Monthly insolvency statistics – February 2024

Monthly insolvency statistics – February 2024

Corporate Insolvencies

England and Wales

Total corporate insolvencies in February were 2,102. This was 17% higher than in the same month in the previous year (1,801 in February 2023) and was even higher than levels seen prior to the Government support measures being put in place in response to the coronavirus (COVID-19) pandemic with a 73% increase on the February 2019 figures. The increase in insolvencies continues to be attributed to the unwinding of the government COVID-19 support packages as businesses struggle to repay borrowings together with the impact of higher interest rates and energy costs with the retail and hospitality industries in particular, continuing to struggle.

Creditors Voluntary Liquidations (“CVLs”) totalled 1,707 marking a 30% increase on the January figures and a 12% increase on the same month last year.

Compulsory Liquidations (“WUCs”) were 37% lower than the previous month with 217 appointments however, still higher than February 2023 with a 35% increase.

Administrations totalled 166 which is 38% higher than in January 2024 and 54% higher than the same month in 2023. This is indicative evidence that the growth in insolvencies this month was not fuelled by creditor driven action through winding up petitions but by way of directors looking at voluntary restructurings.

CVAs remain at low levels with only 12 approved in February 2024, down from 16 in January 2024 and at the same level as February 2023.

Scotland

In February 2024 there were 94 company insolvencies registered in Scotland, 9% higher than February 2023 and similar levels to January 2019. There were 33 compulsory liquidations, 58 CVLs and 3 administrations. There were no CVAs approved nor receivership appointments.

Northern Ireland

In February 2024 there was a 100% increase in company insolvencies compared to the previous month with 26 registered in Northern Ireland which was 37% higher than February 2019. This is comprised of 9 CVLs, 14 compulsory liquidations and three administrations. There were no CVAs nor receivership appointments.

Personal Insolvencies

England and Wales

Total individual insolvencies in February were 10,136, which was notably higher than February 2023 (8,239).

This increase may have also been aided by those exiting a Breathing Space (BS) application and being sign-posted to a DRO as their chosen exit route once the BS period had expired.

The slight upward trend in bankruptcies has continued, with HMRC leading the push on filing petitions. Creditors’ petitions have increased with a monthly average of 141 in 2023, compared to 95 in 2022. This is mirrored in debtor’s bankruptcy applications, which reached 594 in February 2024 compared to 486 in the same month last year.

Breathing Space (BS) registrations in February reached 8,073 compared to 7,173 in February 2023. Registrations consisted of 109 Mental Health BS applications, and 7,964 Standard BS registrations, compared to the 2023 monthly average of 7,244.

An increase in BS applications looks to be continuing in 2024, however, this procedure is merely a pause in the process and the individuals concerned will still have to deal with their indebtedness, although what course of action they take will remain to be seen.

Plans to modernise the current Personal Insolvency framework could result in a single gateway to enable people to access independent, regulated debt advice, via a digital platform, or dovetailed with the current Breathing Space scheme, which may see the removal of barriers into appropriate and regulated insolvency procedures, providing a way out of debt, which will provide equally good outcomes for creditors where possible.

Individual Voluntary Arrangements (IVA) numbers appear to have increased significantly, with 6,420 recorded in February. However, those numbers include IVA’s that were approved more than two months earlier but were not registered until February 2024.

Debt Relief Orders (DRO) - 3,007 - increased significantly from February 2023 (2,083). Following the changes in criteria from May 2021, allowing easier entry into a DRO, take-up has increased, with 2023 averaging 2,643 DRO’s per month.

Bankruptcy numbers have deceased slowly since the DRO criteria was changed. However, in February there were 709 bankruptcy orders, compared to 612 in February 2023, a modest increase, though still significantly lower than pre-pandemic levels.

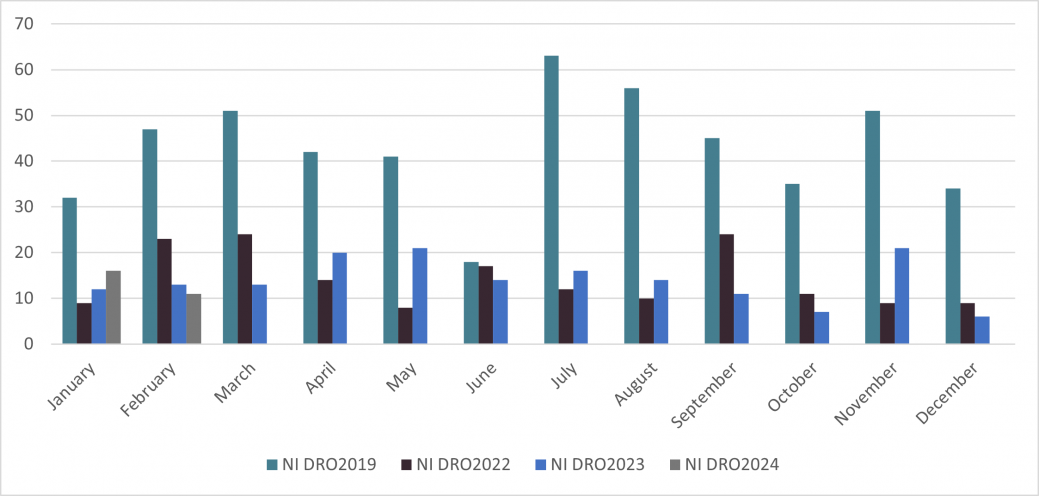

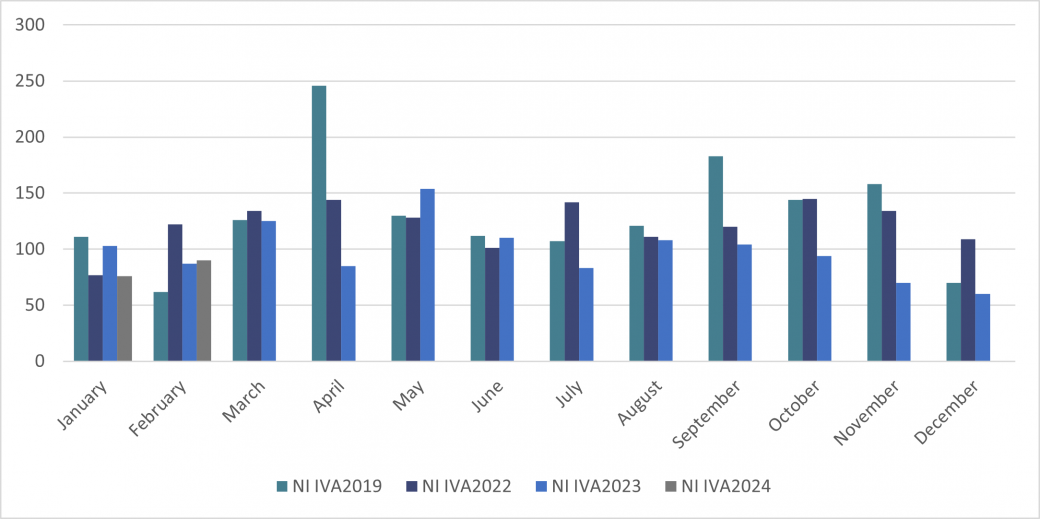

Northern Ireland

In February 2024 there were 122 individual insolvencies in Northern Ireland, 13% higher than in February 2023. This consisted of 90 IVAs, 21 bankruptcies and 11 DROs.

|

|

|

Mazars is an internationally integrated partnership, specialising in audit, accountancy, advisory, tax and legal services*. Operating in over 90 countries and territories around the world, we draw on the expertise of more than 42,000 professionals – 26,000+ in Mazars’ integrated partnership and 16,000+ via the Mazars North America Alliance – to assist clients of all sizes at every stage in their development. *Where permitted under applicable country laws Mazars LLP is the UK firm of Mazars, an international advisory and accountancy organisation, and is a limited liability partnership registered in England with registered number OC308299. A list of partners’ names is available for inspection at the firm’s registered office, 30 Old Bailey, London EC4M 7AU. Registered to carry on audit work in the UK by the Institute of Chartered Accountants in England and Wales. Details about our audit registration can be viewed at www.auditregister.org.uk under reference number C001139861.