A market of two halves...

As the football World Cup is in full flow it seems appropriate to start this article with a sporting cliché, that the current deal landscape would rather aptly be described as a “market of two halves”.

The current political turmoil, rising inflation and interest rates and economic uncertainty has created a clear polarisation in the market, and it’s creating a real challenge in decision-making when it comes to M&A with some businesses ending up as “winners” and some as “losers”.

What is happening in the market and why?

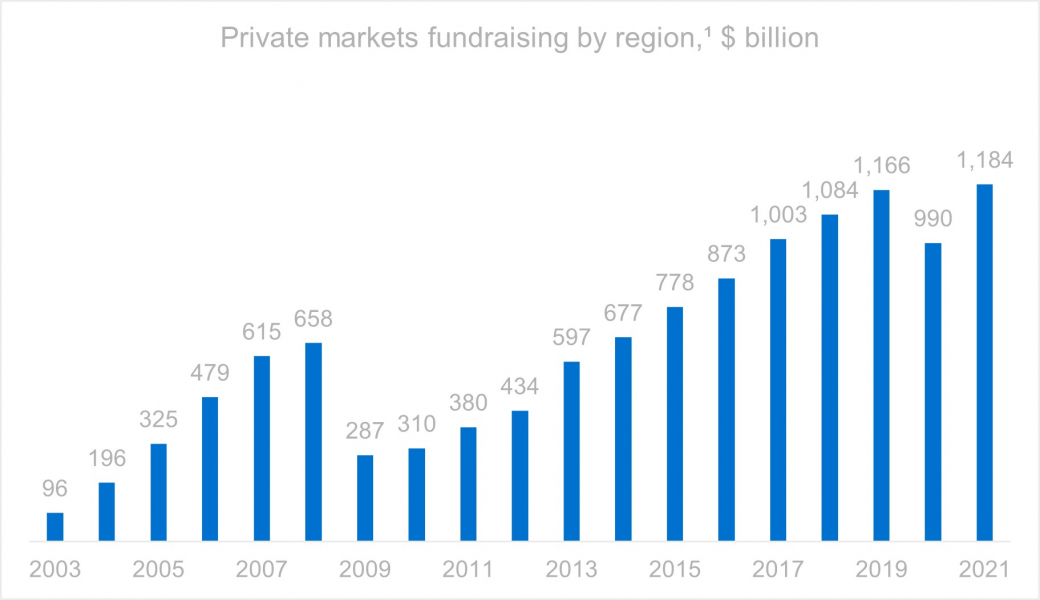

To put the current situation in context, the private fundraising markets have enjoyed over a decade of almost continuous growth, with allocation of capital to both private debt and private equity continuing to grow strongly since the credit crunch in 2009/2010. To illustrate the extent of the inflow, private market fundraising in 2021 was 5x the level it was in 2009 and nearly 3x its peak prior to the financial crash. These represent record historic levels of private capital in the market in need of deployment and are significantly higher than we have ever witnessed before.

| 2016-21 CAGR | 6.3% |

| 2020-21 growth | 19.7% |

¹Excludes secondaries, funds of funds, and co-investment vehicles to avoid double counting of capital fundraised.

Source: McKinsey & Company / Preqin

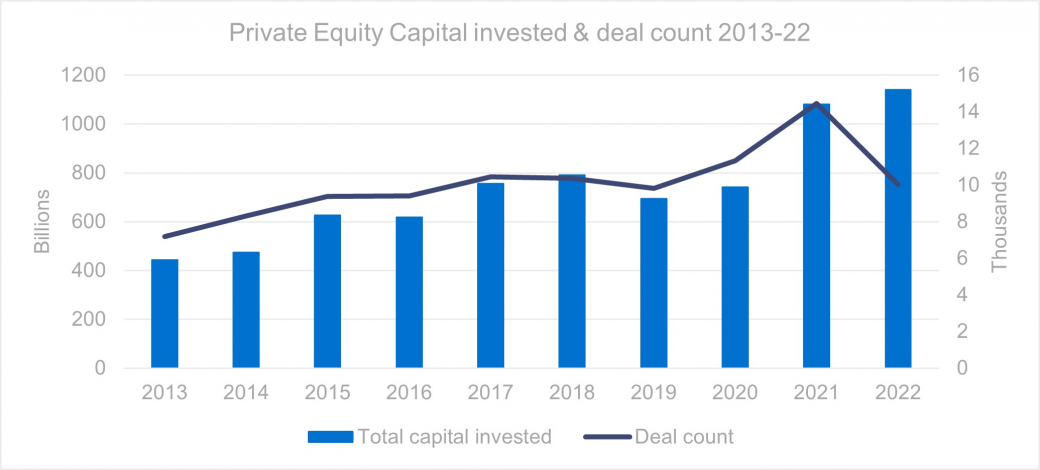

This continually increasing supply of capital in the market has driven private equity transaction volume, rising to record levels of £1.14Tn in 2022.

Source: PitchBook

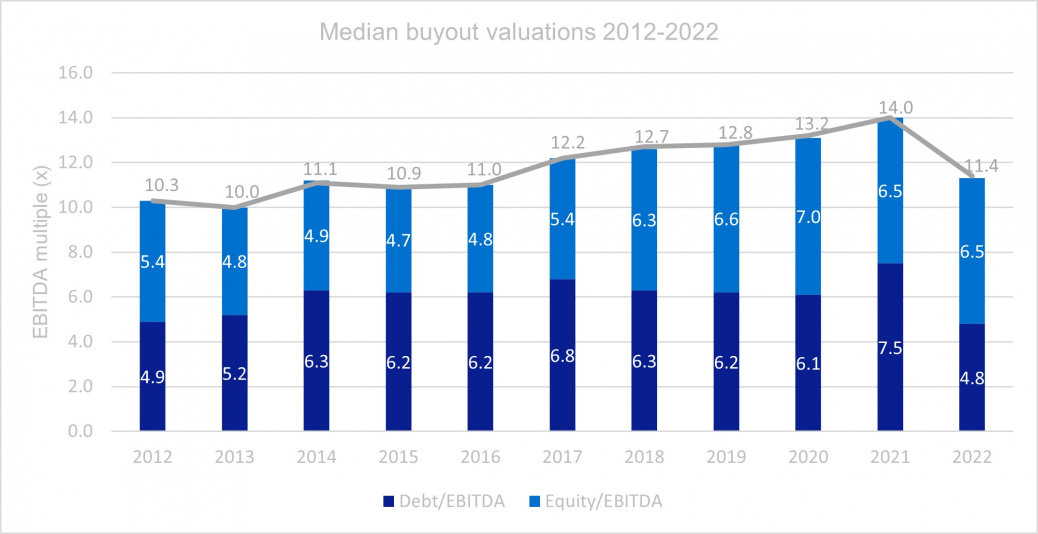

This has resulted in steadily rising valuations in the privately owned and private equity backed space, as more and more capital chases a finite pool of assets in the market. The median valuation for buyouts across the market peaked at 14x EBITDA in 2021 having seen year-on-year increases since 2015, from a median multiple of c.10-11x in the early 2010s:

Source: PitchBook

The challenge that has arisen is that whilst fund raising has continued to grow, the past five years has brought Brexit and Covid and more recently rapidly rising inflation and interest rates. This has created several operational challenges for businesses in specific sectors, particularly those reliant on international supply chains and shipping, those exposed to rising energy and prices and those linked to consumer spending, in particular in the leisure and travel sectors. This imbalance in “demand” for certain businesses, with continually increasing “supply” of capital has created an excess of demand and interest in certain sectors and a significant decline in demand in others.

Winners and losers

So where is the appetite highest and lowest and what is driving multiples in these sectors? The key winners are those in sectors which continue to see robust growth in their markets, driven by long-term demand drivers. These include:

- Healthcare - driven by an ageing population and increasing focus on health, wellbeing and the fear of future pandemics, specialist healthcare and pharmaceutical businesses have performed well and continue to attract interest from both PE and PE-backed players

- Software and tech-enabled services – particularly in sectors where there is the opportunity for long-term disruption and efficiency gains in historically labour-intensive end markets, particularly given resourcing constraints and “war on talent” across a number of industries

- Outsourced services into FS – driven by a combination of resourcing challenges and increasing regulatory scrutiny and enforcement, specialist providers who can not only reduce fixed cost requirements within larger financial services organisations and also provide recurring, regulatory driven services are continuing to be attractive to Private Equity

Conversely, businesses and sectors exposed to certain macroeconomic factors are struggling to attract investment and as a result are seeing valuations fall materially. These include:

- Consumer and leisure – businesses reliant on discretionary but non-luxury purchases are the ones most at threat as consumers cut back on “nice to haves” and who focus their more limited discretionary spending on a smaller number of relative “luxury” purchases (for example, cutting back on weeknight takeaways to fund a weekend restaurant meal)

- Industrials and manufacturing - there has been significant volatility in certain raw material costs during 2022 (such as polymer pricing) which, alongside rising energy prices, has resulted in reduced profitability in some manufacturing and industrials businesses. This has particularly impacted those focused on higher volume, lower margin products where any movements in input prices and overheads have a material impact on profits

What does it all mean?

The question I get asked the most in the current environment is “is it a good time to sell my business?”. My typical answer is that “it depends” and is a result of this clear polarisation in the market between the “winners” and “losers”. Whilst valuations on average have fallen and the market remains challenging, the abundance of private capital to be deployed means that businesses which are performing well and that focus on sectors which have shown resilience through Brexit and Covid are likely to be in even greater demand than ever before. If you happen to own one of those businesses then the answer to that question may very well be “yes” and given the uncertainty in the market, carefully considering your current position and strategic objectives is of paramount importance.

What’s next for your business?

We understand it can be difficult to know where to start, which is why we've put together our What’s next guide for business owners. It may be that you're looking to sell your business, or you're simply looking for future growth.

Whatever your initial thoughts, the guide is designed to help owners and directors who are releasing or raising capital, planning a sale, or considering their best move for the future.

Get in touch

If you’d like to know more about any of the topics discussed in this article, our team of advisors can assist, please use the contact form below.