Monthly insolvency statistics – October 2022

Monthly insolvency statistics – October 2022

Corporate Insolvencies

England and Wales

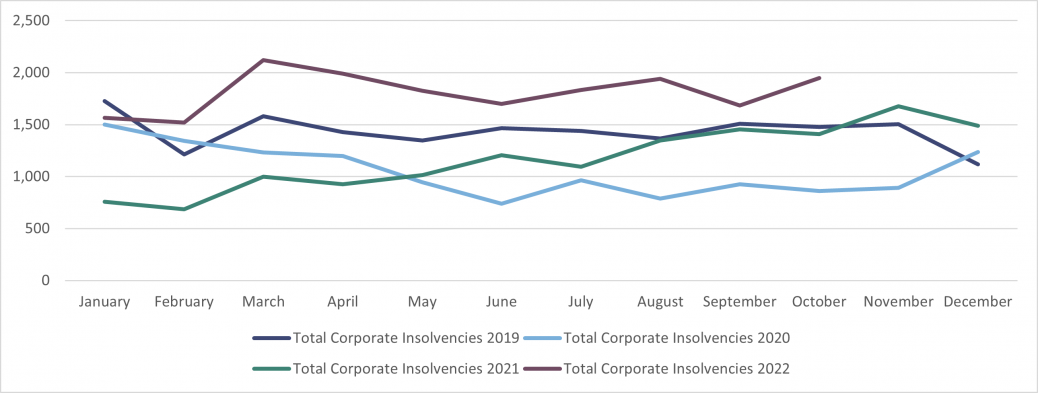

Total corporate insolvencies in October 2022 were 1,948. This is 38% greater than October 2021 and importantly 32% higher than October 2019 (pre-Pandemic).

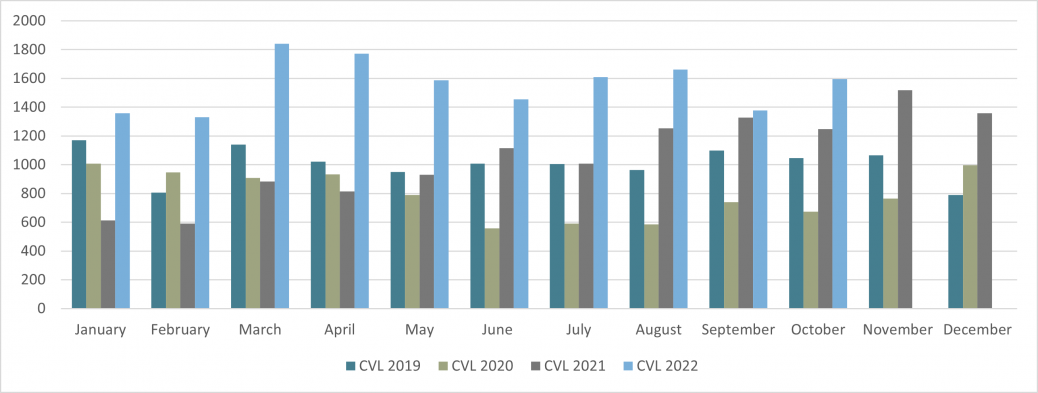

Creditors Voluntary Liquidations (“CVLs”) totalled 1,594 and were 28% higher than October 2021 and 53% higher than in (pre-Pandemic) October 2019. It is notable that the trend in CVL procedures remains significantly higher than pre-Pandemic comparisons.

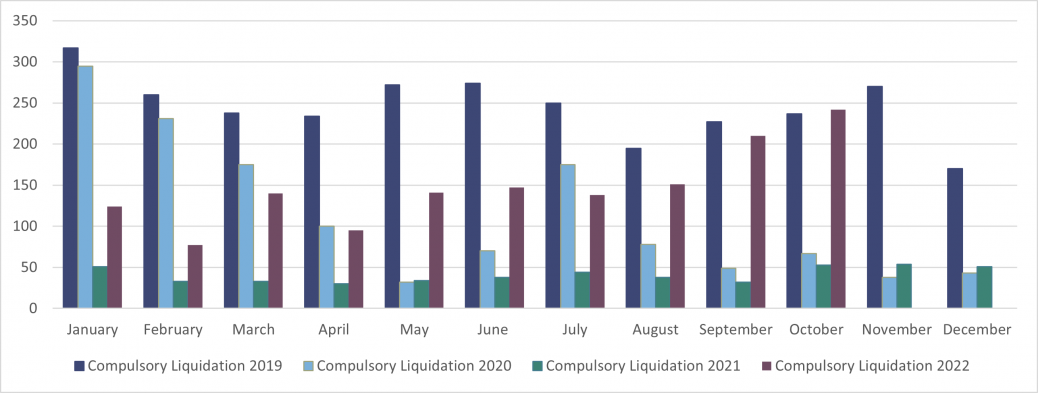

Compulsory Liquidations (“WUCs”) were 242 which is more than 4 times higher than October 2021 and importantly 2% higher than October 2019.

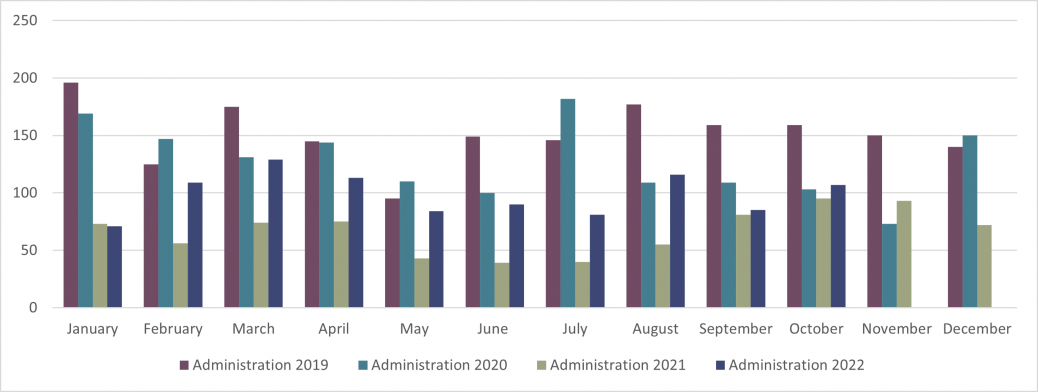

Administrations totalled 107 which is 13% higher than in October 2021 but 33% lower than pre- Pandemic levels.

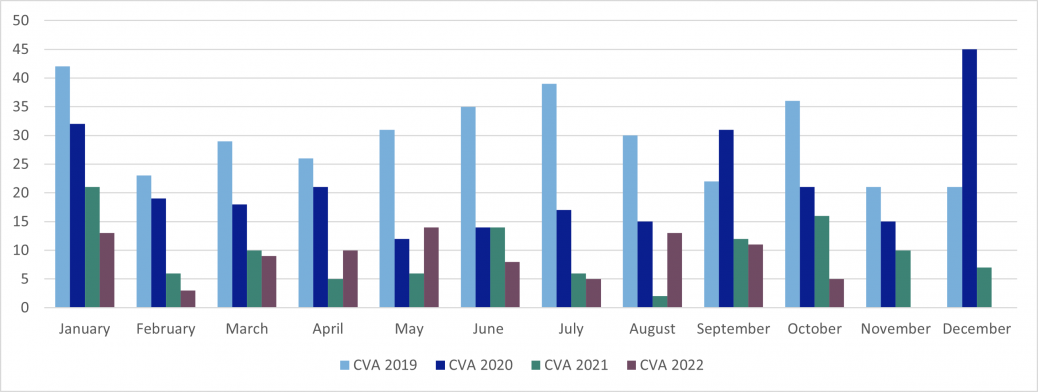

CVAs (5) remain at low levels in October 2022; 69% lower than October 2021 but 86% lower than October 2019

Scotland

In October 2022 there were 82 company insolvencies registered in Scotland, 22% higher than the number in October 2021 and 1% higher than October 2019. This was comprised of 19 compulsory liquidations, 55 CVLs and eight administrations. There were no CVAs or receivership appointments.

Northern Ireland

In October 2022 there were 15 company insolvencies registered in Northern Ireland, a 7% increase on October 2021 but 71% lower than October 2019.This was comprised of 12 CVLs and three administrations. There were no compulsory liquidations, CVAs or receivership appointments.

Personal Insolvencies

England and Wales

Personal insolvency numbers continue to remain flat and show no real signs of increasing in the short term, but this cannot be sustained for an indefinite period. With fuel and energy prices still volatile and the cost-of-living crisis taking effect, personal insolvencies are almost certain to rise in the coming months and show a more marked increase in the first and second quarter of 2023.

It is interesting to see a distinction starting to develop between the frequency of use of the different personal insolvency solutions available to address problems of indebtedness.

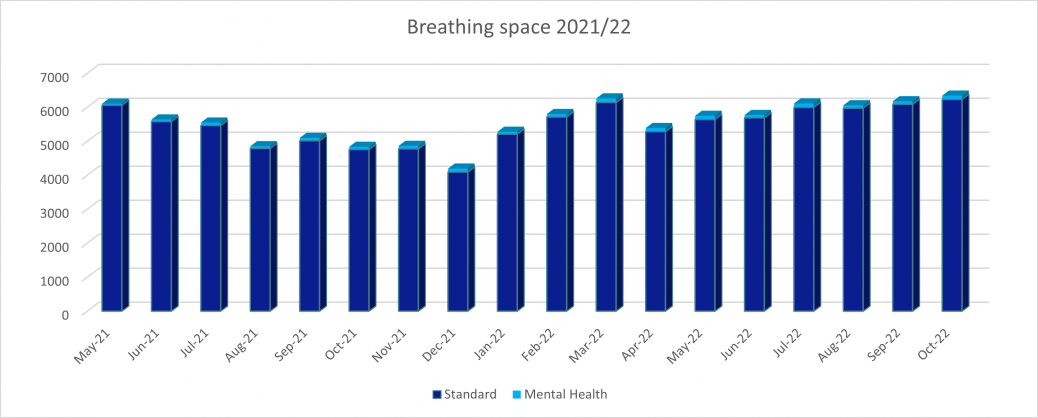

For example, we can see that Breathing Space (BS) applications have hovered around 5,400 per month since inception, and October saw another upturn in 6,342 applications being made – the highest monthly number since inception in May 2021.

112 Mental Health BS applications were made in October, against a similar monthly average, and 6,230 Standard BS applications were made, against a 12-month average of 5,568.

Those using BS, may well be people with more pressing and immediate debts that elicit creditor pressure quickly.

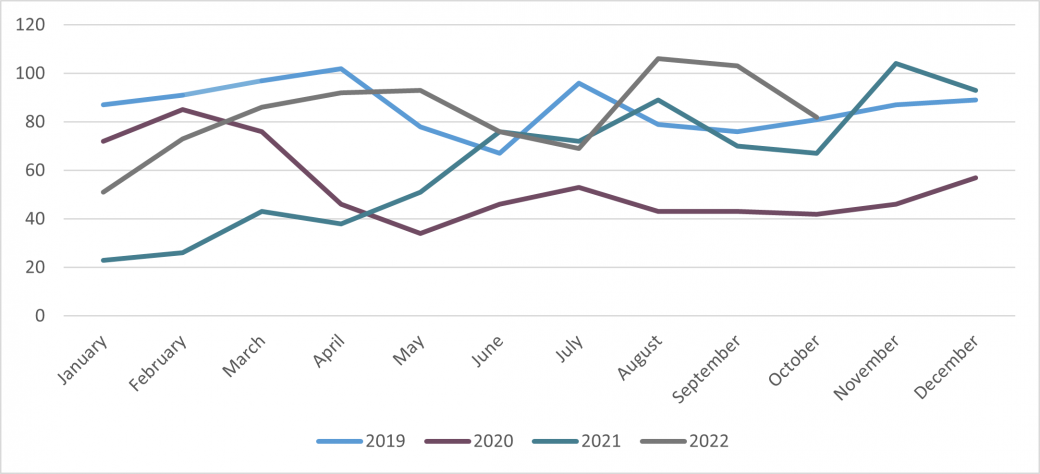

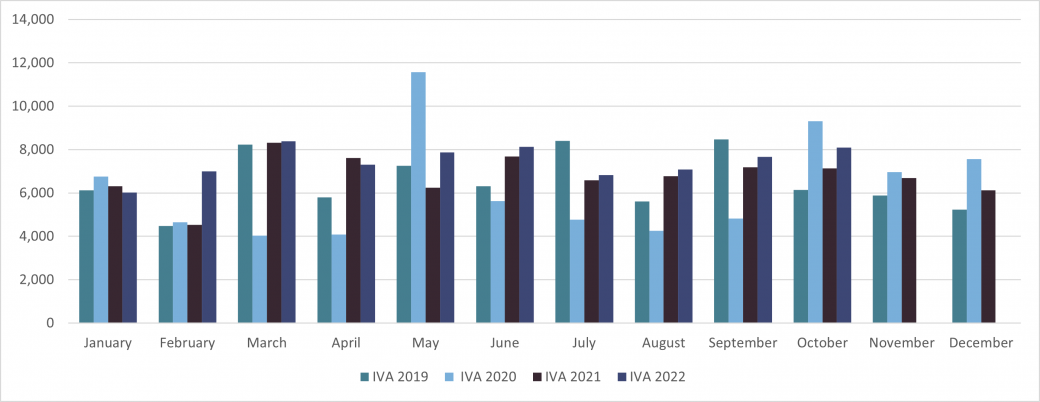

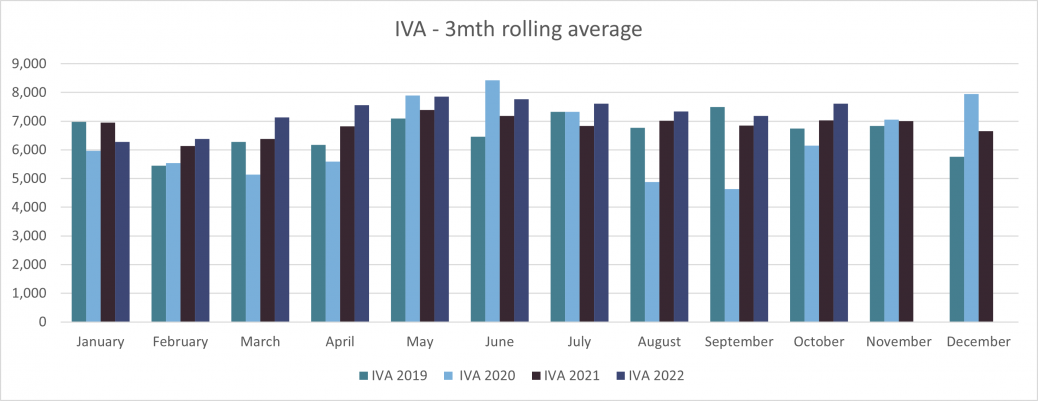

There has been an approximate average of 7,500 Individual Voluntary Arrangements (IVA’s) in the 6-month period to September 2022 and then 7,610 recorded in October, but IVA’s have fluctuated between around 6,300 and 7,800 per month for some time, and October may just represent one of the many minor peaks, rather than the beginning of a more permanent upward trend.

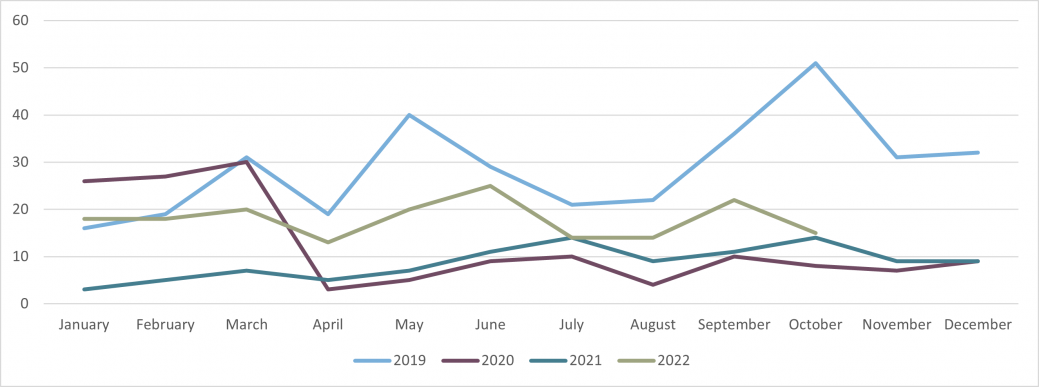

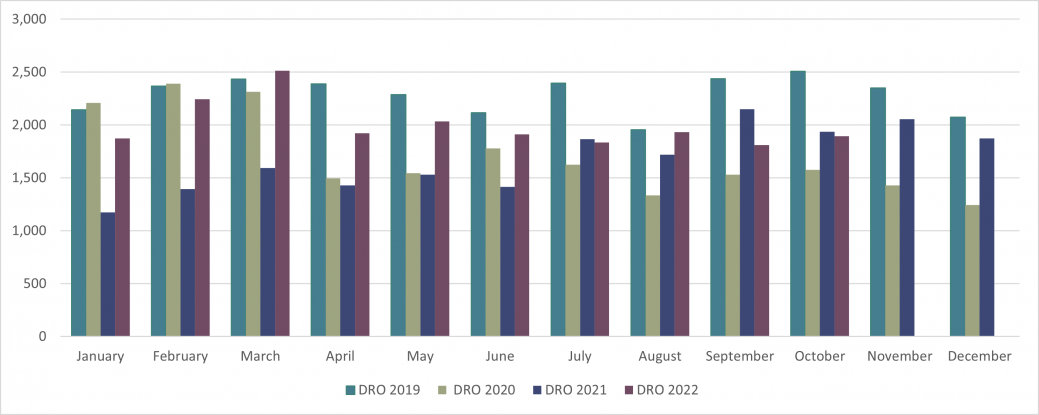

Following the changes in criteria from June 2021, allowing easier entry into a Debt Relief Order (DRO), they have averaged 1,995 per month, with the October figure of 1,894 representing a slight decrease.

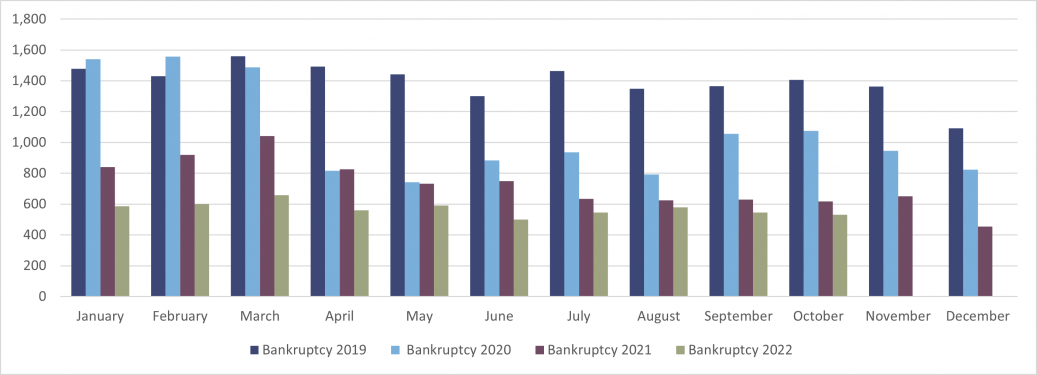

A “new” DRO would have previously likely have been a bankruptcy and therefore, the DRO and bankruptcy graphs travelling in diverging directions is no real surprise. In October, there were only 531 bankruptcies, against a 12-month average of 573.

Bankruptcies are at historical lows and the flat trend in debtors making their own bankruptcy application in October (469 against a 12-month average of 479) is a result of those who are now eligible to choose a DRO instead.

Bankruptcy petitions will undoubtedly have to be issued by creditors to recover debts incurred during the pandemic and as a result of current economic pressures. We do expect to see creditor-driven bankruptcies begin to increase early in 2023. However, in October there were only 62 creditors’ petitions, which is down on the 12-month average of 90. The summer recess of the Courts, who are already experiencing significant backlogs, could explain the downward “blip” in the creditor petition curve, which was slowly starting to creep upwards following the covid stagnation.

One noticeable element to the creditor petition statistics is that HMRC have now crept to the top of the table of volume bankruptcy petitioners, which reflects the government’s intentions in relation to recovery of unpaid tax. Although corporate entities who are engaging with HMRC appear to be obtaining generous time to pay arrangements, individuals who are not engaging appear to be facing no nonsense enforcement.

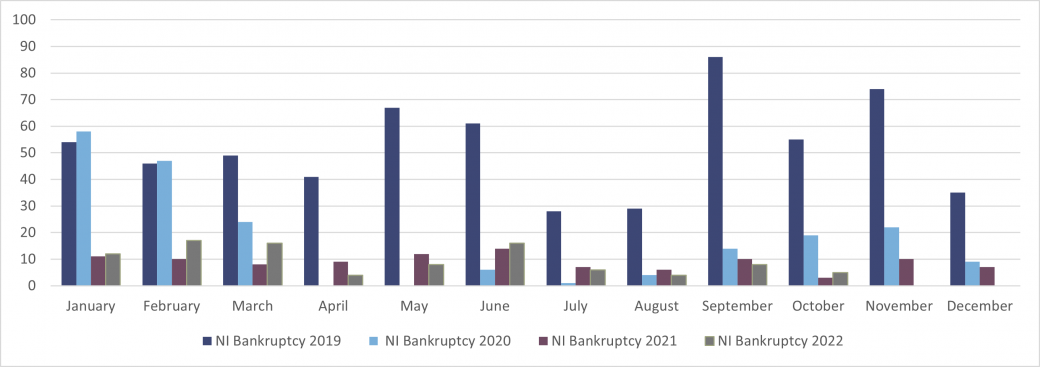

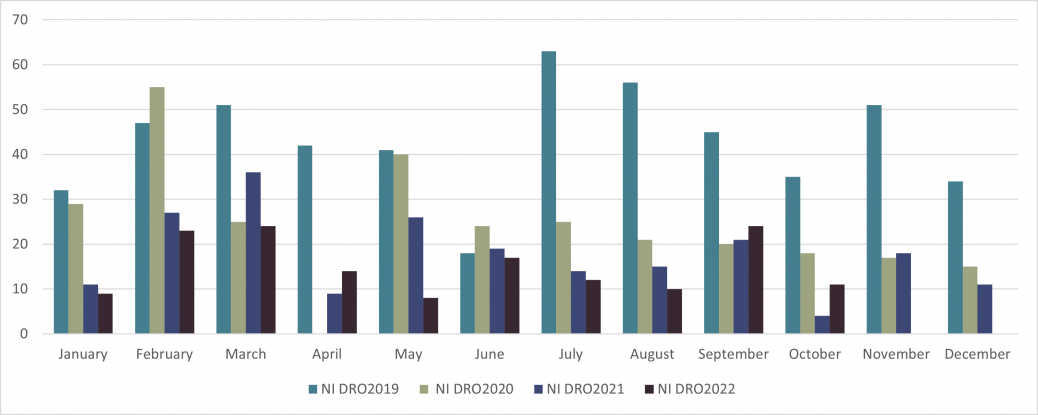

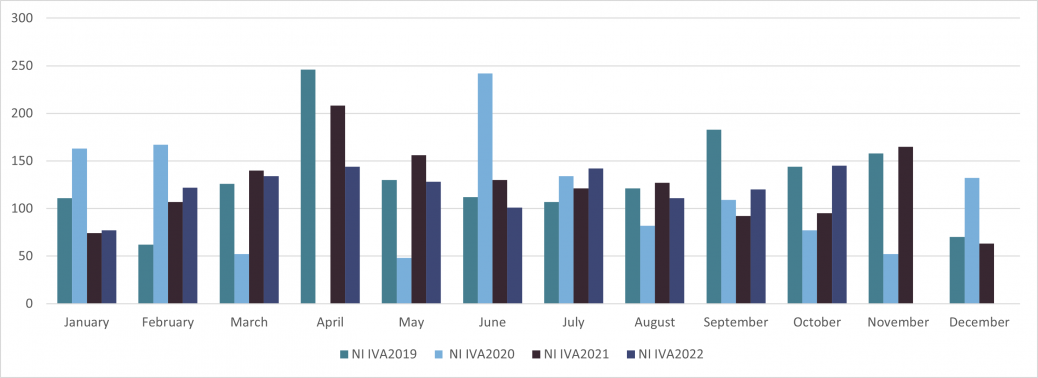

Northern Ireland

In October 2022 there were 161 individual insolvencies in Northern Ireland, 58% higher than in October 2021, but 31% lower than October 2019. This consisted of 145 IVAs, 11 DROs and five bankruptcies.

|

|

|

Mazars is an internationally integrated partnership, specialising in audit, accountancy, advisory, tax and legal services*. Operating in over 90 countries and territories around the world, we draw on the expertise of more than 42,000 professionals – 26,000+ in Mazars’ integrated partnership and 16,000+ via the Mazars North America Alliance – to assist clients of all sizes at every stage in their development. *Where permitted under applicable country laws Mazars LLP is the UK firm of Mazars, an international advisory and accountancy organisation, and is a limited liability partnership registered in England with registered number OC308299. A list of partners’ names is available for inspection at the firm’s registered office, 30 Old Bailey, London EC4M 7AU. Registered to carry on audit work in the UK by the Institute of Chartered Accountants in England and Wales. Details about our audit registration can be viewed at www.auditregister.org.uk under reference number C001139861.