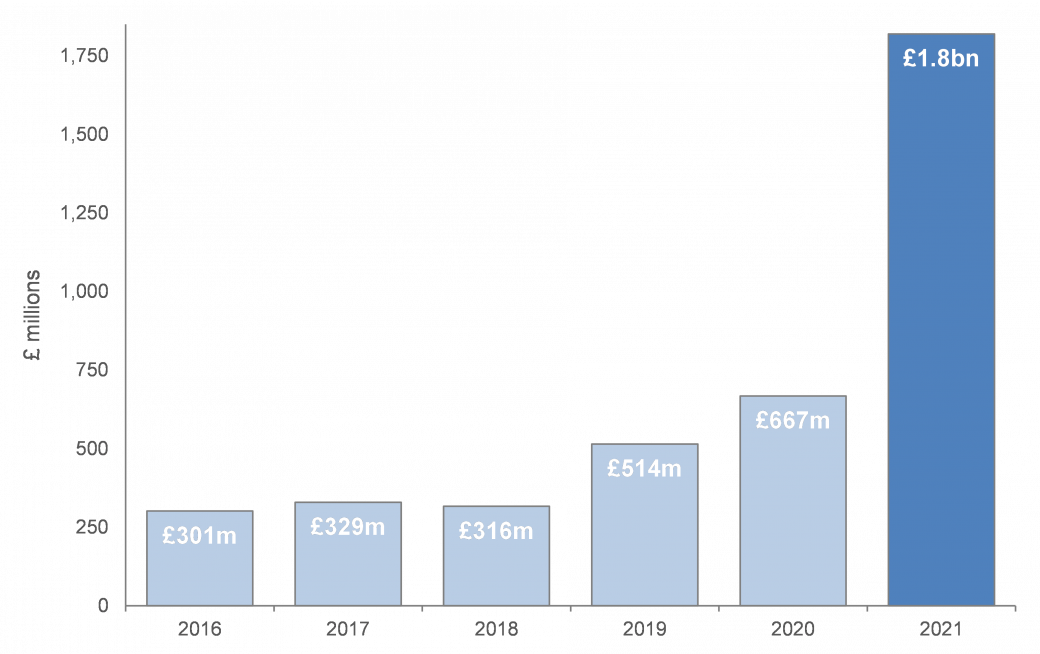

A big year for distressed PE deals as UK funds spend £1.8bn

UK funds £1.8bn spend in distressed PE deals

The UK’s leading mid-tier distressed asset private equity firms made acquisitions totalling £1.8bn in 2021, almost trebling 2020’s figure of £667m. The 12 specialist firms* included in Mazars’ research into the sector bought 26 UK businesses over the period, up from 19 the previous year.

This wave of activity came as a result of the big macro-economic headwinds that have closely followed the pandemic, as Mark Boughey, a partner in Mazars’ Restructuring services practice, explains:

“The huge increase in costs businesses have seen and new indebtedness they have had to incur, just as they put Covid behind them, has put a raft of fundamentally good businesses under financial stress and caused those which were weak to enter deep distress. That is exactly the sort of situation that these funds specialise in acquiring.”

Value of acquisitions by distressed asset funds

The businesses sought by distressed asset funds

According to Mazars’ research, these funds are primarily targeting businesses with “hard” assets. Such assets give a business a more predictable resale value, which provides the fund making the acquisition with more security and easier access to debt finance.

So, for example, businesses in the engineering and manufacturing sectors have been drawing much interest, as have those with recurring revenue streams or subscription models, such as software and technology companies.

One sector that hasn’t been so popular, however, despite the presence of many distressed businesses, is retail. As Boughey notes, “The current cost of living crisis means that businesses that rely on discretionary consumer spending – particularly retailers – could be a riskier proposition for funds at present.”

Distressed asset funds’ strategies

Distressed asset funds have traditionally been associated with a fairly aggressive approach to restructuring. But Harris Waseem, Director in Mazar’s Restructuring services practice, suggests that these funds have evolved their approach.

“The key distressed funds in the UK mid-market are increasingly reputation focused and want to be seen as providing what we call ‘constructive capital’,” he says. “This means avoiding hostile acquisitions and not committing to hasty cost-reduction programmes, but instead sourcing opportunities where companies require specialist expertise to recover and draw out unrealised value.”

The forecast for distressed asset activity

As interest rates rise and inflationary pressures cut disposable incomes, it seems likely that many more businesses will fall into difficulties. And this will create plenty of opportunities for these funds, whether in the form of undervalued assets or the opportunity for a turnaround or a carve-out.

And as long as this challenging and uncertain economic climate continues, we can expect to see plenty of activity in this already highly active sector.

*The funds included in the Mazars’ research were Alchemy Partners, Aurelius Equity Opportunities, Better Capital, Endless, ESO Capital Group, Greybull Capital, Inflexion Private Equity Partners, Maven Capital Partners, RCapital Partners, Ridgeway Capital, Rutland Partners and Sandton Capital Partners.

Get in touch

If you would like to discuss the above with a member of our team, please click the link below: