Monthly insolvency statistics – February 2023

Monthly insolvency statistics – February 2023

Corporate Insolvencies

England and Wales

The upward trend of an increase in corporate insolvencies continues when compared to corresponding months both post and pre pandemic. In February 2023 company insolvencies totalled 1,783. This was 17% greater than February 2022 and 47% greater than February 2019 (pre COVID pandemic).

Creditors Voluntary Liquidations (“CVLs”) totalled 1,505, 13% higher than February 2022 and 87% higher than in (pre-pandemic) February 2019.

Compulsory Liquidations (“WUCs”) totalled 158, twice as many as February 2022 but still lower (39%) than February 2019.

There were 108 Administration appointments which is on a par with February 2022 but 14% lower than February 2019.

CVAs (12) remain at low levels in February 2023, 4 times higher than February 2022 but 48% lower than February 2019.

Scotland

In February 2023 there were 81 company insolvencies registered in Scotland, 11% higher than the number in February 2022 but 25% higher than in February 2019. This was comprised of 21 compulsory liquidations, 57 CVLs and three administrations. There were no receivership appointments or CVAs.

Northern Ireland

In February 2023 there were nine company insolvencies registered in Northern Ireland, 50% lower than February 2022 and 53% lower than February 2019. This was comprised of six CVLs, one compulsory liquidation and two CVAs. There were no administrations or receivership appointments.

Personal Insolvencies

England and Wales

Personal insolvency numbers continue to remain flat and show no signs of increasing in the short term, but this cannot be sustained for an indefinite period. With job losses and the cost-of-living crisis taking effect, personal insolvencies are almost certain to rise slowly in the coming months, and then show a more marked increase into the second half of 2023.

Breathing Space (BS) applications climbed significantly in January, with over 7,500 against the usual monthly average of around 5,900. This trend continued into February with 7,312 applications. This trend might be a significant indicator of things to come, or perhaps just a hangover from the festive season, with many waiting for the new year to apply for some debt respite.

With clamping down on poor advice and better signposting by the regulated debt advice sector, we expect the BS monthly figure to show a continued steady upward trend into 2023. As BS is merely a pause in the debt settlement process, it would not be surprising to see the DRO, bankruptcy and IVA numbers rise once the BS period expires for these individuals.

Notably, February’s Mental Health BS figure of 139 is the highest since inception, and given the stringent entry criteria, is another significant indicator as to the nation’s wider mental health crisis.

With 2020 / 2021 being periods of distortion for longer terms statistical trends, it is more useful to consider 2019 monthly averages against the last 12 months’ average for the other various personal insolvency procedures.

There were only 5,627 Individual Voluntary Arrangements (IVA’s) on average in the 3-month period to February, which is slightly below the usual 6,500-7,000 per month.

Average monthly IVA numbers have increased from 6,611 during 2019, to 7,254 in the last 12 months and IVA’s continue to drive trends and headlines in the wider personal insolvency statistics.

It will now be interesting to see whether the increased BS applications do now drive the IVA figures downwards as better, regulated advice begins to take effect.

In 2019, there were 2,289 Debt Relief Orders (DRO’s) a month on average, and following the changes in entry criteria from June 2021, surprisingly they have only averaged around 1,980 per month. The February figure of 2,083 continues that trend, but we expect DRO’s to remain on a steady upward trajectory into 2023.

A “new” DRO would have previously been a bankruptcy and therefore, the record low bankruptcy numbers of 2021/22 were of no real surprise. The average monthly bankruptcy numbers in 2019 were 1,395, made up of 1,134 debtor’s applications and 261 creditor petitions. The stark decrease from that period to the current numbers is clear against the last 12-month averages of 559 bankruptcies, made up of 462 debtor’s applications and 97 creditor petitions per month.

In February, there were 580 bankruptcies, against a 2022 average of 556 per month. We expect the bankruptcy numbers to steadily pick up into early 2023, showing a more marked increase into the second half of the year.

Bankruptcy petitions will undoubtedly have to be issued by creditors to recover debts incurred during the pandemic, and as a result of current economic pressures. In February, there were 94 creditors’ petitions, which is on par with the preceding 12 months’ average. We do expect to see creditor-driven bankruptcies begin to steadily increase in 2023.

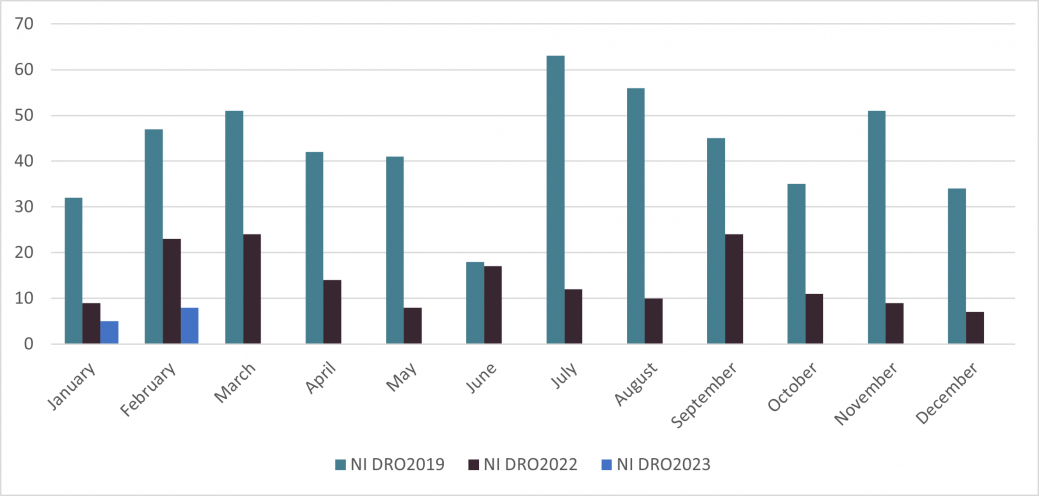

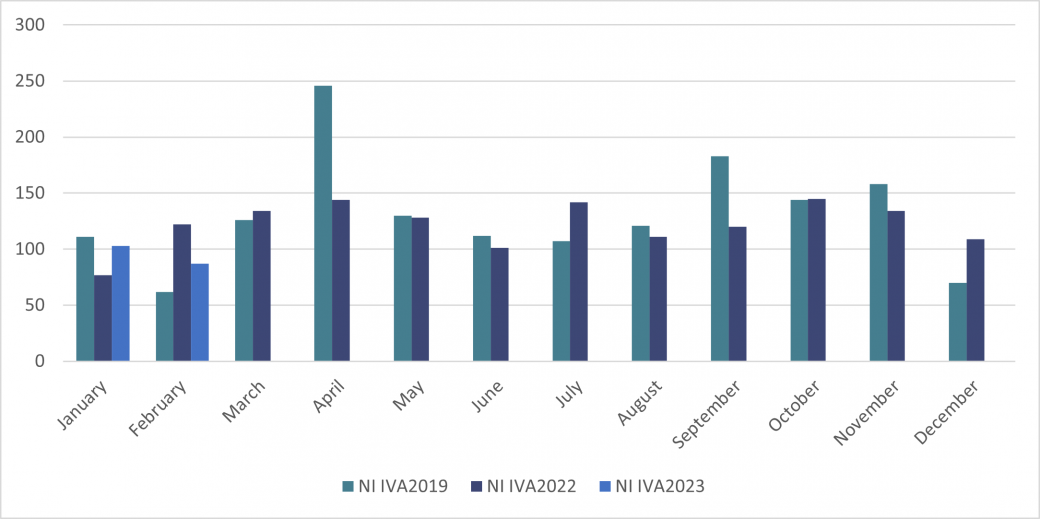

Northern Ireland

In February 2023 there were 111 individual insolvencies in Northern Ireland, 31% lower than in February 2022, and 28% lower than February 2019. This consisted of 87 IVAs, 16 DROs and eight bankruptcies.

|

|

|

Mazars is an internationally integrated partnership, specialising in audit, accountancy, advisory, tax and legal services*. Operating in over 90 countries and territories around the world, we draw on the expertise of more than 42,000 professionals – 26,000+ in Mazars’ integrated partnership and 16,000+ via the Mazars North America Alliance – to assist clients of all sizes at every stage in their development. *Where permitted under applicable country laws Mazars LLP is the UK firm of Mazars, an international advisory and accountancy organisation, and is a limited liability partnership registered in England with registered number OC308299. A list of partners’ names is available for inspection at the firm’s registered office, 30 Old Bailey, London EC4M 7AU. Registered to carry on audit work in the UK by the Institute of Chartered Accountants in England and Wales. Details about our audit registration can be viewed at www.auditregister.org.uk under reference number C001139861.