Another example is the Tech Bubble. As markets got over excited about the earnings potential of internet companies which were at the time ‘pre-profit’ (i.e. loss-making) and in many cases stayed that way, everyone knows how that mania ended.

Yet only a decade later, tech stocks were once again the main drivers of US and global equity markets. Pundits and papers will often give a reason why particular stocks and sectors are performing well, while others lag. However, a narrative is usually all these are – nobody can distil why the transactions that happen every second result in the prices that they do. So when tech stocks outperformed from around 2014-2020, was it due to their current earnings, their expected future growth, or because of a low interest rate environment?

The lazy answer would be to say a bit of all of these. Yet it seems likely that even without the very low interest rates, the earnings growth that these companies experienced would have still seen them lead markets. At times stocks such as Amazon were trading at eye watering P/E valuations, but in fairness markets probably weren’t overvaluing these companies, as most grew into these valuations.

Tech stocks have been on a wild ride since Covid. Initially, it was the best performing sector, as the prospect of us being locked in our homes forever sent valuations soaring. Who can forget that the wrong Zoom stock briefly rose by +1800%? That was possibly a mania brought on by Covid. But then value stocks roared back following vaccine announcements in November 2020 and until the start of 2023 tech stocks were largely out of favour.

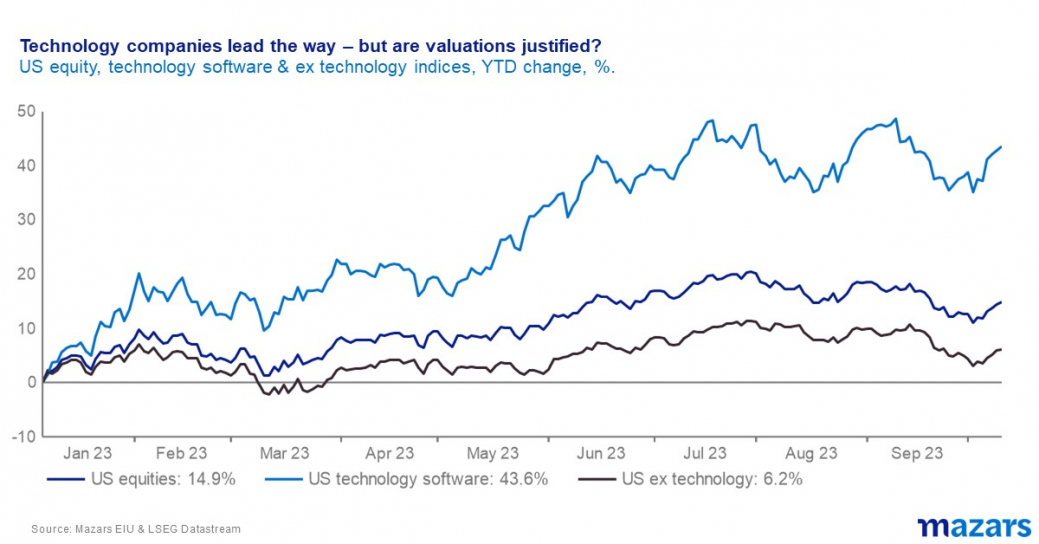

And then almost out of nowhere, markets got excited about AI. NVIDIA is now worth $1.1tn, up over +200%. US equities ex-tech are up 6.2% this year. Including tech, US equities are up 14.9%.

The concern now is that this is an AI mania. Why? Because revenue growth amongst the FAANGs (Meta (formerly Facebook), Amazon, Apple, Netflix and Alphabet (formerly Google)) has been almost flat over the last couple of years. And yet US tech stocks trade just short of 25x forward earnings, compared to 19x earnings for the wider market.

Unless AI or some other presently unknown factor causes a sudden jump in revenue growth, it is very hard to see tech stocks justifying their current valuations. It has been proposed that given the lower growth, but steady earnings profile of many of these companies, they should instead be trading like utilities, which are on 16x earnings.

There is always a fear of missing out when manias set in, which often helps to feed a spiral as it can cause those late to the party to pile in even when it is widely acknowledged that prices are too high.

The current AI obsession could well be a mania, and even if there is some justification, we believe that there is a significant risk that earnings growth will not be enough to warrant current tech valuations.

James Rowlinson, Senior Investment Manager