Key summary

BCBS aims to make credit risk more risk sensitive and reduce variability in capital requirements. The UK and US have introduced new exposure classes and made significant changes to the parameters of each exposure class, to ensure that the risk associated with each exposure is measured accurately.

Which new exposure classes have the UK introduced to measure credit risk?

The UK, for example, is creating a new corporate SME category with lower risk weights than other corporate exposures, and allowing SME exposures that qualify to be treated as retail exposures. This will significantly decrease capital expenditure associated with SME lending. To avoid a doubling-up effect of these changes, the UK has decided to remove the SME Support Factor. The market has seen these changes as a net negative, as the SME Support Factor disproportionately eased the cost of SME lending, compared to the changes in risk weights.

Which new exposure classes have the US introduced to measure credit risk?

The US does not have an equivalent to the SME Support Factor, but they have changed the definition of retail exposures to include regulatory retail exposures to SMEs (in addition to individuals). US SME lenders are likely to suffer despite this change because retail exposures under Basel III Endgame will experience a 10-percentage point increase compared to the BCBS guidance. [1] Furthermore, SME exposures that do not qualify as regulatory retail, will be treated like other corporate exposures, with no concessions.

Real Estate Exposure

Key summary

The treatment of real estate exposures under credit risk illustrates the wider differences between Basel 3.1 and Basel III Endgame. Below we break down the options provided on how to implement the regulation, followed by a comparison of the application across jurisdictions. The BCBS guidance introduces the following parameters:

- Firms can use a whole-loan or loan-splitting approach to treat real estate exposures. The whole-loan approach is based solely on the property value, and the loan-splitting approach is where risk weighting is based on the property value and creditworthiness of the counterparty. Thus, the loan-splitting approach is less risk-sensitive as one determinant of the risk weight (counterparty creditworthiness) is less prone to volatility.

- BCBS introduces another layer of granularity, with risk weights based on whether exposure repayments are materially dependent on cash flows generated by the property (dependent repayments) or not (independent repayments).

What is the UK’s approach to Real Estate Exposure?

The UK chooses the more lenient application of the guidance. They apply a loan-splitting approach for loans with independent repayments and a whole-loan approach for loans with materially dependent repayments. UK lenders have the advantage here, because they can structure portfolios with a greater proportion of mortgages with “independent repayments” and yield less risk-sensitive capital requirements overall.

How does the US’s approach to Real Estate Exposure differ?

The US, however, is only using the whole-loan approach based on LTV. While there is still a difference in risk weights for exposures with dependent and independent repayments, their entire approach is more risk sensitive than the UK and BCBS. For residential real estate alone, Basel III Endgame risk weights are 20 percentage points higher than the BCBS framework. [2] This shows that the US is being stricter in its interpretation of BCBS’ guidance, resulting in significantly higher capital requirements for banks.

Unrated Corporates

Key summary

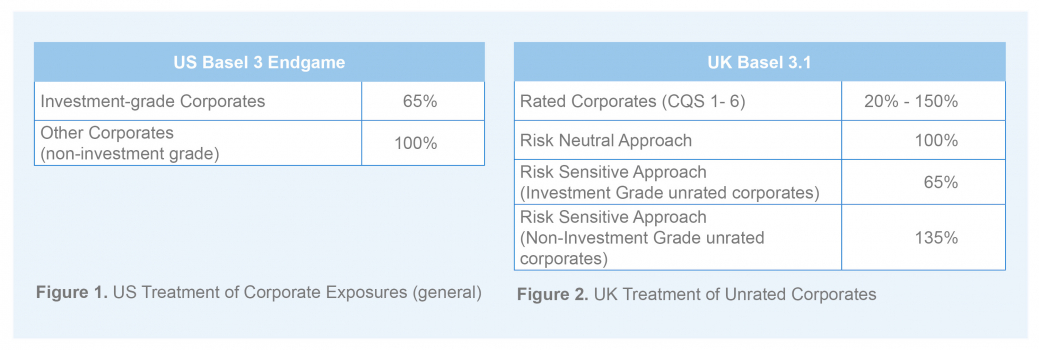

The credit quality step (CQS) is based on the external ratings of banks’ corporate borrowers, and it directly informs the risk weight associated with each exposure for rated corporates. However, counterparties can be considered unrated if the rating institution is not recognised by the national supervisor or has not been nominated by the bank. In these cases, the treatment of exposures becomes more risk neutral, which can be significantly costly to firms, in terms of their capital requirements. For instance, if a corporate exposure has an external rating of CQS1 to CQS 3, its risk weight would be between 20% and 75% under Basel 3.1.

However, if considered unrated, this same exposure attracts a risk weight of 100%, between 25 and 80 percentage points higher than the rated counterparts.

For unrated corporates, BCBS incentivises firms to increase their due diligence capabilities to assess the adequacy of counterparties, with the aim of reducing the global market’s reliance on external ratings. Firms without proven due diligence capabilities can follow the risk neutral approach of 100% risk weight for all exposures. Larger firms which have the necessary infrastructure, can determine whether unrated counterparties are investment grade or non-investment grade and use a 65% or 100% risk weight, respectively. The risk-sensitive approach would be more costly to operate but could generate significant savings for firms that focus their lending on investment-grade unrated corporates.

How has the UK approached unrated corporates?

UK firms will be able to choose between the risk-neutral and risk sensitive approach for unrated corporates, however under the risk sensitive approach, the risk weight for non-investment grade exposures will be 135% (compared to BCBS’ 100%). UK firms will need to take a good look at their corporate portfolio before choosing the risk-sensitive approach, to avoid the substantial increases in their capital requirements. If they choose the risk-sensitive approach and have a portfolio containing mostly non-investment grade exposures, this will raise their capital requirements significantly.

How does the US’s approach to unrated corporates differ?

The US has taken an even bolder approach than the UK to streamline risk weights across corporate exposures. Currently, all corporate exposures are subject to a 100% risk weight, and under Basel III Endgame, investment-grade corporate exposures will qualify for the 65% risk weight if the counterparty or its parent has securities outstanding on a public securities exchange, as seen in Figure 1. The US framework differs from BCBS and the UK in two important ways. Firstly, they apply the investment-grade/non-investment grade split, to all corporate exposures that do not qualify for other exposure classes, even those that would be equivalent to rated corporates in the UK; they significantly reduce the range of risk weights associated with general corporate exposures, compared to the UK (see figure 2). Secondly, the US is the first major jurisdiction to define the due diligence requirements for firms to qualify as investment grade. It will be interesting to see whether the UK follows suit and provides insight into what due diligence is required for firms using the risk-sensitive approach.

Credit Risk IRB Approach

Key summary

In a major step change from international counterparts, the US proposes to remove credit risk modelling for the purposes of capital calculation entirely. The rationale for this is due to the extreme variability in credit risk RWAs. The UK is unlikely to go as far as the US, but they have prohibited IRB modelling for equity exposures and central banks & central governments, which is still stricter than the Basel approach.

Overall RWAs and the Output Floor

Key summary

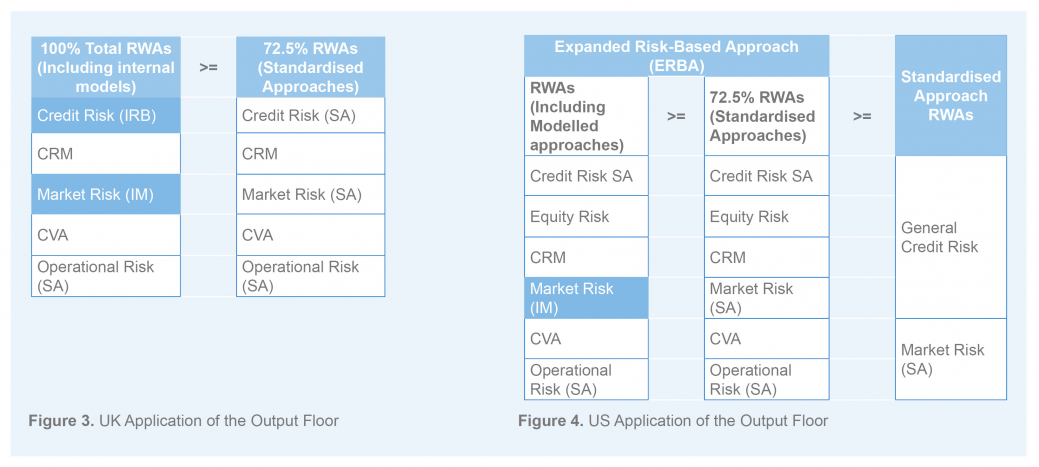

While smaller firms in the UK have been protesting the removal of the SME support factor, larger institutions across jurisdictions have shown concerns about how the introduction of a 72.5% output floor will impact their capital requirements. BCBS introduced the output floor to limit excessive capital savings from the use of internal models, and further the overarching goal of increasing comparability of capital requirements across firms of similar scope and size.

Application of the output floor under Basel 3.1 is straightforward and aligned with BCBS: Total RWAs calculated using all approaches to credit risk, credit risk mitigation (CRM), market risk, credit valuation adjustment (CVA) and operational risk, including internal models where applicable, must be equal to at least 72.5% of total standardised approach RWAs as shown Figure 3.

Figure 4 shows that US firms with a balance sheet above $100 billion (Category I to IV) will have to hold the higher of two total RWAs to satisfy their capital requirements:

- The existing Standardised Approach (SA) based on general credit risk and the standardised market risk framework, and.

- The new Expanded Risk-based Approach (ERBA), based on credit risk, equity risk, CRM, market risk, CVA and operational risk.

The output floor calibration is nestled within the Expanded Risk Based Approach (ERBA) to RWAs. Total ERBA RWAs using modelled market risk must be equal to at least 72.5% of total ERBA RWAs using standardised approaches. Firms would then compare the higher ERBA RWAs to the standardised approach RWAs and use the higher total, which renders lower risk-weighted capital ratios.

What is the UK’s approach to calculating overall RWAs and applying the Output Floor?

As expected, the UK have closely aligned their calculation of total RWAs and the output floor to the BCBS guidance. UK firms have an advantage over US firms, because they still have internal modelling for credit risk and have a broader application of the output floor. The UK proposes a slower transition into the 72.5% floor over 4.5 years, compared to the US’ 3 years, allowing firms to leverage internal modelling gains for a longer period.

How does the US’s approach to calculating overall RWAs and applying the Output Floor differ?

Basel III Endgame introduces a more risk sensitive approach to calculating overall RWAs and applying the output floor. Their aim is to ensure that the RWAs accurately reflect the risk profile of larger banks (which are more likely to have market risk internal modelling) and thus they propose to apply the output floor in a more granular manner than the UK and BCBS. Furthermore, the equivalent total RWAs calculation in the current system only applies to banks with over $750 billion in total assets. By extending the updated framework to Category III and IV banks, the US is in part, taking strides to avoid financial market failures such as the ones of March 2023. However, post-mortem analysis of SVB [3] and Credit Suisse [4] show that factors such as governance, risk management failures and supervisory shortcomings (such as the misapplication of Pillar 2 guidance), were the more salient problems faced by these banks. Thus, it is questionable whether strengthening the Pillar 1 capital framework through these reforms is an appropriate response.

Market Risk

Key summary

Two years after the final Basel reforms, the BCBS released the Fundamental Review of the Trading Book (FRTB) which focused solely on changes to the market risk framework.

Which market risk approaches have the UK adopted?

The UK proposes three approaches for market risk:

- Simplified standardised

- Advanced standardised

- A modelled approach

The UK’s proposal aligns with BCBS’ and introduces granularity into the market risk framework, through the simplified and advanced standardised approaches. The simplified approach is intended for firms with limited market risks, while the advanced approach is for firms with more complex market risks which do not have internal modelling permissions.

How do the US’s approaches to market risk differ?

The US focuses on the standardised approach used under SA, and the modelled approach used under ERBA, without a simplified approach for smaller firms. Both jurisdictions prescribe securities to include in the trading book, reducing firms’ flexibility to self-assess.

Despite not having a ‘simplified’ standardised market risk approach, the US introduced market risk sensitivity into their framework, through the dual RWA calculation requirement, illustrated in Figure 4. The difference between modelled and standardised market risk may be the deciding factor as to whether firms will base capital requirements on the standardised or more granular ERBA RWAs. Thus, the US discourages internal modelling for most firms, by having more stringent requirements that firms must meet to enjoy the benefits.

Regarding internal modelling, both the US and UK follow BCBS and will grant internal modelling permissions at the trading desk level as opposed to the organisational level, further enhancing risk sensitivity into the framework.

Operational Risk

Key summary

The UK and the US are both eliminating internal modelling for operational risk and introducing a single standardised approach, following the BCBS guidance. The major difference between the two frameworks is that the UK is setting the Internal Loss Multiplier measure to 1, and the US is flooring this measure at 1.

The ILM is intended to be a scalar for operational risk capital requirements based on the firm’s idiosyncratic history of operational losses. By setting this variable at 1, the UK is eliminating the historical loss component of the calculation. The US' approach holds firms accountable to reflect operational losses in their capital requirements. Perhaps the UK is worried about reintroducing excessive variability in operational risk RWAs through this ILM. However, by setting it at 1 across the board, they lose a significant source of risk sensitivity in the operational risk model proposed by BCBS. The PRA has stated that any unintended decrease in firms’ operational risk RWAs from the changes in the Pillar 1 operational risk framework, will be offset by an increase in Pillar 2A add-ons, all else being equal. [5]

Conclusions

Overall, the UK follows BCBS’ proposals, with some instances of gold-plating (higher risk weights for credit risk and changes of definition of residential real estate exposures), so UK firms will need to be strategic in their implementation, to align with the regulatory change and optimise their capital spending. For example, firms can leverage the new corporate SME risk category (85% as opposed to 100% for other unrated corporates) to soften the impact of the SME support factor removal. Moreover, the retail exposure class has a wide range of risk weights (45% to 150%) which firms can explore as they assess their lending portfolios. Additionally, the tightening of internal modelling capabilities across risk types should prompt firms to think more critically about whether to use internal modelling or standardised approaches to calculate risk weighted assets.

The US has demonstrated that they share BCBS’ objectives of reducing unnecessary variability in capital requirements and enhancing risk sensitivity. However, their approach to achieving these goals has been more radical than the UK’s, resulting in a degree of misalignment with other international regulatory authorities’ proposals. US firms face higher capital requirements and higher implementation costs, as they make operational changes to comply with the incoming framework, within the 3-year transitional period.

Learn more about Basel 3.1 proposals across the UK, US and the EU.

Get in touch

If you have any questions about the implementation of Basel 3.1, please contact us and a member of our team will be in touch.

[1] FDIC - Jonathan McKernan’s statement on the Proposed Amendments to the US Capital Framework

[2] FDIC - Jonathan McKernan’s statement on the Proposed Amendments to the US Capital Framework

[3] Review of the Federal Reserve’s Supervision and Regulation of Silicon Valley Bank

[4] Why did Credit Suisse fail and what does it mean for banking regulation? - Economics Observatory

[5] CP 16/22 Chapter 10. Interactions with the PRA’s Pillar 2A framework (Pillar 2A – Operational Risk)

This website uses cookies.

Some of these cookies are necessary, while others help us analyse our traffic, serve advertising and deliver customised experiences for you.

For more information on the cookies we use, please refer to our Privacy Policy.

-

This website cannot function properly without these cookies.

-

Analytical cookies help us enhance our website by collecting information on its usage.

-

We use marketing cookies to increase the relevancy of our advertising campaigns.