The NHS pension scheme: Choice 2 and making your decision

What was the Choice 2 exercise?

Members of the NHS Pension Scheme were previously offered the option to move all their 1995 Section membership to the 2008 Section – this was known as the ‘Choice’ exercise and took place in 2009.

A second Choice exercise, known as ‘Choice 2,’ was offered to members in 2015, when the 2015 Section of the Scheme was created on account of widescale pension reform. Where members had elected to remain in the 1995 Section as part of the initial Choice, this second exercise offered them a further chance to move those benefits to the 2008 Section, and that decision had to have been made by 2017.

In order to be eligible to move benefits from the 1995 Section to the 2008 Section under Choice 2, members had to be in the Scheme on 1st April 2015. This second exercise was for those members who would be moved to the 2015 Section as part of the wider pension changes (i.e. those without any form of transitional protection on account of age).

What is happening now?

Individuals who opted to move the 1995 Section service to the 2008 Section under Choice 2 can now revoke that decision, thereby moving your 2008 Section service back into the 1995 Section.

This only applies to service up to 31st March 2015, as well as service accrued within the Remedy Period under the McCloud Judgement (which lasted up until 31st March 2022), and this will decide which section members will retain; the 1995 Section or the 2008 Section.

It is important to note that those who made a decision under the initial Choice exercise of 2009 do not have the option to revoke that decision now. The original Choice decisions were made based on lifestyle and anticipated retirement plans, whereas those affected by Choice 2 may well have made a different decision if the 2015 Section had not been introduced (and affected members knew at the time that they could elect to remain in the 1995 Section for the Remedy Period).

When do you need to decide?

There are estimated to be 10,000 members affected by Choice 2 and they will be contacted from 20th February 2024 with the offer to revoke the decision and return the relevant service to the 1995 Section. Should they wish to take up this offer, they must respond to the letter by 20th May 2024.

If no response is received by that date, eligible benefits up to 31st March 2022 will remain in the 2008 Section of the Scheme.

Things to consider

As with wider 'at retirement' decisions, whether to revoke the Choice 2 exercise will depend heavily on personal circumstances and retirement plans.

There are a number of differences between the relevant sections of the Scheme, including Normal Retirement Age, automatic lump sum rights and death benefits. As such, factors such as the need for a lump sum in retirement, and the point at which individuals expect to cease work, amongst other things, will need to be considered in order to decide on what appears the more appropriate option for members.

Ultimately, the decision is circumstantial and so affected individuals should seek advice when deciding whether or not to exercise the option by May 2024.

1995 Section | 2008 Section | |

Pension (Officer) | 1/80th of final pensionable pay | 1/60th of reckonable pay |

Pension (Practitioner) | 1.4% of uprated earnings | 1.87% of uprated earnings |

Lump sum | 3x annual pension (and option to take more) | No automatic lump sum (but option to take one) |

Normal retirement age | 60* | 65 |

Early retirement | Yes, but actuarial reduction applied | Yes, but actuarial reduction applied |

Late retirement | Yes, but without actuarial enhancement | Yes, with an actuarial enhancement |

Death benefit lump sum | 2x final pensionable pay | 3x reckonable pay |

Pension to survivors | 50% of uprated pension (based on Tier 2 ill-health retirement) | 37.5% of uprated pension (based on Tier 2 ill-health retirement) |

*Assuming no Special Class or MHO status |

Wider impact of the decision

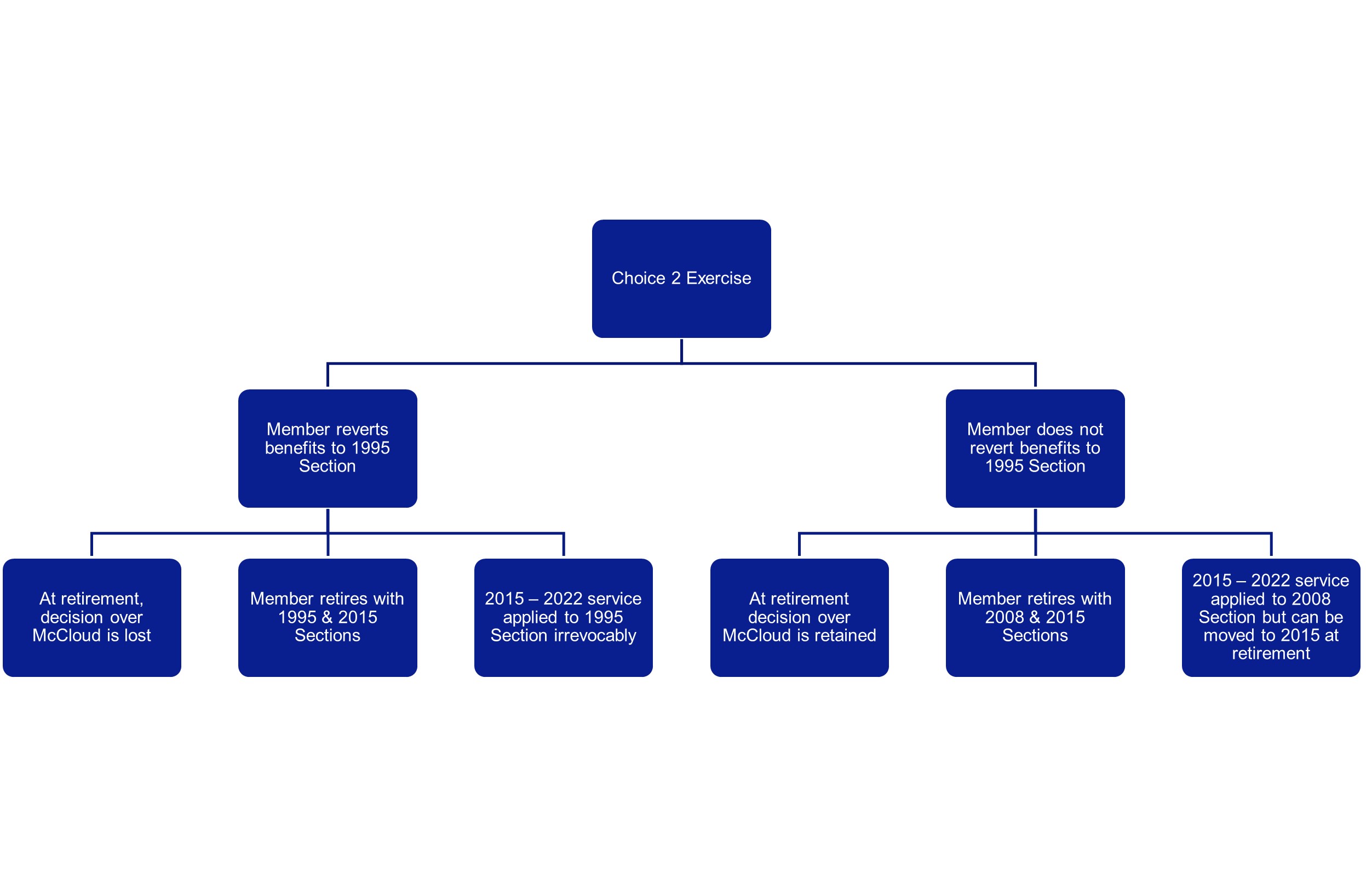

This Choice 2 decision will impact the availability of further, ‘at retirement’ decisions as part of the broader McCloud Remedy.

Where members choose to place benefits back into the 1995 Section as part of revoking Choice 2, they are effectively also making their ‘at retirement’ decision now – eligible benefits up to March 2022 will revert to the 1995 Section and there will not be an opportunity to place these benefits into the 2015 Section at retirement.

Where a member does not exercise their right to revoke the Choice 2 decision, thereby placing eligible service into the 2008 Section, they will effectively lose the chance to move back to the 1995 Section in the future. However, they retain the right to a further ‘at retirement’ decision, whereby they could opt to move this eligible 2008 Section service to the 2015 Section on retirement.

Once the Scheme is aware of a member’s decision to either remain in the 2008 Section (at least for now) or transpose the service to the 1995 Section (permanently), Remedial Pension Savings Statements will be provided.