It's worth noting that the 'typical use' definition has been redefined for future caps taking into account that people are using less energy.

What is the energy price cap?

The energy price cap is a limit on the amount that an individual can be charged, by a supplier, for each unit of gas and electricity. The price cap is based on daily allowance. It is important to note that the energy price cap only applies to standard variable or default tariffs, not fixed-term tariffs.

The price cap is reviewed and can change every three months.

How to check if you are on a standard or default tariff

Default or standard variable tariffs are those where the price of energy changes every three months, January, April, September, and October, and you can pay by direct debit, cash or cheque, or prepayment.

You will be on a default or standard variable tariff if you:

- Have never switched your energy tariff.

- You were on a fixed deal and never switched again.

- Your supplier has gone into liquidation.

- You have moved and have set up a new account.

Fixed vs Standard Variable Tariffs

A fixed tariff stays at the same rate for the length of your energy contract. A fixed tariff can provide peace of mind as you know how much you will pay each month. A fixed tariff usually lasts for a 12-month period.

If you want to switch your tariff before your contract ends, you may incur and exit fee. Fixed Tariffs are not covered by the price cap and so may be more expensive overtime.

Are oil and gas prices on the rise again?

Economic growth is heavily correlated with energy usage – the development of new products and technological advances all require energy. However, in an era of heightened geopolitical uncertainty and deglobalisation, energy is becoming an increasingly valuable economic tool to put pressure on foreign economies, namely by restricting supply.

Last year, Russia cut natural gas deliveries to Europe via the Nord Stream 1 pipeline, while Saudi Arabia, one of the world’s major oil producers, has recently extended voluntary production cuts.

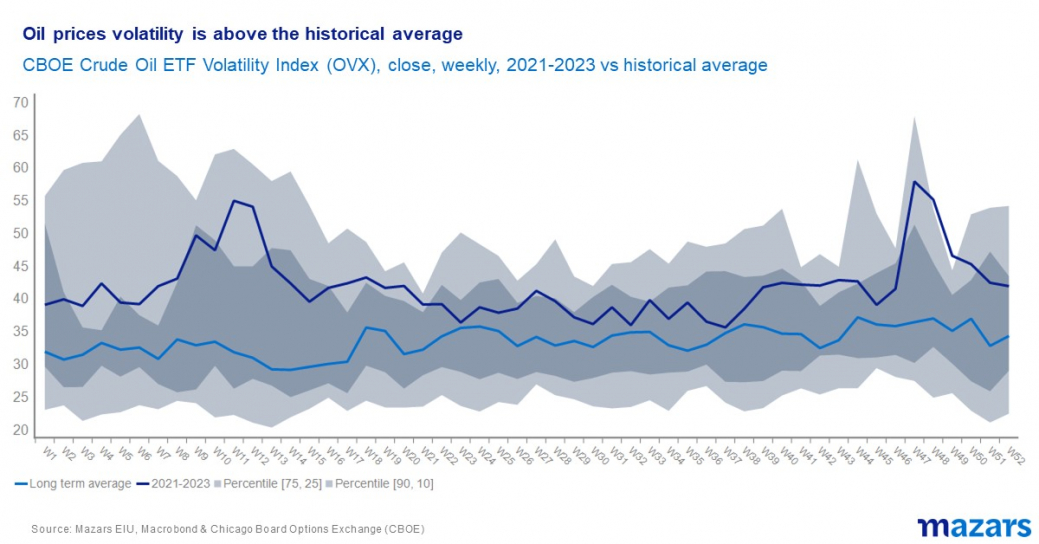

This has resulted in significant volatility in energy markets. Oil prices over the last three years have been significantly higher than the long-term historical average and ongoing deglobalisation and heightened geopolitical uncertainty mean that the likelihood of prolonged spells of high oil prices is increasing.

We have previously discussed the long-term reduced reliance on fossil fuels globally will affect oil consumption patterns (see Has the demand for oil finally peaked?). However, this is unlikely to have a material impact on short-term oil supply and dynamics. Indeed, market participants have become increasingly concerned about the cost of renewable energy in recent months, as higher interest rates weigh heavily on the sector’s debt obligations.

Despite general consumer willingness to accept higher prices for green energy, we ultimately remain heavily dependent on fossil fuels in our day-to-day lives, and a more complex, uncertain world means that energy prices are likely to remain a hot topic for the foreseeable future.

What does all of this mean for my energy tariff?

After the market movements and legislative complexities of the past two years, most households are now on variable tariffs, meaning that the price they pay for their energy could move as the price of oil and gas changes.

However, all such variable contracts are covered by the price cap meaning that within any given three-month period you have certainty as to how much you pay.

As energy prices have reduced in recent months, many have started to ask whether they should now look to fix their energy tariffs to provide greater certainty and potentially lower costs.

At the time of writing in October 2023 there were a small number of tariffs offering energy at lower rates that the price cap for Q4 2023. Naturally, for those wanting certainty over payment levels, or those who fear energy prices may rise, such fixed tariffs may be attractive.

We would encourage all readers to review their energy tariff position and consider the options available. There are various online comparison tools available to assist in this process.

Adam Fisher, Investment Analyst