect the fact that the employee in question had begun employment with the firm in December 2019. The RTI should have been submitted from December 2019 and the responsibility of this had been left with the firm’s accountant.

Although the Tribunal justified HMRC’s view on the matter, there are those that would argue that this is a particularly aggressive stance, given the overriding spirit of what this arrangement was brought in to do. The result of this was that the Tribunal ordered the appellant to repay £4,789.35.

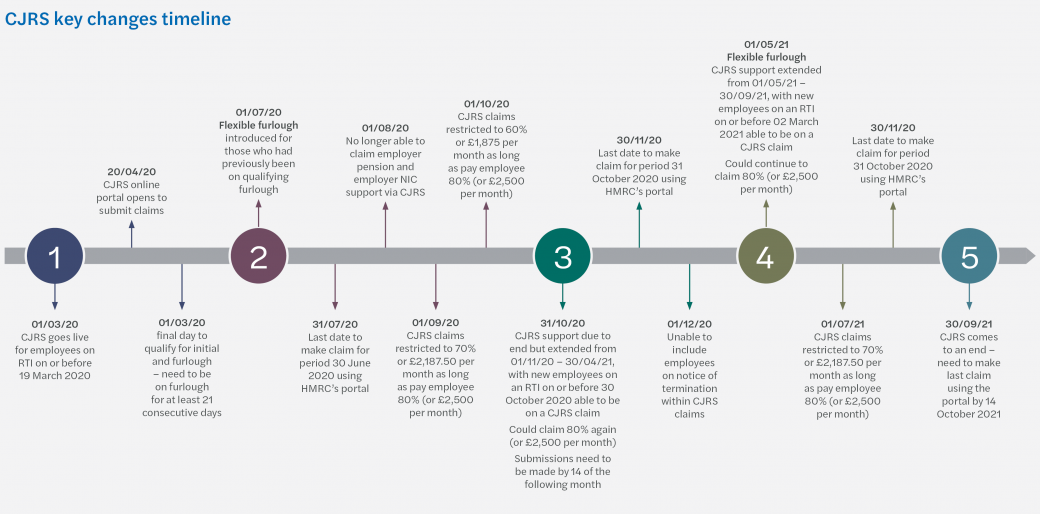

There have been numerous other enquiries where HMRC have taken a strict stance in upholding the CJRS entitlement rules with the aim of recovering as much CJRS relief as they can. The hurried introduction of the CJRS in tandem with the fast-changing rules has left many businesses uncertain as to whether they have complied with and properly navigated the maze of CJRS rules. There have been over 200 changes to HMRC’s guidance to the CJRS since its introduction and we provide a timeline of the key changes to the CJRS rules below.

Sources of erroneous claims

While HMRC’s CJRS compliance team’s main focus is seeking to bring to account those who have committed “furlough fraud” [1], HMRC will demand all CJRS relief mis claimed to be repaid with interest from the date the relief was claimed.

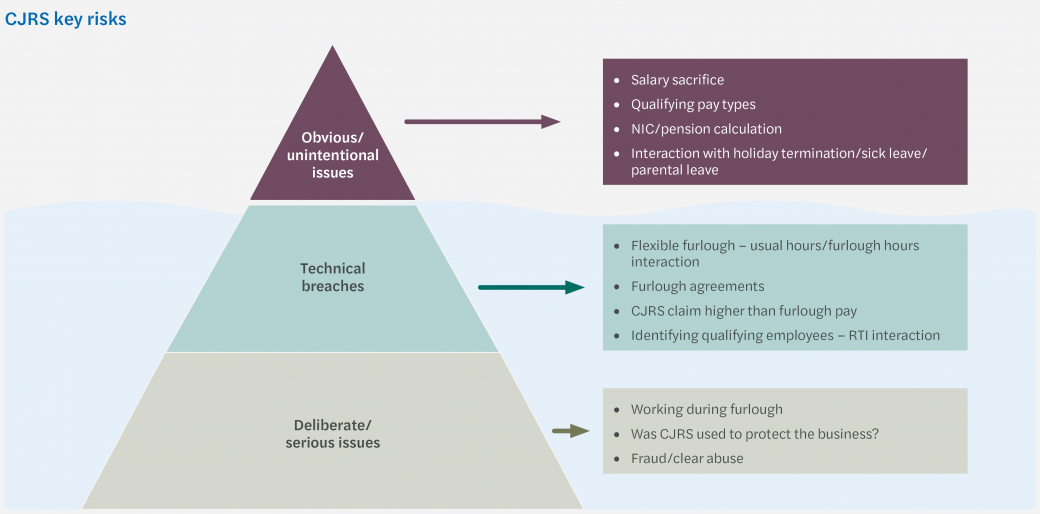

HMRC will assess the behaviour of those that have mis claimed CJRS relief and decide the size of the penalty based on their judgement of the nature of the behaviour of the firm leading up to the error.

There have been numerous examples of CJRS compliance checks where there was previously no HMRC guidance for each circumstance. These include CJRS interactions with salary sacrifice schemes, interactions with sick/parental leave, and situations where employees are transferred under TUPE conditions. We refer to the below infographic to summarise the key risks of CJRS and how HMRC may interpret the behaviour of the firm in each situation.

Beyond CJRS

It is likely HMRC’s compliance team will continue investigations for the 2023 financial year but from then onwards, the number of CJRS cases being opened is naturally going to decrease as HMRC make their way through the businesses that have claimed..

Furthermore, the Financial Times reports that the current return on investment for CJRS compliance efforts is less than a fifth of that of regular tax compliance work [2]. Beyond the 2023 Financial Year, it is likely HMRC will be looking to redirect their resources towards other areas such as compliance of IR35 and the National Minimum Wage.

Like CJRS, these are complex areas with technical legislation and a myriad of government guidance that can have a major impact on many businesses across the UK. It is essential for businesses to remain vigilant and well-informed to ensure that all employment taxes and government tax schemes have been complied with.

Please contact Ian Goodwin, Nabeel Thakur, Joe Goldacre, Jane Gilmore or David Lewis should you want to discuss anything further.

Get in touch

If you require support or would like to know more about CJRS compliance, please get in touch via the button below and a member of our team will be in touch.

For more advice and support in relation to Employment Taxes and CJRS compliance, please visit: https://www.mazars.co.uk/Home/Services/Tax/Global-mobility-and-employment-tax/Employment-tax/CJRS-and-furlough-suppport-for-employers

For our CJRS FAQs, please visit: https://www.mazars.co.uk/Home/Services/Tax/Global-mobility-and-employment-tax/Employment-tax/CJRS-and-furlough-suppport-for-employers/Coronavirus-Job-Retention-Scheme-FAQs

References

[1] https://www.bbc.co.uk/news/uk-england-leeds-57027046

[2] Thomas, D. (2023, January 17). Covid fraud task force ‘not best value’ for UK taxpayers, admits HMRC. The Financial Times