Monthly insolvency statistics – May 2023

Monthly insolvency statistics – May 2023

A snapshot of corporate and personal insolvencies across the UK in May 2023.

Corporate Insolvencies

England and Wales

Corporate insolvencies totalled 2,552 in May 2023, compared to 1,348 in May 2019, 944 in May 2020, 1,013 in May 2021 and 1,824 in May 2022.

Creditors Voluntary Liquidations constitute 83% of all corporate insolvencies of 2023 to date, compared to 70% in the same period in 2019, and 87% from January to May 2021 and 2022.

Creditors Voluntary Liquidations (“CVLs”) totalled 2,181, 38% higher than May 2022 and 130% higher than in (pre pandemic) May 2019.

Compulsory Liquidations (“WUCs”) totalled 189, 34% higher than May 2022 but 30% lower than May 2019. Compulsory Liquidations made up 20% of all corporate insolvencies in May 2019, and 10% in May 2023.

There were 151 Administration appointments in May 2023 which is 80% higher than May 2022 and 59% higher than May 2019.

There were 31 CVAs in May 2023, which was more than double than in May 2022 and the same number as in May 2019.

Scotland

In May 2023 there were 97 company insolvencies registered in Scotland, 4 more than in May 2022. This was comprised of 35 Compulsory Liquidations, 57 CVLs and 5 Administrations. There were no Receivership appointments or CVAs.

Northern Ireland

In May 2023 there were 11 company insolvencies registered in Northern Ireland, 45% lower than in May 2022, and include 8 CVLs.

Personal Insolvencies

England and Wales

Personal insolvency numbers remain on a slow upward curve, as interest rates hit a 15-year high and the cost-of-living crisis continues to take effect. Personal insolvencies are almost certain to continue this trend into the second half of 2023 but remain quite volatile month to month.

There were 6,683 Breathing Space (BS) applications in May, against the usual monthly average of around 5,900. This trend might be a significant indicator of things to come.

With clamping down on poor advice and better signposting by the regulated debt advice sector, we expect the BS monthly figure to show a continued steady upward trend. As BS is merely a pause in the debt settlement process, it would not be surprising to also see the DRO, bankruptcy and IVA numbers rise once the BS period expires for these individuals.

May’s Mental Health BS application figure of 74, given the stringent entry criteria, is another significant indicator as to the nation’s wider mental health debt crisis.

There were 6,767 Individual Voluntary Arrangements (IVA’s) on average in the 3-month period to May, which is on par with the usual 6,700 per month seen since 2019.

It will now be interesting to see whether the increased BS applications do now drive the IVA figures downwards as better, regulated advice begins to take effect.

The FCA have also warned of an imminent ban on fees being paid to debt packaging companies, so the impact on IVAs might be interesting in the coming months.

In 2019, there were 2,289 Debt Relief Orders (DRO’s) a month on average, and following the changes in entry criteria from June 2021, surprisingly they have only averaged around 2,000 per month. The May figure of 2,505 might suggest a slight uptick in DRO’s but some organisational changes in the administration of DRO’s in February may be the true reason for the last two months’ spike in registrations.

A “new” DRO would have previously been a no-asset bankruptcy and therefore, the record low bankruptcy numbers of 2021/22 were of no real surprise. The average monthly bankruptcy numbers in 2019 were 1,395, made up of 1,134 debtor’s applications and 261 creditor petitions. The stark decrease from that period to the current numbers is clear against the last 12-month averages of 563 bankruptcies, made up of an average of 459 debtor’s applications and 103 creditor petitions per month.

In May, there were 617 bankruptcies, against a 2022 average of 557 per month. We expect the bankruptcy numbers to steadily pick up, showing a more marked increase into the second half of the year.

Bankruptcy petitions will undoubtedly have to be issued by creditors to recover debts incurred during the pandemic, and as a result of current economic pressures. In May, there were 96 creditors’ petitions, which is slightly down on the preceding 12 months’ average. We do expect to see creditor-driven bankruptcies begin to steadily increase in the second half of 2023, led by HMRC in the recovery of unpaid tax liabilities. The volume of bankruptcy petitions will be driven by resource availability at HMRC, and by the ability of the Court system to manage them.

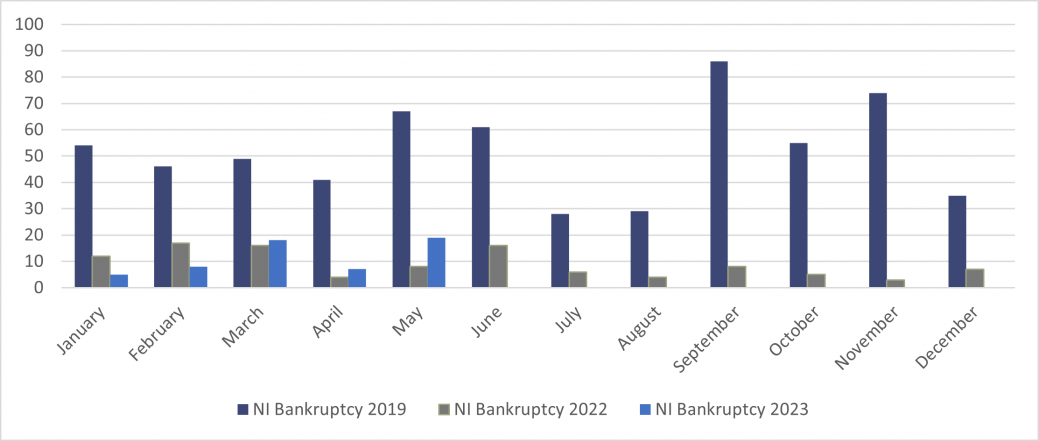

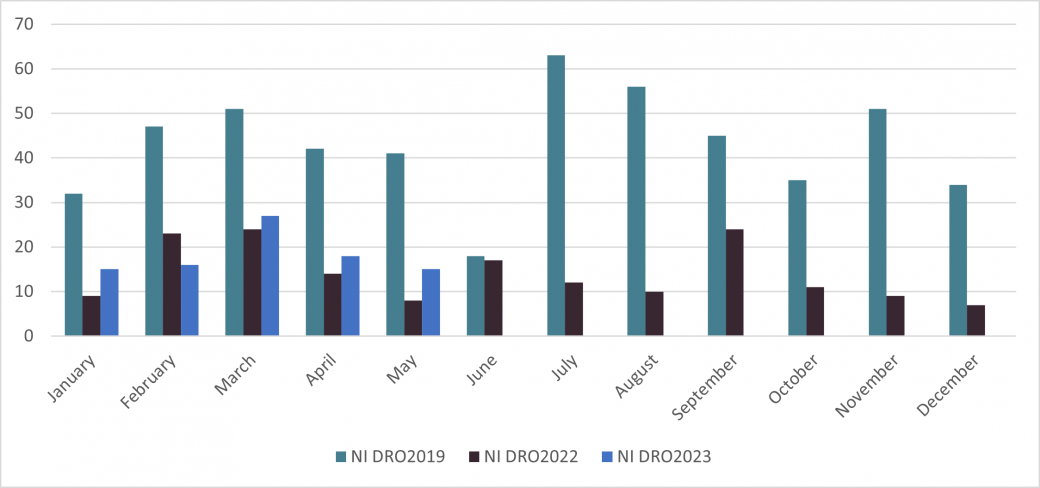

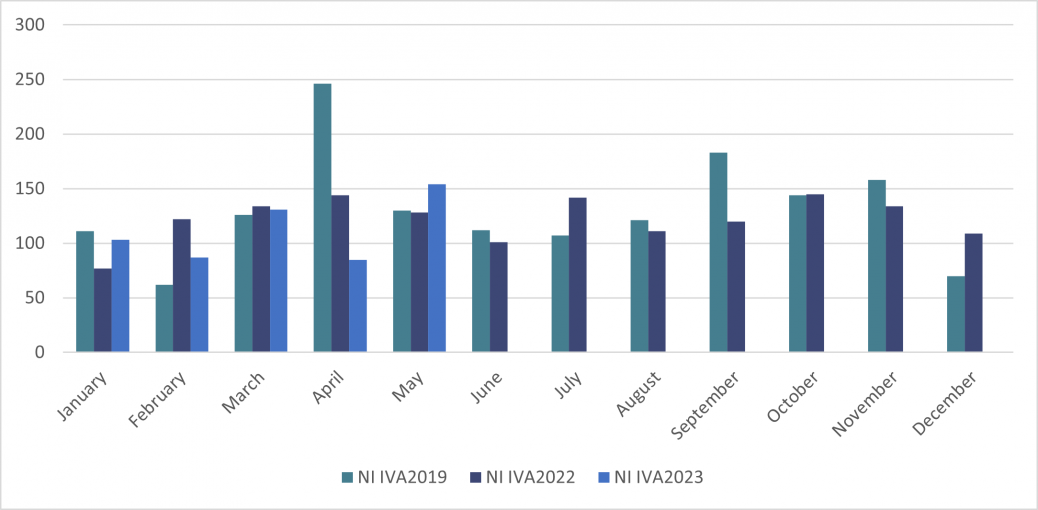

Northern Ireland

In May 2023 there were 188 individual insolvencies in Northern Ireland, 31% higher than in May 2022. This consisted of 154 IVAs, 15 DROs and 19 bankruptcies.

|

|

|

Mazars is an internationally integrated partnership, specialising in audit, accountancy, advisory, tax and legal services*. Operating in over 90 countries and territories around the world, we draw on the expertise of more than 42,000 professionals – 26,000+ in Mazars’ integrated partnership and 16,000+ via the Mazars North America Alliance – to assist clients of all sizes at every stage in their development. *Where permitted under applicable country laws Mazars LLP is the UK firm of Mazars, an international advisory and accountancy organisation, and is a limited liability partnership registered in England with registered number OC308299. A list of partners’ names is available for inspection at the firm’s registered office, 30 Old Bailey, London EC4M 7AU. Registered to carry on audit work in the UK by the Institute of Chartered Accountants in England and Wales. Details about our audit registration can be viewed at www.auditregister.org.uk under reference number C001139861.