Millennial millionaires - £1m pension pot to retire

• Pension pot of £1m required for today’s millennials to retire

• One in three millennials expects to never retire

• Up to four million over 65’s in the workplace by 2056

Millennials will need a £1m pension pot to fully retire according to research by international advisory and accountancy firm Mazars.

A survey of 2,000 UK adults conducted by OnePoll on behalf of Mazars found that around a third of millennials (those born between 1982 and 2000) believe they are facing a future where they will never have the opportunity to give up work completely.

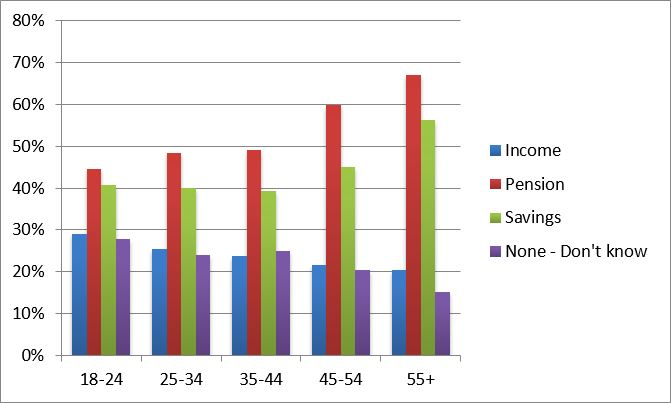

It also suggests young adults’ views of finance in later life put far less emphasis on saving and much greater emphasis on continuing to earn a living than any other age group.

The expectation of working in retirement is 50 per cent higher among 18-24 year olds than those who are nearing, or already in, retirement, which means up to four million over 65’s in the workplace by 2056.

Liz Ritchie, Partner at Mazars and Head of Private Client Services said:

“Millennials told us that 63 was their anticipated retirement age; a 24-year-old earning around £24,000 a year today would need £1miliion to fund their retirement and maintain their standard of living until they were 80 for men, or 85 for women1.

“However, changes to pension structure, the closure of final salary schemes and the erosion of tax benefits have had an effect on the public’s view of pensions which could impact on future generations.

“A million pounds is a realistic figure and at the same time will be very daunting. This makes it all the more important for millennials to seek professional financial advice and plan for their future so they can fulfil their life ambitions.”

The working retired

Mazars estimates that by 2040 there could, conservatively, already be two million ‘working retired’. In reality, if recent increases in older workers are repeated, the figure could be much higher and we face having a generation that may never actually retire.

The UK currently has 1.2 million ‘working retired’; adults employed over the age of 65, which is approximately one in ten. Using the Government’s own population estimates, the number of over 65s is set to rise by almost a half to 18m by 2039. Based on a similar rate of ‘working retired’, there would be 1.8million over 65s in the workforce in the next 20 years.

However, if the 3 per cent growth in the ‘working retired’ seen in the last year (October 2015 -October 2016) is used to project how many over 65s will be in the workplace by 2056, when today’s young adults will start to hit 65, the figure is more than double at 3.9million.

Indeed, trends agency The Future Laboratory has seen a new consumer mind-set emerge. Termed the ‘Flat Age Society’, it describes how people are refusing to slow down just because they have reached the traditional age of retirement.

Healthy life expectancy

The importance of making long term financial plans for later life is borne out by health statistics. Improvements to healthcare mean life expectancy in the UK has never been higher and consequently the number of years in retirement that have to be financially supported is at its highest too.

Life expectancy at age 65 has increased markedly. We now expect those hitting 65 in 2040 to live another 24 years on average, almost double what it was in 1981 (Source: ONS).However, the ability to actually work all these years is another matter.

The number of people living with three or more long-term health conditions is expected to reach 2.8milion by 2018. This is a 50 per cent increase in just 10 years. The over 60s are most likely to suffer from a long-term condition, with 58 per cent suffering compared to 14 per cent of under 40s.

Data from across Europe suggests that even before reaching retirement age, most of us are likely to suffer from a condition that limits our activities in some way. On average, by the age of 62 for men and 60 for women, our ability to conduct our lives as before will be limited by health issues.

Liz Ritchie, observed:

“Those thinking they can simply work longer may find themselves unable to and as a result, with a gap in their finances.

“We all hope our later years will be a time to slow down, relax and enjoy life. To achieve this, we have to make long-term financial planning a priority. This is not just among those newly entering the workforce but also across all ages. It is never too late to help make your finances in later years that bit more comfortable.”

ENDS

Contact

GLR Public Relations – 01943 851311

Jason Clarke – Jason.clarke@glrpr.co.uk

Case study available on request

Notes to editors

- The £1m pension pot calculation is based on average life expectancy figures and assuming an average annual salary growth of 3.6 per cent, and a retirement income of 50% of final salary.

- The Success Survey was conducted by OnePoll on behalf of Mazars in December 2016. A representative sample of 2,000 people from across the UK were asked about their attitudes to success.

- For more information on individual financial planning visit https://www.mazars.co.uk/Home/Privately-Owned-Business/Individual-Financial-Planning/

- Healthy Life Years

http://ec.europa.eu/health/indicators/healthy_life_years/hly_en#fragment2

How do you plan to fund/have you funded your retirement?”

Source: The Success Survey, Mazars, Dec. 2016

About Mazars

Mazars is an international, integrated and independent organisation, specialising in audit, accountancy, advisory and tax services. As of January 1st, 2017, Mazars operates throughout the 79 countries that make up its integrated partnership. Mazars draws upon the expertise of 18,000 women and men led by 950 partners. We assist clients of all sizes, from SMEs to mid-caps and global players as well as start-ups and public organisations, at every stage of their development.

In the UK, Mazars has approximately 140 partners and over 1,700 employees serving clients from 19 offices, and is ranked one of the top 10 firms nationally.

For all national news and expert commentary, visit our website at www.mazars.co.uk

News and our latest announcements are also published via the firm’s page on LinkedIn at www.linkedin.com/company/mazars-UK or you can follow us on Twitter @Mazars_UK