What does effective regulatory reporting assurance look like?

Effective regulatory reporting assurance

Why must banks provide assurance over their regulatory reporting?

The Prudential Regulatory Authority (PRA) published its Dear CEO Letter on the “Thematic findings on the reliability of regulatory reporting” on the 10th of September 2021 (DCEO Letter). The DCEO Letter outlines the expectation that Banks should prepare their regulatory returns with the same care and diligence applied to financial reporting that is shared externally. The PRA further states that a key practical way for banks to achieve this is for banks to perform more independent assurance work on their regulatory reporting.

Why have banks had problems performing sufficient assurance?

In many cases, due to the specificity of knowledge required to provide effective assurance work on regulatory reporting, the second-line function may not have the requisite subject matter expertise to perform additional assurance work. Furthermore, the third line may already be stretched to cover reviews over other areas within the bank, and are therefore unable to spend more time providing assurance work over regulatory reporting.

What does effective regulatory reporting assurance look like?

There are two essential components to effective assurance over regulatory reporting. These are:

- Deep-dive reviews into the regulatory returns

- Reviews of the governance, controls and data processes underpinning the regulatory reporting

Below is an overview of our approach to performing effective assurance.

1. Deep dive into regulatory returns

| Materiality | We will select these returns using quantitative and qualitative criteria. This will be based on the complexity and importance of the return, the significance of material ratios that are included within the return and other considerations such as the amount of previous errors found within the return or whether the return is a "hot topic" in the prevailing regulatory landscape. |

| Sampling | We will sample the rows within the returns by considering a number of factors. This will primarily be based off their contribution to material ratios and the amount reported in the row. For example, rows with a 0% risk weighting would have a lower likelihood of being sampled. Dependent on the number of returns being reviewed and their complexity, we will aim to review 50%-100% of the rows populated in the returns templates. |

| Analysis | Our testing methodology encompasses four key aspects: enquiry, observation, review, or reperformance. We use a combination of each of these aspects, with reperformance being the most rigorous and time-intensive method.

We will determine the methodology to be used based on the sampling criteria as above. Most rows would be analysed using the review or reperformance methodology, with the enquiry and observation methodologies used for the simplest rows. |

| Reporting | We will provide a detailed explanation of all the areas of improvement found within the production of the return. We will also provide practical recommendations to remediate findings, taking into consideration industry best practices and proportionality, given the complexity of the bank. |

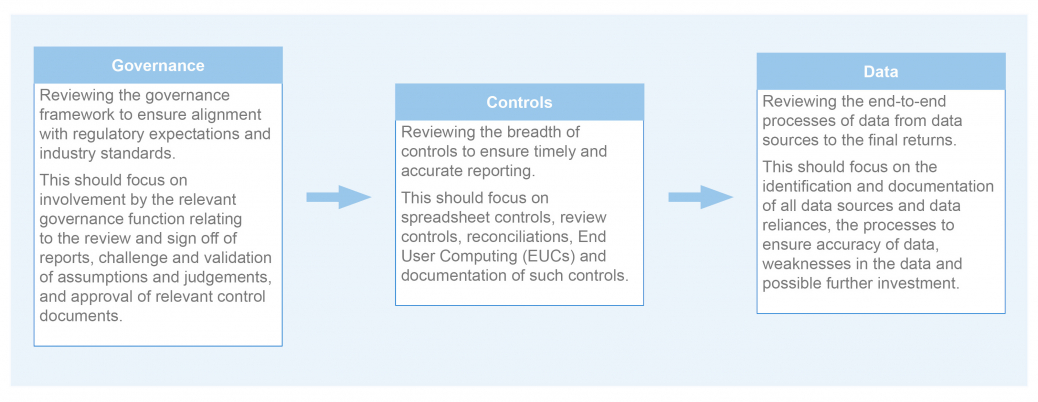

2. Governance, controls and data processes

Get in touch

For more information about our regulatory reporting assurance service, please contact us.