Scottish Budget 2021: The Key Changes

No Surprises in the Scottish Government's 2021 budget

Commentary from our tax experts in Scotland

For the second year running the Scottish Government has published its fiscal statement before that of the UK and there were no significant changes to taxation announced. This is no surprise with the devolved tax powers extending only to Land and Buildings Transaction Tax, Scottish Landfill Tax and the income tax that applies to earned income. In reality, any significant tax changes in response to the Covid 19 crisis will be decided by Westminster which retains powers over capital gains tax, inheritance tax, corporate tax, VAT, national insurance and the income tax rates that apply to investment income.

Scottish Income Tax

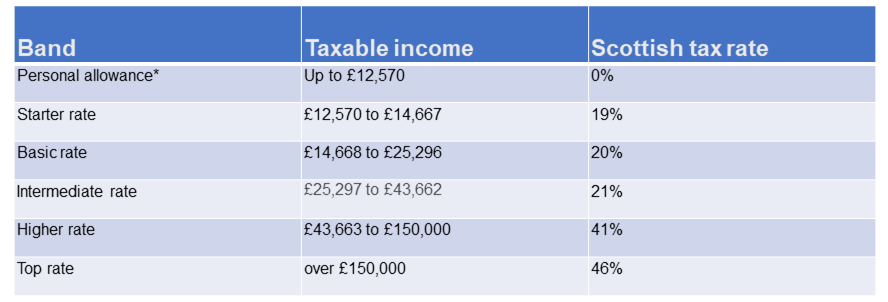

The Scottish Finance Secretary, Kate Forbes, confirmed the five band format that applies to earned income for Scottish Taxpayers will continue with the bands increased in line with inflation for the 2021/22 tax year.

* Personal Allowance set by UK Government.

Subject to an unlikely reduction in the higher rate threshold for taxpayers in the rest of the UK being announced in the UK Budget, Scottish Taxpayers will continue to start paying higher rate tax well before their counterparts south of the border.

Land and Buildings Transaction Tax (LBTT)

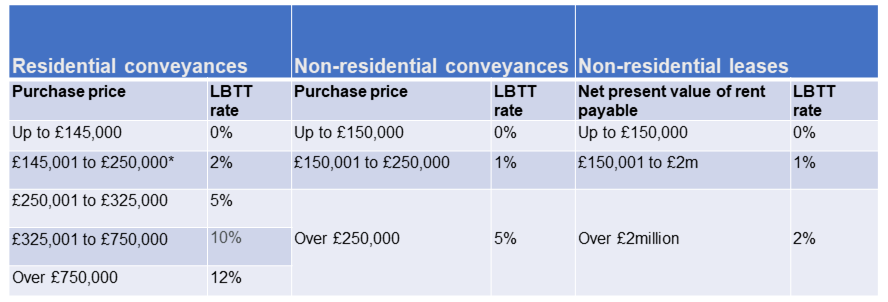

The temporary increase of the LBTT nil rate band for residential property will return from £250,000 to £145,000 from 1 April 2021. First‑time buyers will continue to be able to claim the relief which can extend the nil rate band up to £175,000.

* First‑time buyers are entitled to LBTT relief up to £175,000.

An Additional Dwelling Supplement (ADS) is payable, in addition to LBTT, on purchases of residential properties above £40,000, although the Scottish Government announced there will be some fine tuning to the rules forthcoming.

What next?

As noted, the powers retained by Westminster mean the UK Budget could have far greater implications for Scottish Taxpayers than today’s announcements. The recent publication of the Capital Gains Tax Review by the Office of Tax Simplification put forward the possibility of aligning capital gains tax rates with that of income tax. Meanwhile, the Final Report of the Wealth Tax Commission proposed a one-off wealth tax which might extend to both property and pension values. With so many options available, none of which will be particularly popular, it will be very interesting to see what Rishi Sunak announces on 3 March 2021.