We are going to analyse this key element of the economy. We will look at how consumers feel, how confident they are, what are they observing, how they are reacting, and how we expect them to behave in 2024.

How consumers feel?

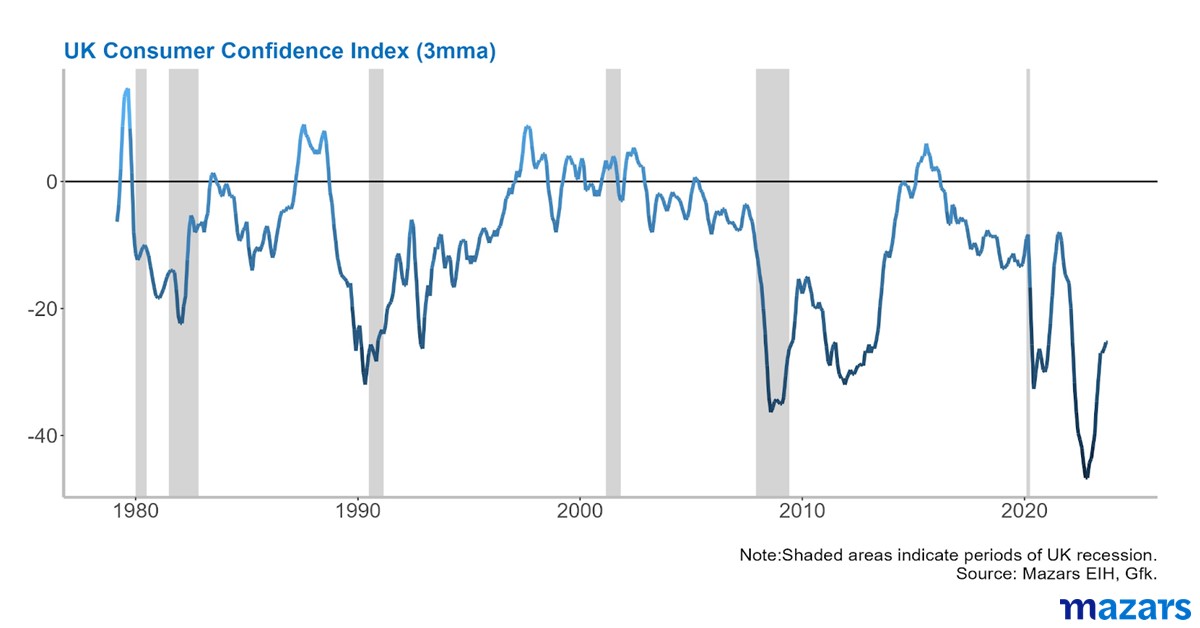

The GfK consumer confidence index measures a range of consumer attitudes, including future expectations of the general economic situation and the financial situation of households. Historically, it has had a relatively high correlation with consumption growth.

Since bottoming out at -49 in September 2022 (mini budget crisis), consumer confidence has steadily improved over the past year, with the 3-month average now at -25. Despite the sharp improvement, these levels are among the lowest ever recorded in the UK and are similar to those observed during the global financial crisis and the 1991-92 recession.

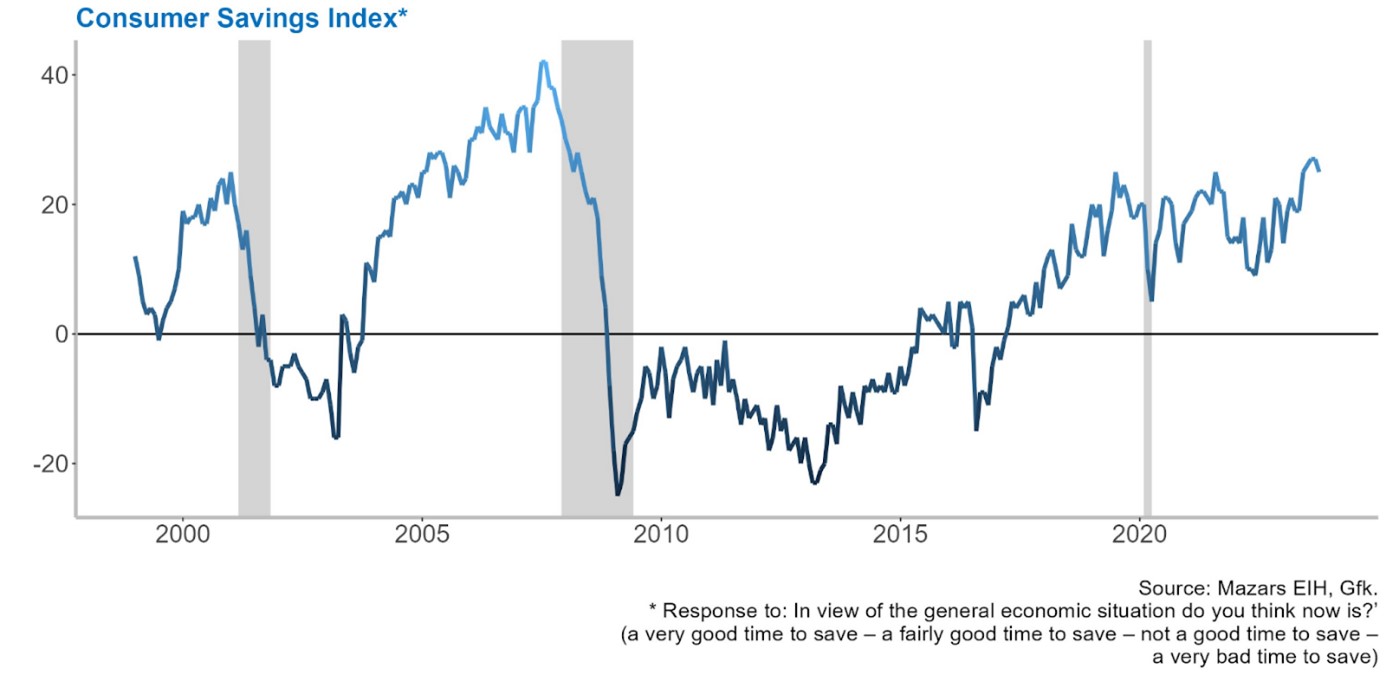

High interest rates and pessimism about the economic outlook are partly to blame for the low levels of consumer confidence. This is reflected in the fact that the savings index, which measures consumers' intentions to increase their savings rate, is at its highest level since 2008. High rates incentivise consumers to postpone consumption decisions, while the bleak prospects for the UK economy also increase precautionary savings.

Figure 2: Consumers tend to save more ahead of recessions

What consumers observe?

Consumers pay attention to many variables (wages, interest rates, asset prices, inflation, inflation expectations, growth expectations, taxes, etc.), but among the most relevant are their real disposable income (wages after taxes minus inflation) and their net wealth (real assets and financial wealth). The logic is very simple: if their real income or net worth increases (decreases), consumers tend to consume more (less).

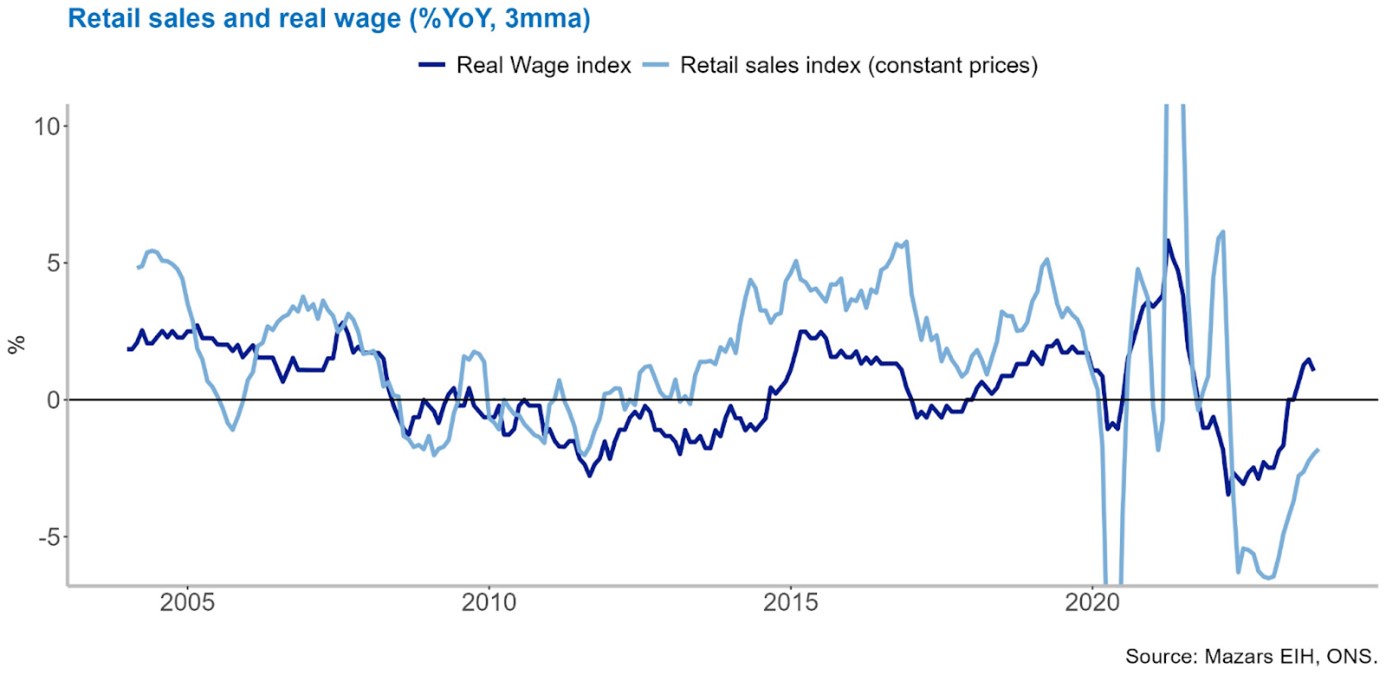

Helped by lower inflation and a tight labour market, wages have grown in real terms in 2023 (+1% YoY in September). This, as expected, has shown historically a high correlation with consumption. We think that wages will continue to grow in real terms over the next year, and this should support retail sales (see chart).

Figure 3: Real wage growth should support retail sales next year

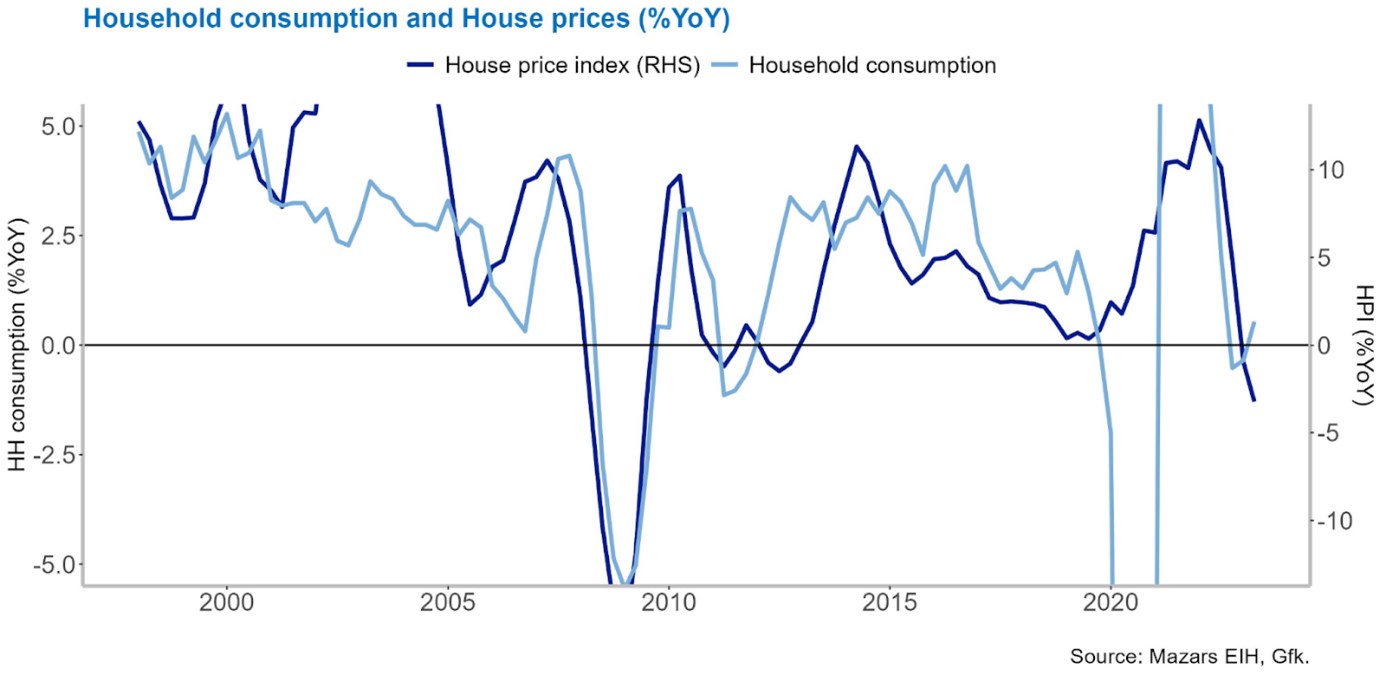

However, our optimism is tempered by the signals we see in household wealth. Both house prices and financial assets (especially long-term bonds, which play an important role in pension funds) are falling. We estimate that a 10% drop in HH wealth can lead to a 0.5 percentage point contraction of consumption. So far, house prices (which account for 60% of total HH wealth) have fallen 5% yoy and are expected to keep falling until the end of 2024.

Figure 4: Wealth effects contribute negatively to consumption growth

How consumers are reacting

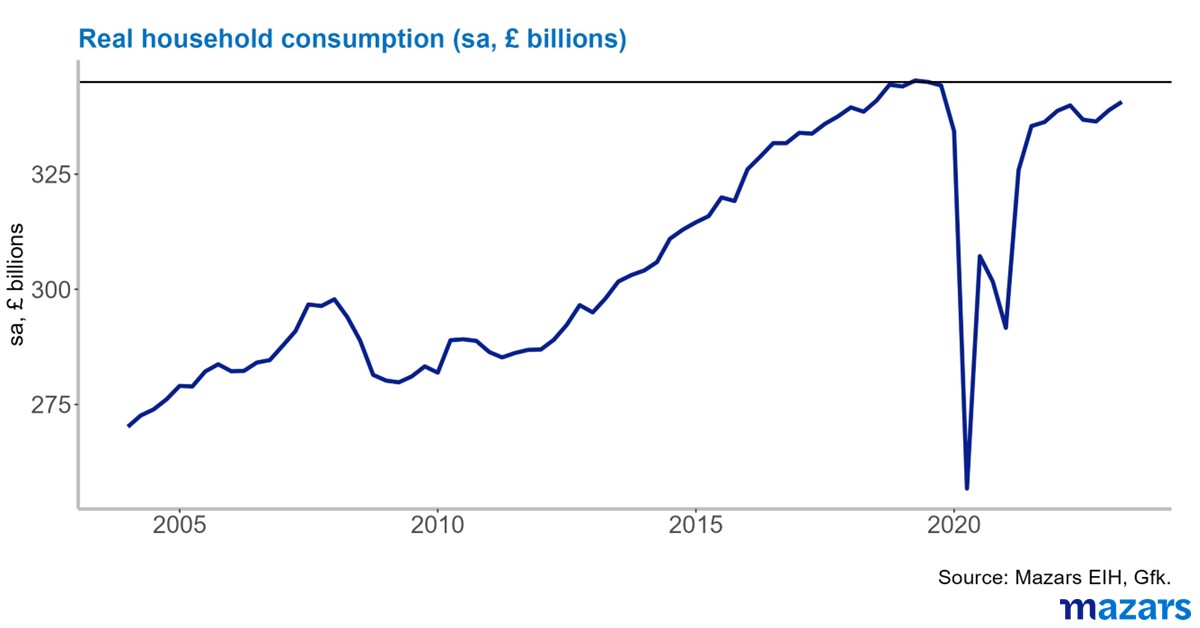

The latest available data suggest that consumption grew by 0.3% year-on-year in the nine months to September. However, compared to pre-pandemic levels, total consumption is still 1.5% lower than in 4Q19 (see graph).

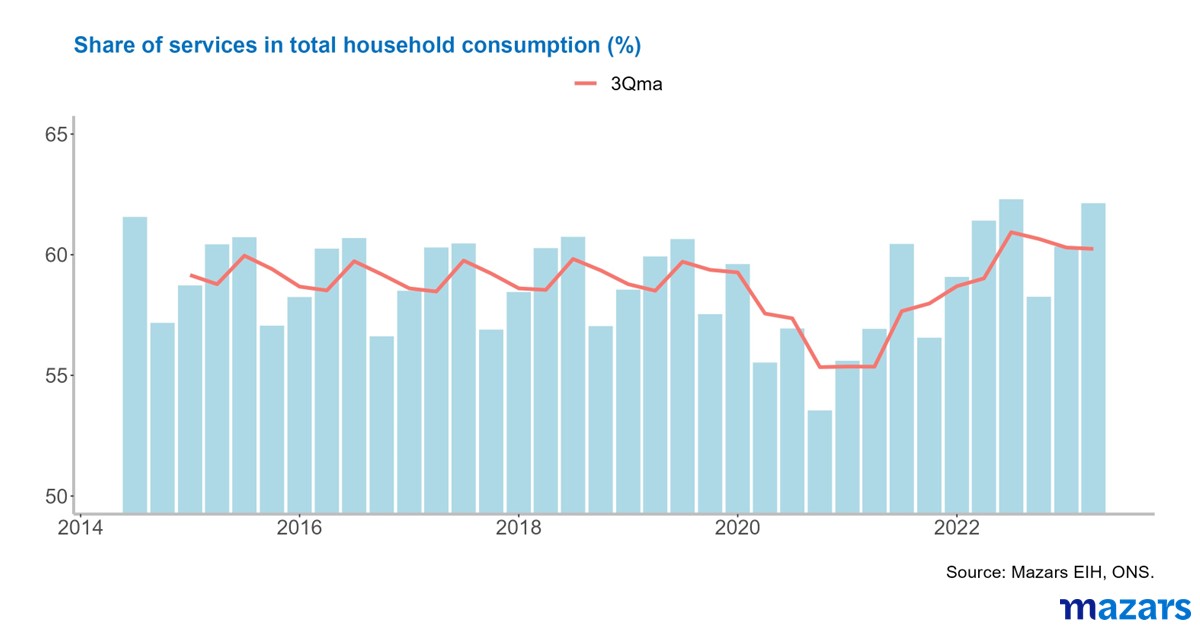

During the pandemic, the fact that we were unable to leave our homes led us to consume much more goods than usual: before the pandemic, the overall consumption basket was 60% services and 40% goods, but during the pandemic this was inverted to 60% goods and 40% services. This trend has been reversing over the last two years, and since Q2 23 the share of services has returned to the pre-pandemic normal. During this renormalisation goods’ consumption suffered, as seen in the negative retail sales figures.

Figure 5: Consumption remains below pre-pandemic levels

Figure 6: Services regained their share in the consumption basket

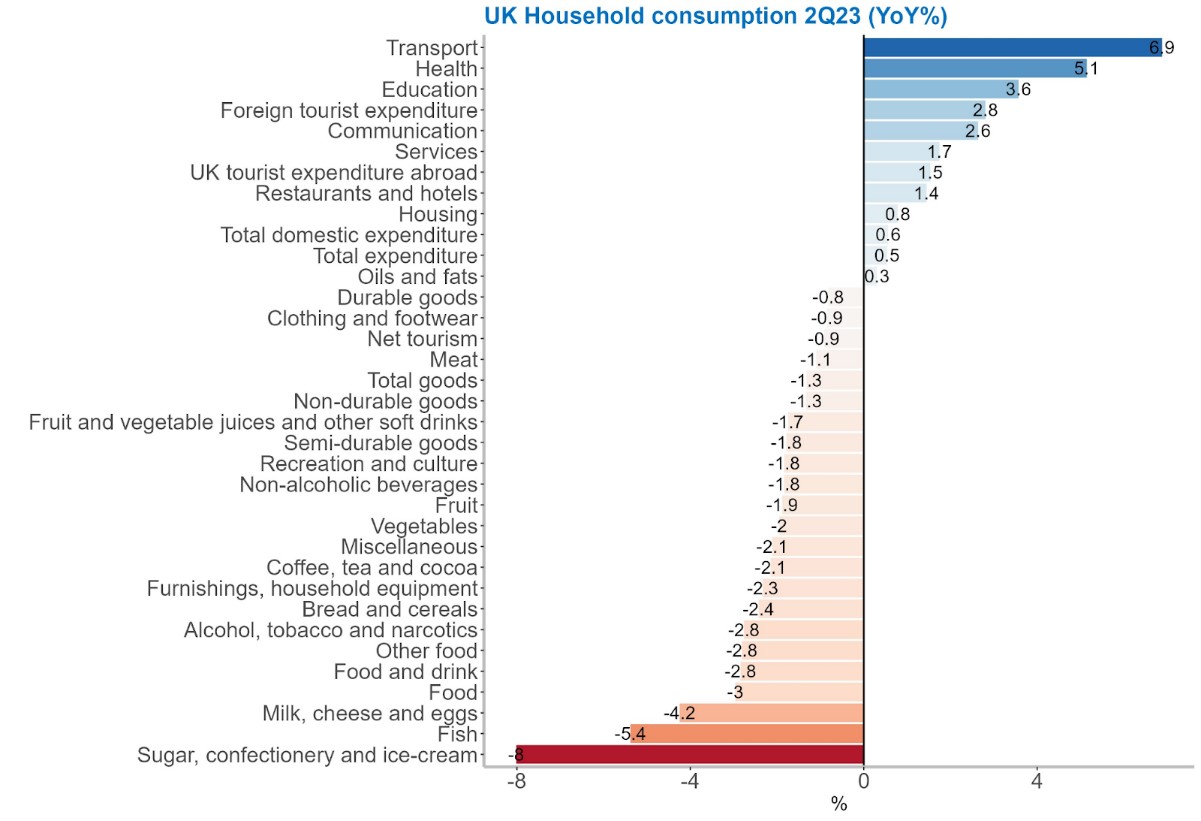

Figure 7: Demand for services grows as demand for goods falls

Given the bleak macroeconomic context of high inflation and low growth, consumption has fared relatively well this year: in the first three quarters of 2023, real consumption grew 0.3% year-on-year, not a spectacular figure but much better than the 1% contraction expected by the consensus of analysts in December 2022.

However, not all consumption segments showed positive figures. Sales of services grew as the mix of goods and services in the consumption basket normalised, while sales of goods fell.

Looking ahead, we expect consumption to continue to grow at a moderate pace (~0.5-0.8% yoy). On the one hand, real wages are likely to rise next year, supported by lower inflation and a labour market that will remain tight. On the other hand, this will be partly offset by high interest rates, which will encourage higher savings rates, and the negative wealth effects generated by lower house prices.

Santiago Rossi, Senior economist

Register for our upcoming economy webinar

Join our Chief Economist and Chief Investment Officer as they discuss the global economy, inflation, interest rates, and the investment landscape.

Register today