Monthly insolvency statistics – August 2023

Monthly insolvency statistics – August 2023

Corporate Insolvencies

England and Wales

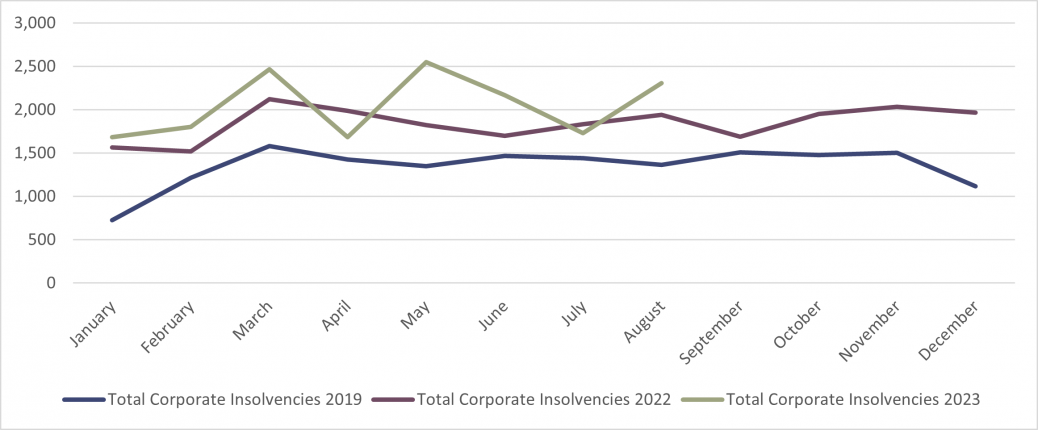

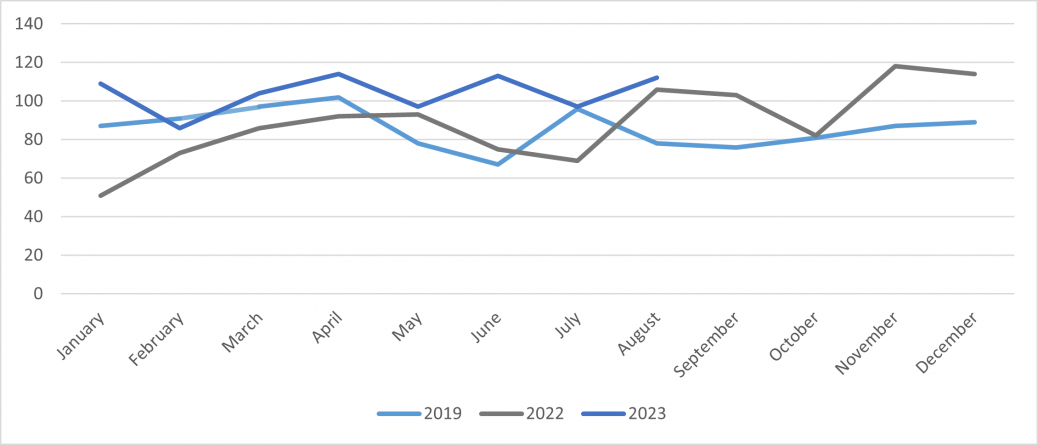

August showed another increase in overall company insolvencies, with 2,308 cases recorded (up by over a third on the number of cases in July). The rolling 12-month period ending July 2023 has seen average numbers of insolvencies of 2,002 per month, compared to the average number of cases for the 12 months of 2019, of 1,431 insolvencies. The impact of the cost of living crisis, interest rate increases, Covid and Brexit, is clearly visible. It also means that the average number of insolvencies per month (1,491) for the 41 months post initial Covid lockdown is now higher than the average number of insolvencies per month for the 15 months pre-lockdown (1,417). Arguably, the much-talked about “backlog” of insolvencies (the insolvencies that would have happened at any normal time had Covid measures not intervened) have now washed through and what we are now seeing is a genuine increase in distress.

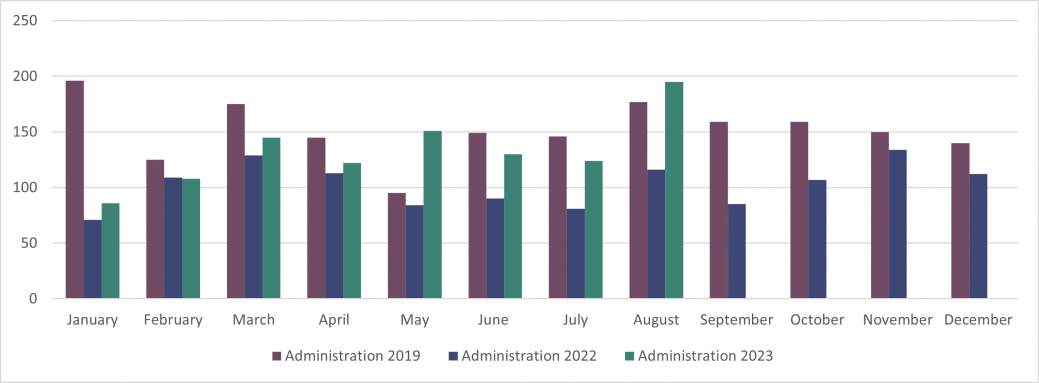

Of particular note in the August figures is the significant increase in the number of administrations. At 195 cases in August, which is 50% higher than the 6-month average in the preceding months, these are the highest administration numbers we have seen since January 2019. We are seeing companies weighed down by debt who just cannot meet their debt repayments on sales figures negatively impacted by the headwinds facing businesses at the moment. There are still business purchasers with cash in their pockets looking for distressed deals, which means we expect that a number of these businesses will survive the company administration.

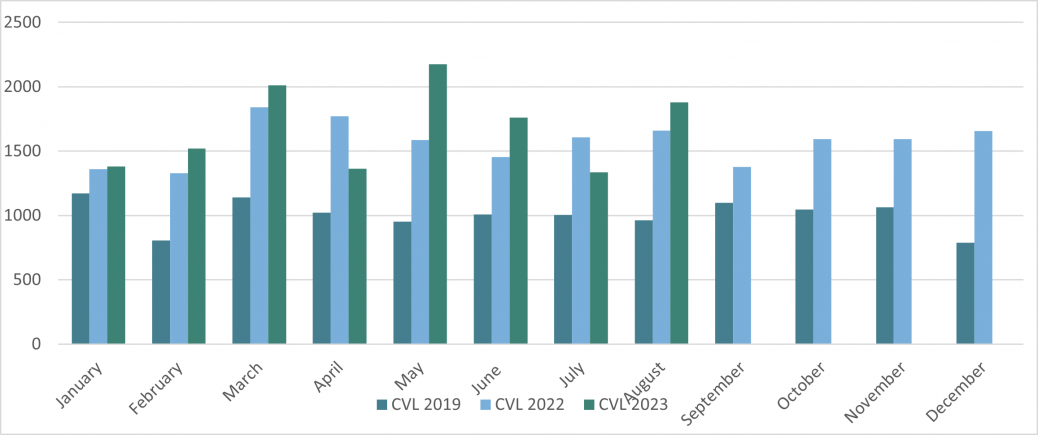

On the other hand, figures for creditors’ voluntary liquidations (CVL) are up some 40% on July. This is a rapid increase, although it does reflect some volatility in CVL numbers, with July and April showing low levels (average 1,350), whereas March, May, June and August were all much higher (average 1,956).

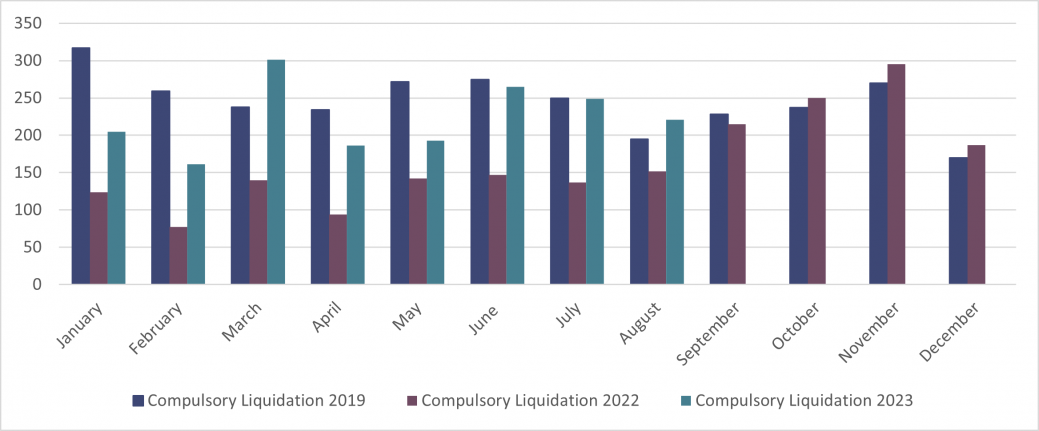

There were fewer compulsory liquidations (221) in August, showing a steady decline since the recent peak of 265 in June, however, it is still 45% higher than August 2022.

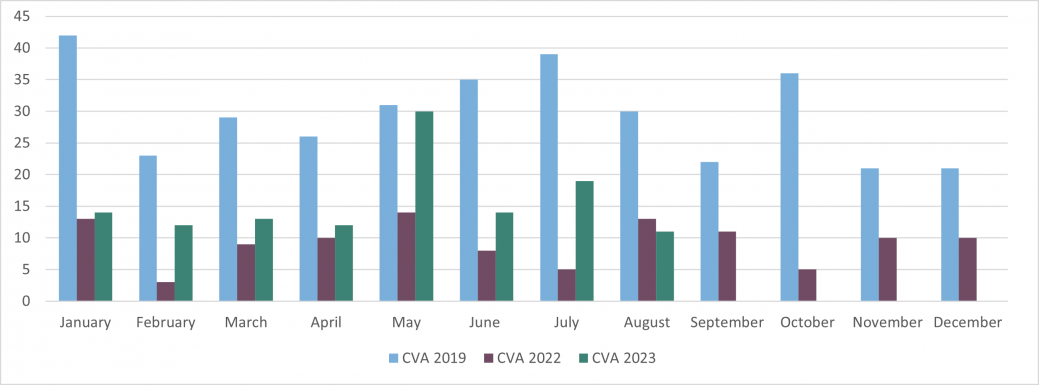

Company rescues (CVAs) have decreased and match those for the same period last year, after running at higher levels during the course of this 12-month period. This is likely reflecting the higher levels of debt being carried and tougher trading conditions, making forecasting difficult and financing harder to find.

Scotland

Total company insolvencies in Scotland were 112, which, whilst higher than July, is trending just above average (104) for the preceding 12-month period. Compulsory liquidations of 33 were on trend for the 12-month period. Creditors’ voluntary liquidations have shown volatility and at 71 cases, may be showing a trend towards increasing numbers but given the volatility, it is too early to call that. This is also the case for administrations, of which there were 8 in August; 4 times as many as in July, and well above the average of 5 for the last 12 months.

Northern Ireland

Northern Ireland insolvency cases were on trend, with 12 cases during the month, of which 2 were compulsory liquidations, 6 were creditors’ voluntary liquidations and CVAs were higher-than average at 4.

Personal Insolvencies

England and Wales

Personal insolvency numbers have been on a steady upward curve, since interest rates hit a 15-year high and the cost-of-living crisis has taken effect. However, a significant decline in IVA’s has seen total individual insolvencies fall in recent months, with 8,319 insolvencies on average in the 3-month period to August, compared to 9,773 in the same three-month period ending August 2022.

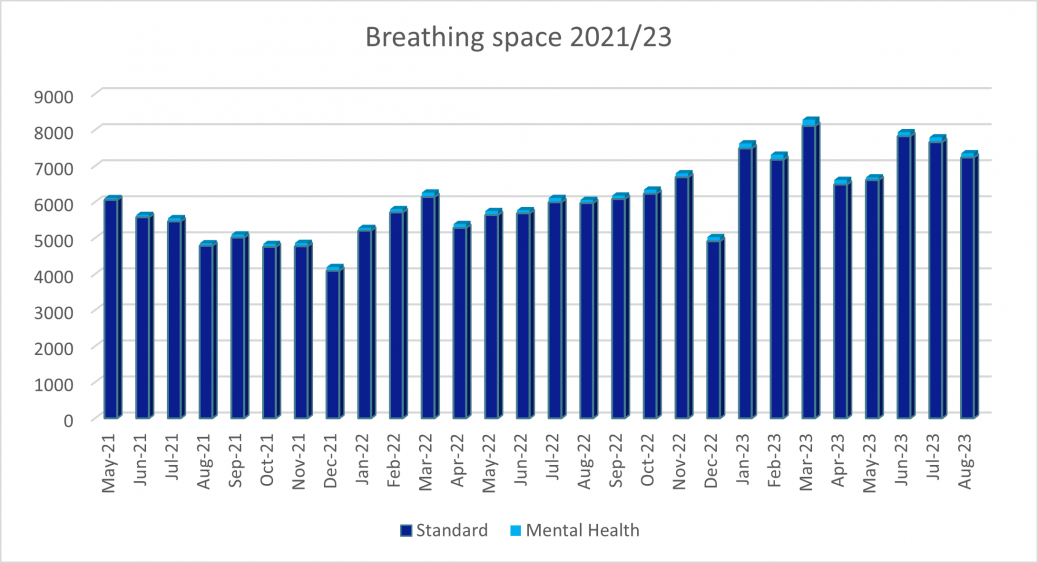

There were 7,235 Breathing Space (BS) registrations in August, which is significantly higher than the number registered in August 2022.

With clamping down on poor advice and better signposting by the regulated debt advice sector, we expect the BS monthly figure to show a continued steady upward trend. As BS is merely a pause in the debt settlement process, it would not be surprising to also see the DRO, bankruptcy and IVA numbers rise once the BS period expires for these individuals.

August’s Mental Health BS application figure of 116, given the stringent entry criteria, is another significant indicator as to the nation’s wider mental health debt crisis.

There were 5,104 Individual Voluntary Arrangements (IVA’s) on average in the 3-month period to August, which is significantly lower than the three-month period ending August 2022.

The FCA have banned fees being paid to debt packaging companies, with the impact on IVAs already taking effect. There were 5,174 registered IVA’s in August against 7,073 in August 2022. As better regulated advice begins to take effect, coupled with the increased BS applications, IVA numbers so far in 2023 have been notably lower than the record high numbers in 2022.

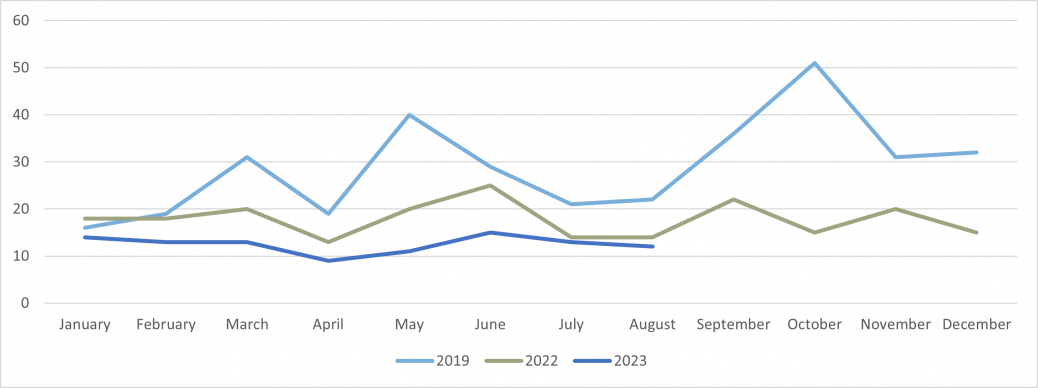

In 2019, there were 2,289 Debt Relief Orders (DRO’s) a month on average, and following the changes in entry criteria from June 2021, surprisingly they have only averaged around 2,000 per month. The August figure of 2,714 continues the steady uptick in DRO’s, compared to 1,932 in August 2022.

A current DRO would have previously been a no-asset bankruptcy and therefore, the record low bankruptcy numbers of 2021/22 were of no real surprise. The average monthly bankruptcy numbers in 2019 were 1,395, made up of 1,134 debtor’s applications and 261 creditor petitions.

The stark decrease from that period to the current numbers is clear against the last 12-month averages of 595 bankruptcies, made up of an average of 476 debtor’s applications and 119 creditor petitions per month.

In August, there were 648 bankruptcies, against a 2022 average of 557 per month. We expect bankruptcy numbers to steadily pick up, showing a more marked increase into the second half of the year.

Bankruptcy petitions will undoubtedly have to be issued by creditors to recover debts incurred during and since the pandemic, as a result of current economic pressures. In August, there were 126 creditors’ petitions, which is slightly up on the preceding 12 months’ average.

We expect to see creditor-driven bankruptcies begin to steadily increase further in the second half of 2023, led by HMRC in the recovery of unpaid tax liabilities. The volume of bankruptcy petitions will be driven by resource availability at HMRC, and by the ability of the Court system to manage them.

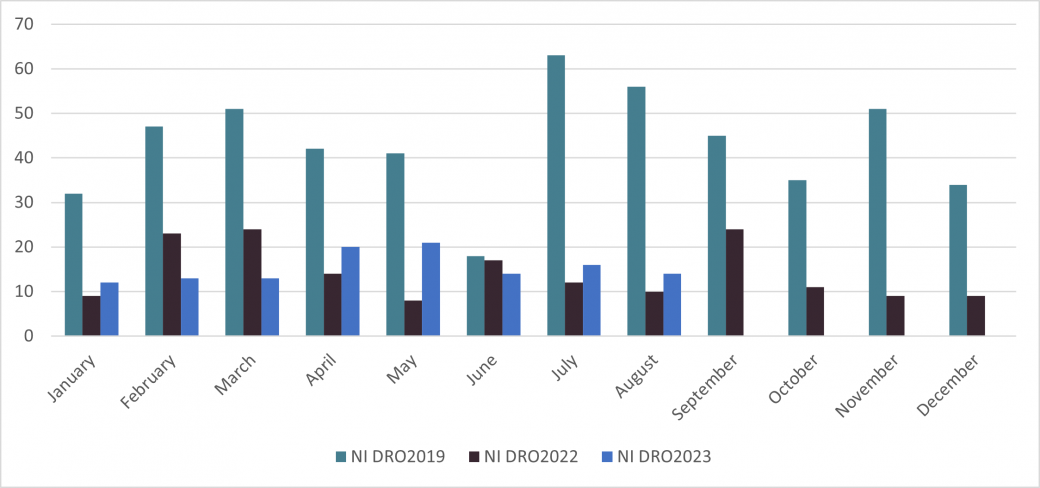

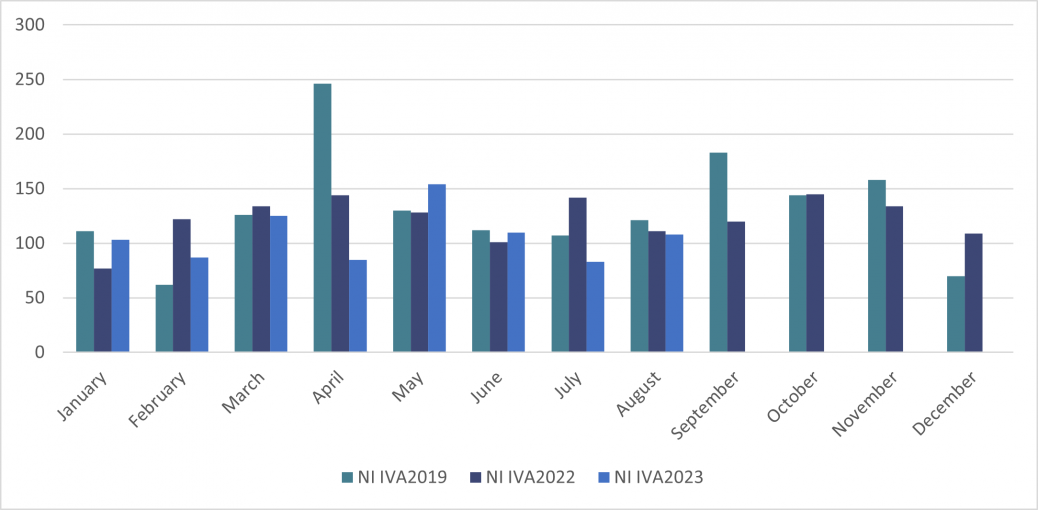

Northern Ireland

In August 2023 there were 139 individual insolvencies in Northern Ireland, 11% higher than in August 2022. This consisted of 108 IVAs, 14 DROs and 17 bankruptcies.

|

|

|

Mazars is an internationally integrated partnership, specialising in audit, accountancy, advisory, tax and legal services*. Operating in over 90 countries and territories around the world, we draw on the expertise of more than 42,000 professionals – 26,000+ in Mazars’ integrated partnership and 16,000+ via the Mazars North America Alliance – to assist clients of all sizes at every stage in their development. *Where permitted under applicable country laws Mazars LLP is the UK firm of Mazars, an international advisory and accountancy organisation, and is a limited liability partnership registered in England with registered number OC308299. A list of partners’ names is available for inspection at the firm’s registered office, 30 Old Bailey, London EC4M 7AU. Registered to carry on audit work in the UK by the Institute of Chartered Accountants in England and Wales. Details about our audit registration can be viewed at www.auditregister.org.uk under reference number C001139861.