1. Inflation 3.0

The ubiquitous economic, financial and possibly even geopolitical risk for 2024 is of course an unexpected rebound in global inflation.

We are very far from the pre-pandemic regime of somewhat stable inflation, and closer to the 1970s paradigm of inflationary waves. At the time of writing, goods inflation had come well under control, but services inflation was too high for comfort. Yet the risk comes from the supply side (goods). Spikes in energy or food prices could usher in a new wave of inflation, forcing central banks to maintain rates higher for longer, or even hiking rates instead of cutting them. Additionally, the gradual transition of the global supply chain away from the world's biggest manufacturer, China, could cause hiccups in the transport of goods around the globe and result in higher prices.

The first area that would be damaged would be financial markets. Investors would be disappointed, and we could see some volatility spikes in risk assets. Bond markets have been aggressively pricing in rate cuts in the first half of the year. In the case of Europe, traders are now betting that the ECB will cut in the first half of 2024. With the best possible scenario priced in, it’s easy to see an investment disappointment on the horizon. However, this is part and parcel of everyday market operations.

The larger problems would appear in the real economy. A second year of high rates could cause a sharper economic slowdown and higher unemployment. Areas of the market that have so far managed to remain unscathed could experience dislocation, deepening an economic downturn. So far consumers have not changed behaviour versus pre-pandemic. However, a third year of high inflation could fundamentally change the way people consume or make capital spending decisions, from buying a house to building a company. Yield curves, which are assumed to steepen after rate cuts have ended, could flatten or remain inverted for another year, causing problems within the banking and insurance market as well as real estate. Capital expenditure decisions could be kicked further into the long grass, hurting much-needed investments in the industrial sector, utilities and possibly materials. Consumer goods (whether services or manufacturing) would suffer as well, as central banks would continue to tighten conditions and inflation would again eat into real incomes. With the exception of the energy sector, we feel that an inflation rebound would be damaging for all other sectors of the economy.

The biggest risk, however, is systemic. High inflation would tie the hands of central bankers and delay fast decisions that are critical for monetary authorities to put fires out fast. In case of a financial accident, accelerated by tight liquidity conditions, central bankers could delay or defer key monetary easing decisions if inflation is threatening. In essence, the more inflation persists, the more the economies and financial markets fly without a sturdy safety net provided by the lenders of the last resort.

Given the unstable nature of global geopolitics at this particular juncture, the low prices of oil at the time of writing (below $70) and Chinese deflation, we feel that a noticeable rebound in inflation is the key risk. It would simply take very few out of many possible factors for prices, which are far from stabilised, to rebound.

2. Geopolitics worsening

Geopolitical tensions are a very wide umbrella, covering at least two major conflicts, the radicalisation of mainstream politics in the west, deglobalisation, trade wars and possible commodity shortages resulting from all of the above. Early last year we noted that the world had decidedly spun off its post-Soviet collapse axis. The winner of both the Second World War and the Cold War, the US, failed to convert victory into the long-term competitive economic and military advantage that is historically typical of empires. As a result, the world is quickly reverting from unipolarity back to multi-polarity. This tectonic shift has already encouraged a rekindling of conflicts, as actors, whether aggressors or aggrieved, can now seek beneficial alliances in multiple places. The gradual breakdown of international order is encouraging the rise of individual power centres, in turn fuelling more acerbic politics and, in certain cases, extremism in even traditional mainstream parties. This in turn promotes even more conflict, trade or physical, which, under certain circumstances, may even cause embargoes on certain key materials that are necessary for industrial growth and the ‘Green Transition’. It goes without saying that political and geopolitical instability also comes hand-in-hand with regulatory instability, as quickly shifting and more extreme governments overturn each other’s agendas.

In an environment where centrifugal forces are further encouraged, European cohesion is likely to be further threatened. The ascent of euro-sceptic governments in both the north and the south is a symptom of increasing distrust. European politicians are feeling increasingly empowered by their electorates to challenge Europe’s fragile status quo. Just recently, Italy’s government blocked a key reform that would allow the European Stability Mechanism, a lifeline to Euro governments shut off from markets, to be expanded. The reform would bring the European Banking Union closer, drastically reducing the risks of a Euro breakdown during a future crisis.

While the centrifugal tendencies are well noted, and in fact encouraged by certain commodity-rich but rogue governments who strategically pour gasoline onto the fire, there are incentives in 2024 for key actors to co-operate. The global economic slowdown and loss of long-term competitiveness, in conjunction with high levels of debt, are a very strong motive for Western democracies to consider slowing the rate of fragmentation. The situation is not too dissimilar for China, which is experiencing the classic effects of a meltdown in its real estate sector. Like Western economies, China also has an incentive to co-operate more in 2024. While our base case scenario is that we will see gradual petering out of the worse aspects of global conflict, a key risk is that with so many fires lit up, one or more of them could spread significantly, further exacerbating the tense geopolitical climate.

3. Global recession

A third key risk is that of a global recession. While we highlighted that in the context of an inflation-induced slowdown, we think that a recession can very well happen without an inflation spike. The global economy is set to slow down in H1 2024. The risk we are highlighting is that the slowdown and possible shallow recession, turn into a deep recession. There are a number of scenarios under which a sharp global slowdown could be initiated:

- China’s downturn deepens, causing a further slowdown in global growth.

- Unemployment goes up. Western consumers sharply cut back on expenditures as companies stop paying higher salaries.

- Private Equity funds begin to go bust, affecting the real economy in a way yet unforeseen.

- A credit or liquidity event, accelerated by tight liquidity conditions, causes market panic and arrests economic growth.

- A real estate crisis breaks out in Western economies, starting with commercial real estate and then spreading to other assets.

With so many open fronts, normally this would have been flagged as our biggest risk. However, for the purposes of this analysis, we assume that these risks develop independently of an inflationary spike. We believe that while some of those risks may materialise if they happen in a lower inflation environment, central banks would be quick to act to put out the fire before it spreads.

4. Climate tipping point

Weather risks mark a new entrance to the list. Last year we saw a surge in wildfires, droughts and heavy rainfall even in more temperate climates. Wildfires, in particular, are a key risk for global warming as burning forests cause the release of significant amounts of carbon dioxide into the atmosphere, further warming the planet. They make up of 5% to 10% of global emissions per annum. In 2023 Canada’s wildfires emitted as much carbon dioxide to the atmosphere as Mexico did in one year. Greece experienced both severe wildfires and severe floods within the space of less than one month.

While the science behind the impact of wildfires is still unclear, scientists warn that we may be entering a vicious cycle where climate change-related incidents are accelerating. A tipping point.

We are reaching the era where climate change begins to have a very real impact on economic growth, the normal course of business and financial stability. Historically, shifts in climate have caused mass migrations, which have often triggered territorial wars or, at best, threatened social cohesion.

5. Technological disruption

Historically, technological disruption has caused huge disruption in industries. The first industrial revolution swept through Georgian and Victorian Britain in the early nineteenth century, as it disrupted a number of established industries.

We now stand at the cusp of the fourth industrial revolution.

In 2023, the emergence of generative AI already disrupted a number of industries. On the one hand, the effect of technology is positive. Over the next 10 years, the generative AI market could grow from $40bn to $1.3tn, a 42% growth per annum. Generative AI could add up to $7.9tn in the global economy through productivity gains alone.

However, risks also abound. The simplest risk is the disruption in the jobs market. Already, the ‘gig economy’ is at risk, especially where white-collar jobs are concerned. A study found that freelancers who had the highest earnings, were no less likely to see their employment and earnings dwindle than other workers, and in fact, had worse outcomes. The consulting market has also come under attack.

Apart from the labour market disruption effect, and the natural creative destruction, we must also consider some worse outcomes. The most obvious one is a step-up in tech regulation and oversight. Some of this would come due to the natural response of governments wanting to protect jobs and slow down the pace of disruption. It could also reflect a concern about the threat AI poses to national security.

Another risk would be the exact opposite, i.e. the unfettered and unchecked proliferation of AI technology, to the point where it could threaten economic and political stability. ‘Smart algorithms’ have already threatened both democracy and the financial markets in the past few years. An even smarter AI could cause even more disruption.

AI is one of those items that fall within the ‘unknown unknowns’ category. We simply don’t know what to expect. It makes for a unique opportunity, but also for a risk that we can’t really account or prepare for.

6. Pandemic 2.0

Since the Covid-19 pandemic, the world has become more attuned to the possible impact of new viruses. While Covid-19 itself is a risk that has fallen off the key risks list for 2024, we are already receiving news of a new pneumonia breakout in China and Europe.

The risk at this particular juncture is an overreaction or action in general that could lead to another pandemic-related economic downturn, with implications for inflation, growth, geopolitics etc. To put it simply, a ‘Great Lockdown’ is more easily facilitated now, as working from home has been experienced once and deemed a success.

Having said that, this particular risk is low on our list. We think that the collective economic trauma following the pandemic will weigh in before decisions about strict lockdowns are taken again. Having said that, even short lockdowns could have a pervasive effect on the global economy and upset very delicate economic ecosystems.

George Lagarias, Chief Economist

Market update

Equities were mostly positive last week, with global equities gaining +0.9% in GBP terms. European equities were the best performers, surging by +2.5% on optimism over central bank rate cuts. US equities also performed well, returning +1.0% as Google’s new AI model, Gemini, boosted tech sector sentiment. UK and Japanese equities lagged, each rising by +0.3%. Emerging market equities were flat.

The US 10-year treasury yield ended the week one basis point higher at 4.23%, as yields increased after a stronger than expected jobs report. Yields fell in the UK and EU: 10-year gilt yields fell by 14 basis points to 2.26% while 10-year bund yields fell by 10 basis points to 2.26%.

The price of oil dropped by -3.1% over the week, falling under $70/bbl at its lowest. The sharp decline in oil prices in recent weeks, in spite of rising geopolitical tensions and OPEC+ supply cuts, appears to in part be related to a large volume of trading by trend-following algorithmic trading funds.

Macro news

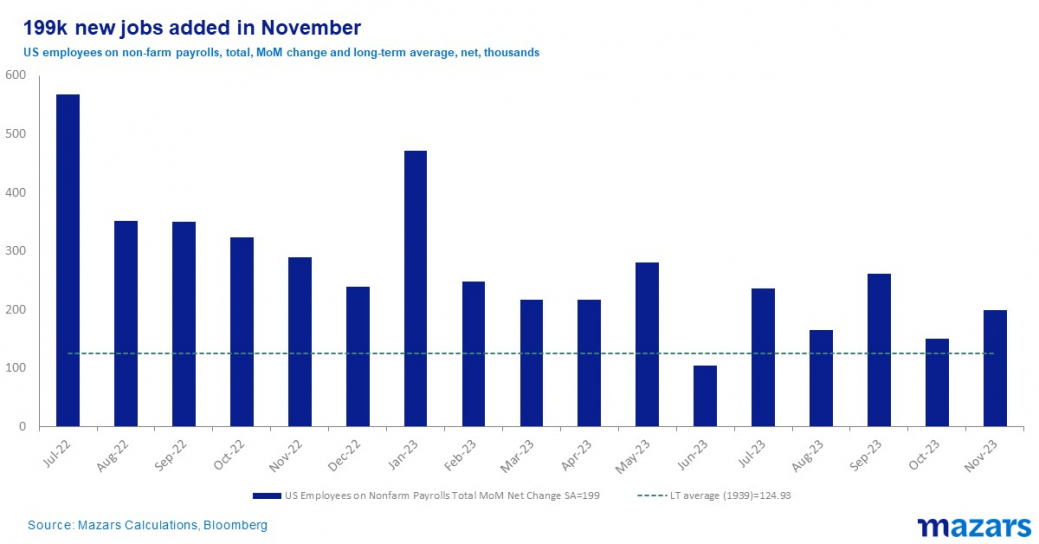

US nonfarm payrolls rose by 199,000 in November, more than the median estimate of 185,000. The unemployment rate also fell to 3.7%, while the participation rate increased slightly to 62.8%. The gain in the headline number was mostly driven by government and healthcare jobs, as well as the return of striking auto workers, which alone contributed 30,000 jobs to the count. Year-on-year wage growth fell to 4%, its lowest level since May 2021, although the monthly increase of 0.4% was tied for the largest increase in 2023.

Rating agency Moody's cut its outlook on China's sovereign credit rating to negative on Tuesday, citing growing risks of persistently lower medium-term economic growth and the overhang from a property sector crisis. Moody's said the downgrade, the first for China since 2017, reflected risks from financing difficulties for local and regional governments and state-owned enterprises.

The week ahead

Central banks will be the focus next week as the Fed, Bank of England and European Central Bank will all be having meetings to deliberate on interest rate policy. While it is expected that interest rates will be kept steady across the three regions, investors will be keen for any inkling or indication of when rate cuts may come.