[Insurance] A new challenge for insurers

The PRA issued a letter to insurance CEOs on 18 July 2016 (this letter) outlining their recent analysis from regulatory returns and observations regarding industry reserving and pricing trends. The regulator highlighted their current concerns on both of these topics and the fact that this type of analysis will be used as part of their individual firm supervision going forward.

The letter details a number of key observations of which the accurate measuring, monitoring and projecting of calendar year trends (eg inflation) is a consistent theme.

We have deconstructed the PRA letter into key areas of concern as follows:

Reserving observations

- Reserve strength at the end of 2015 was probably weaker than for many years.

- Reserve releases may be at unsustainable levels.

- Within Lloyd’s some lines of business show weaker case reserves.

- Calendar year inflation is poorly understood and insurers may not be giving the risk of future inflation enough consideration.

- Calendar year inflation, and changes in inflation, is different for each company.

- Calendar year inflation in historical data was estimated and compared to implied future inflation assumptions in an insurer’s booked reserves.

- Insurers are expected to consider the impact of a range of inflationary assumptions.

Pricing observations

- On top of this, commercial lines premium rates have declined and particularly for longer tail business and financial lines are below technical levels.

- There is an insufficient feedback loop between booked loss ratios (reserving), market pricing and business planning.

- New business often exhibits poorer loss ratios than renewed business yet market behaviour ignores this.

Companies approach

- This varies between company and line of business and the possibility that speeding up settlements may partly contribute is acknowledged.

- Some smaller companies with less information than larger established companies may be taking over optimistic views on new risks.

- Boards should fully appreciate these issues when agreeing reserve levels.

Estimating historical calendar year trends

The above observations involving reserving and pricing have been a key focus for Mazars’ and Insureware’s work with insurers for many years.

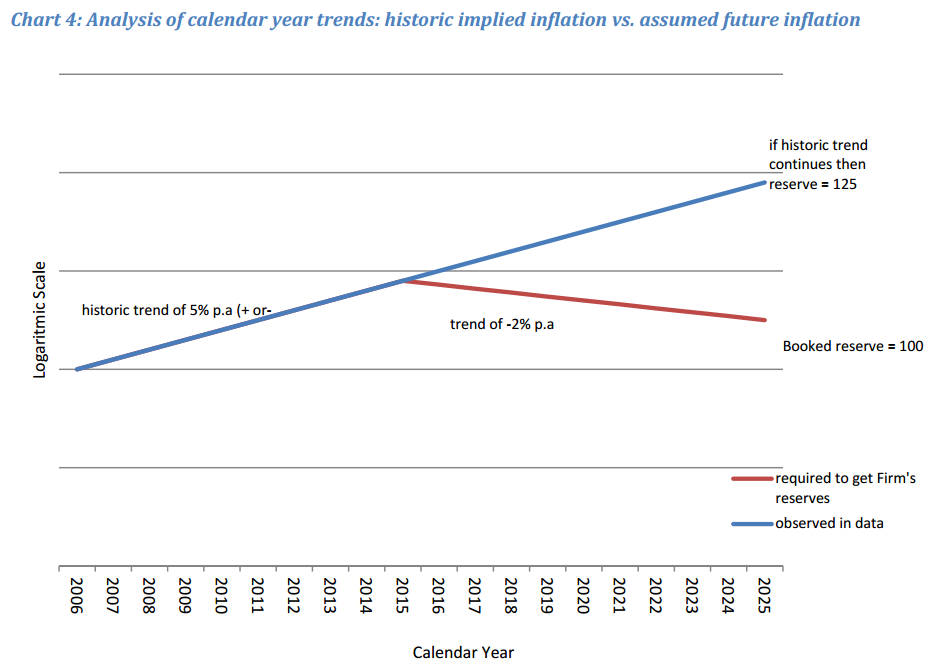

One of the most striking examples in the PRA letter demonstrates a way of assessing an insurer's reserve adequacy by comparing the historic rate of claims inflation with the implicit future rate, where the latter is found by working backwards from the posted reserves.

An extract from page 6 of the letter:

“In several cases, our estimate of implied future claims inflation was lower than that implied by the claims inflation inherent in the historic data. In an extreme case, as illustrated in the Annex [Chart 4], we estimate the historic claims inflation to be 5% per annum, whereas to obtain the insurer’s booked reserves would imply a claims inflation assumption of -2%. For this particular class, this would suggest that if the future trend is in fact in line with past inflation, booked reserves would need to be 25% higher than currently assumed.”

In order to measure calendar year trends meaningfully, trends in the data must be decomposed into the three directions (development, accident, calendar year trends) and volatility.

ICRFS™, Insureware’s reserving and pricing platform, is well-placed to look at the types of analysis that the PRA expects insurers to conduct when setting their reserves and articulating the potential sensitivities around some of the core assumptions including past inflation versus future inflation.

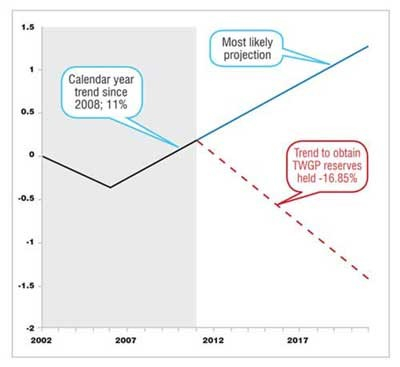

This case study demonstrates how this knowledge could have been used to give an early warning of trouble before the situation becomes irreversible for another insurer. Note the similarity between Chart 4 and the graphic below derived from ICRFS™.

Conclusions and how we can help

Mazars’ and Insureware’s own experience in this area has led to the following conclusions.

We are well placed to support you with the types of analysis that the PRA expects insurers to conduct when setting their reserves and articulating the potential sensitivities around some of the core assumptions. Insurers will benefit from these unique models developed in ICFRS to measure and forecast or adjust for calendar year trends in a probabilistic framework.

Our market analysis is in line with PRA’s observations:

- Year-on-year trends (calendar trends) are impossible to detect or measure using standard actuarial techniques.

- These can undermine long-tail reserves like the proverbial "old mole".

- It is vital to know how to quantify these trends and how to shore up reserves against them in a timely fashion.

From a strategic point of view we second the recommendation cited in the letter that:

“Given the current low inflation environment, the potential inflationary risks associated with currency fluctuations and the potential for long term inflation rates to be higher than recent experience, we expect insurers to consider the impact of a range of inflationary assumptions so that boards are able to understand the sensitivities in this area.”

The importance of maintaining "tight feedback between pricing, reserving and business planning" cannot be over emphasised.

The insights and capabilities provided by Mazars’ actuarial expertise and utilisation of ICRFS™(Insureware’s reserving & pricing platform) in the process enables firms to identify early warnings of trouble before the situation becomes irreversible and addresses the above described challenges.

We are offering insurance companies a cost effective and rapid reserve health check which will provide insights into calendar year inflation including a review of the reserve/rating feedback loop and the management information generated to assist Boards to appreciate these issues when agreeing reserve levels.

To arrange a meeting to address the above issues using our reserve health check and to discuss how we can support your objectives in the light of the PRA’s letter, please get in touch.