April 2023 saw the biggest increase to date in the National Living/Minimum Wage of approximately 10% and the LPC is already predicting a National Living Wage rate of £11.08 for 2024/25, a further 6% increase. Couple that with the NLW eligibility threshold due to be lowered to 21-year old’s in the not too distant future and HMRC’s increasing enforcement activity, now is the time to make sure that your organisation knows how to avoid National Minimum Wage breaches and your obligations are being met.

National Minimum Wage investigations and breaches

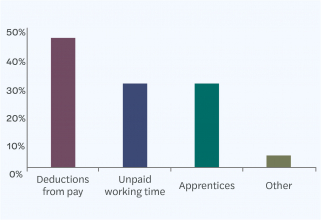

Did you know that in 2021/22 there were: | The top 3 breachesof minimum wage in closed investigations were: |

- 2,800 investigations closed by HMRC

- £16.3 million arrears identified for over 120,000 workers

- £13.2 million penalties levied

- 71% of closed investigations related to HMRC targeted enforcement

| - 47% related to deductions from pay, such as salary sacrifice reductions, purchase of clothing, training/ travel costs.

- 30% related to unpaid working time, e.g., rounding of time, pre/post shift time, excess hours for salaried staff

- 19% related to apprentices, e.g., failure to pay the correct rate, incorrect classification

|

What are HMRC doing?

HMRC are increasing their compliance activity and widening their targeted enforcement approach by focusing on:

- Geographical locations

- Specific categories, salaried workers, non-low paying occupations

- Re-visiting closed investigations

- Promoting compliance and health checks

How to avoid National Minimum Wage breaches - Key considerations for employers

1. Getting it wrong can be costly

HMRC enforcement of minimum wage underpayments incur:

- Repayment of arrears to all current and former workers for up to a six-year period

- Financial penalty of 200% of the underpayment calculated

- Additional employer NIC costs

- Lengthy investigation period impacting on employer time and resource

- Reputational damage from naming in the media by the Department of Business & Trade

2. Be pro-active

Undertaking an internal review and correcting any errors ahead of a HMRC enquiry, will avoid any penalties or naming – however it is important that the self-review is thorough and accurate otherwise HMRC can enforce on any risks that may have been missed, leading to a penalty charge, and being named.

National Minimum Wage health check and initial consultation

Find out how to avoid National Minimum Wage breaches and how at risk you are by completing our questionnaire.

You will receive a high-level risk report and risk score as well as a free, initial consultation with one our specialists. We will highlight any potential remedial actions necessary to ensure your organisation is up to date with their compliance obligations.

Complete our questionnaire