Pension Salary Sacrifice: cost reduction for you and your employees

Pension Salary Sacrifice for you & your employees

What is Pension Salary Sacrifice?

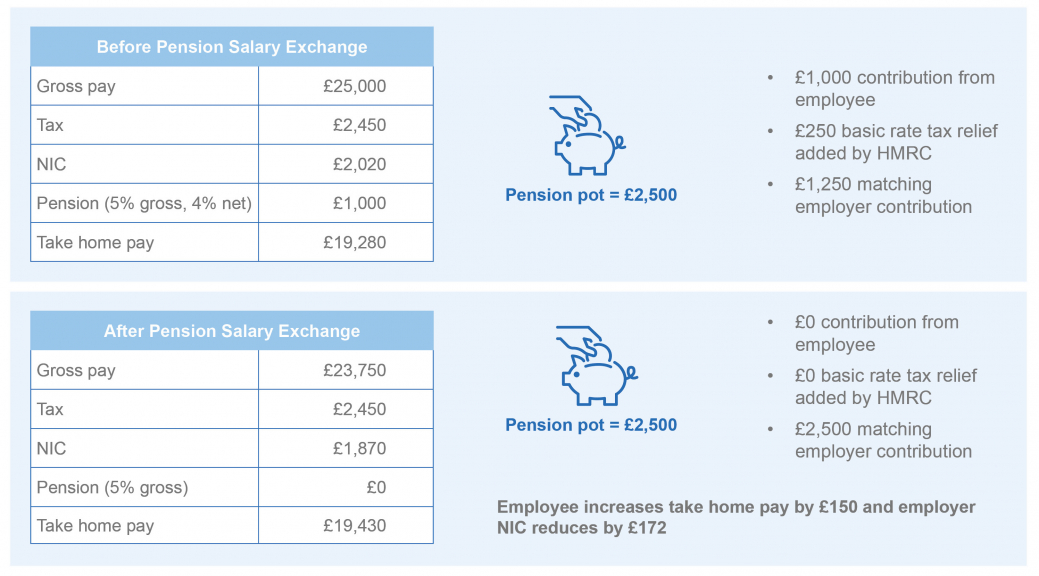

Pension Salary Sacrifice schemes allow employees to give up part of their gross salary in exchange for pension contributions. As well as providing employees with an additional aspect to their total reward package, some schemes have the benefit of the reductions being exempt from tax and NIC, generating significant cost savings for both employee and employer.

Before Pension Salary Sacrifice an employee gets tax relief on these contributions, they do not get NIC relief. Therefore, by reducing their pay by an amount equal to their gross pension contribution, and in exchange the employer making the contribution for them, NIC can be saved by both the employee and employer. For example, if the employee contributes £1,000 per year, they will increase their net pay by c. £130 and the employer will save c. £150.

How are savings generated?

What to consider?

The main risk areas are:

1. National Minimum Wage and Statutory Pay

Salary cannot be sacrificed to the extent that an employee’s pay falls below the National Minimum Wage (NMW), so it is essential that compliance is continually monitored. Similarly, the interaction with the scheme and employees receiving statutory pay / leave is also a key requirement.

2. Cost-effectiveness

Cost savings will be higher for employees at higher marginal tax bands. Therefore, it is more effective for higher paid employees to sacrifice larger amounts of pay, for example by utilising bonus waivers, and we can advise you how to most effectively make contributions from a tax and NIC perspective.

3. Optional remuneration Arrangements

Only salary sacrifice schemes that are not in scope of OpRA will be eligible for tax and NIC relief. These include qualifying pension schemes, electric cars, and cycle to work. Therefore, it is important to confirm the proposed scheme is exempt from OpRA to avoid significant tax and NIC charges.

4. Implementation

There are many steps to implementing a successful salary sacrifice scheme, including creating policies, issuing employee communications, and setting up pay codes within payroll. We can assist with each of these steps to make this process as smooth as possible.

What does Pension Salary sacrifice look like in practice?

We have been working with a Social Housing provider to help with the implementation of Pension Salary Sacrifice to a population of approx. 300 employees.

Prior to implementation, we undertook an eligibility analysis for the Employer to enable a salary ‘threshold’ to apply to employees entering the scheme. This ensures the Employer met their legal obligations around National Minimum Wage as well as protecting employee entitlement to certain state benefits

A ‘Key Decisions’ meeting with the client took place with all key stakeholders (HR, Payroll, Finance, Legal) to ensure the scheme was designed to fit within the culture and their requirements.

We prepared all the employee communication documents provided to employees to ensure the scheme was compliant from a HMRC perspective and also undertook presentations to all employees to introduce the scheme and also help maximise the take up amongst the eligible employee population.

The scheme was a success with total savings over 12 months of circa. £40,000 for employees and circa. £68,000 for the employer.

Get in touch

To discuss how Pension Salary Sacrifice can benefit social housing organisations to reduce costs and benefit employees please get in touch using the button below.