Asset backed funding

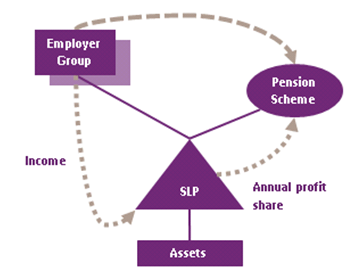

- The sponsor transfers a suitable asset to an independent “bankruptcy remote” Scottish Limited Partnership (SLP) with themselves and scheme as the partners.

- Suitable assets can be physical (e.g. building, stocks such as cheese) or virtual (e.g.brand).

- Income from the asset is distributed to the scheme and sponsor.

- Asset returned to company at the end of the agreement.

There are key benefits to sponsors taking this route:

- Save cash: Can reduce cash contributions and PPF levy.

- Retain asset: Operational control of the asset retained.

- Efficient: Range of assets including intangibles can be used.

- Company finances unaffected: No impact on balance sheet/ profit and loss statement.

The trustees of the scheme can also benefit via:

- Additional security: An asset backed funding deal provides security to trustees that its funding needs will be met, using the asset as security.

- An immediate deficit reduction

- Investment freedom: An ABF could allow schemes to be less constrained in its investment policy.

- Access to a guaranteed income stream

- An attractive yield over the term of the agreement

It is also important to consider the tax implications of any asset backed funding deal. These will depend on the the terms and conditions of arrangements, and could include:

- Up-front tax relief for total payments to be made by the SLP to the scheme over the term of the investment (which will be subject to the usual spreading rules), or

- Tax relief when, and equal to, cash payments made from the SLP to the pension scheme.