Monthly insolvency statistics – January 2022

Monthly insolvency statistics – January 2022

Corporate Insolvencies

England and Wales

Total corporate insolvencies increased by 5% this month to 1,560. It is notable that this total is 106% higher than January 2021 (758) and 3% higher than January 2020 (pre-pandemic).

Creditors Voluntary Liquidations (“CVLs”) totalled 1,358 and were over 100% higher when compared to January 2021 and 34% higher than in (pre-Pandemic) January 2020.

Compulsory Liquidations (“WUCs”) (118) continue to be significantly lower than they were pre-Pandemic, 60% lower when compared to January 2020 but 131% higher when compared to January 2021. The more than doubling of orders is likely an indication of movement towards pre-pandemic levels as governmental reliefs start to lessen and creditors move to increase pressure.

Administrations totalled 71 which is 3% lower in January 2021 and 58% lower than January 2020. CVAs remain at low levels with 13 registered in January 2022, 38% lower than January 2021 and 59% lower than January 2020. Concerns remain as to being able to reliably forecast future trading performance.

Scotland

In January 2022 there were 51 company insolvencies registered in Scotland, 122% higher than January 2021 and 30% lower than in January 2020. This was comprised of 14 compulsory liquidations, 34 CVLs and three administrations. There were no CVAs or receivership appointments.

Northern Ireland

In January 2022 there were 18 company insolvencies registered in Northern Ireland, six times as many as in January 2021, but 31% lower than January 2020. This was comprised of two compulsory liquidations, 12 CVLs, three CVAs and one receivership appointment. There were no administrations.

Personal Insolvencies

England and Wales

The personal insolvency statistics for January 2022 reveal that there were only 575 bankruptcy orders made in the month, 32% lower than January 2021 and 63% lower than January 2020.

The 1,873 Debt Relief Orders (DROs) in January 2022 were 59% higher than January 2021 but remained 15% lower than January 2020.

There were an average of around 1,400 DROs per month in 2021 before the criteria were widened, and an average of 1,929 per month after the changes.

As we have stated previously, this increase is largely a result of those “bankruptcies” which have now become eligible to be a DRO.

The monthly trend of around 7,000 Individual Voluntary Arrangements (IVAs) being registered dipped again this month (6,281). The January 2022 IVA numbers are 5% lower than January 2021 and 15% lower than January 2020 and the overall trend remains flat.

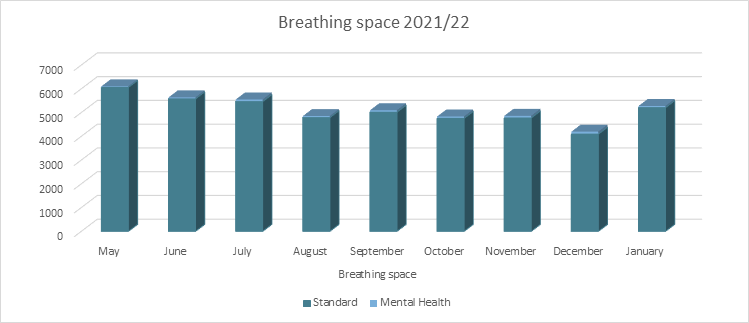

Breathing Space

Since the launch of the Breathing Space (BS) legislation, there have been 46,407 registrations (averaging 5,156 per month), with 45,710 Standard BS and 697 Mental Health. BS registrations.

January saw an increase in BS registrations with the highest number recorded since July 2021 with an increase in Standard BS schemes entered (5,207), but a decrease in Mental Health registrations (72).

Overall, personal insolvency numbers remain very low driven by a significant reduction in bankruptcies and DRO’s.

In the summer, many were predicting the turn of the year as the point at which personal insolvency numbers would noticeably increase. We think it is safe to say that bankruptcy numbers have hit “rock bottom” and DRO numbers will similarly increase in the coming months, but not rapidly. We expect IVAs to fluctuate between 6,500 and 7,000 per month.

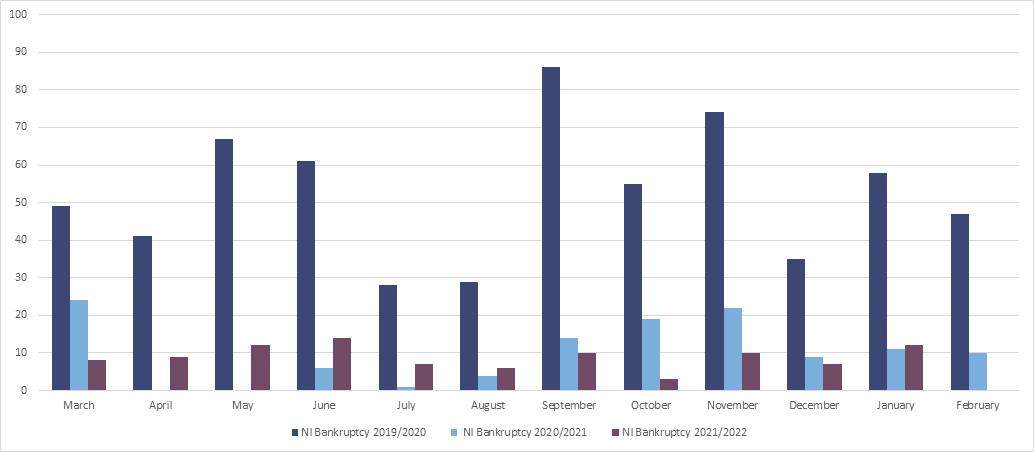

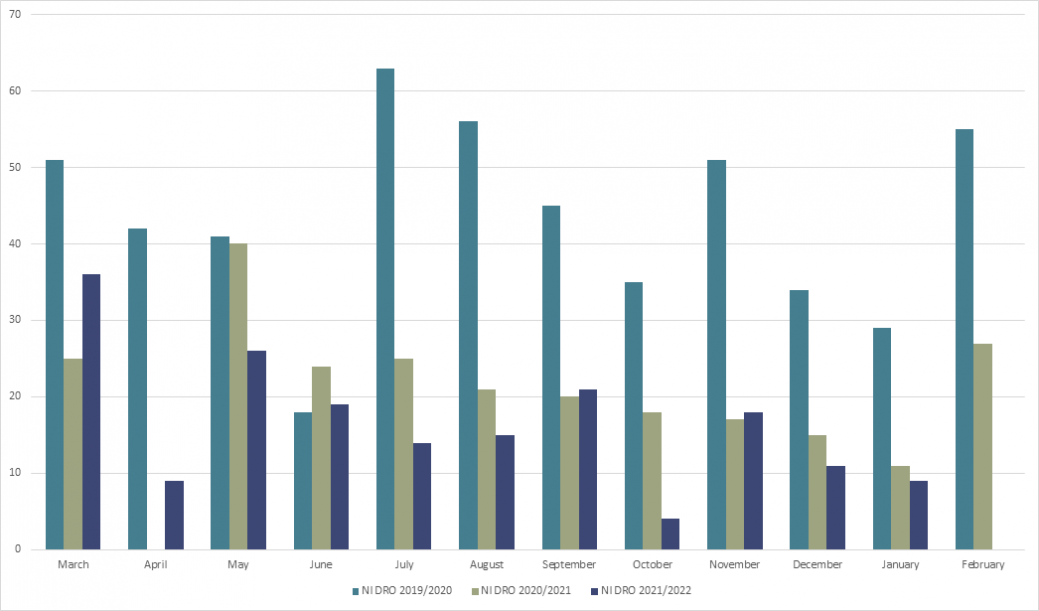

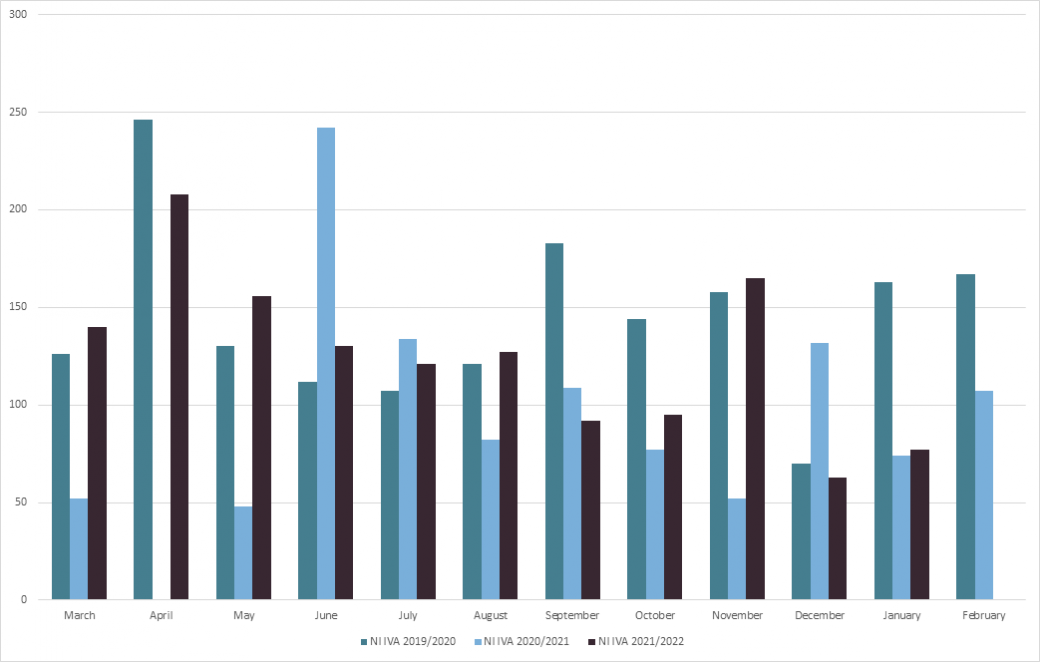

Northern Ireland

In January 2022 there were 98 individual insolvencies in Northern Ireland, 2% higher than in January 2021, but 61% lower than January 2020. This consisted of 77 IVAs, nine DROs and 12 bankruptcies.

|

|

|

Mazars is an internationally integrated partnership, specialising in audit, accountancy, advisory, tax and legal services*. Operating in over 90 countries and territories around the world, we draw on the expertise of more than 42,000 professionals – 26,000+ in Mazars’ integrated partnership and 16,000+ via the Mazars North America Alliance – to assist clients of all sizes at every stage in their development. *Where permitted under applicable country laws Mazars LLP is the UK firm of Mazars, an international advisory and accountancy organisation, and is a limited liability partnership registered in England with registered number OC308299. A list of partners’ names is available for inspection at the firm’s registered office, 30 Old Bailey, London EC4M 7AU. Registered to carry on audit work in the UK by the Institute of Chartered Accountants in England and Wales. Details about our audit registration can be viewed at www.auditregister.org.uk under reference number C001139861.