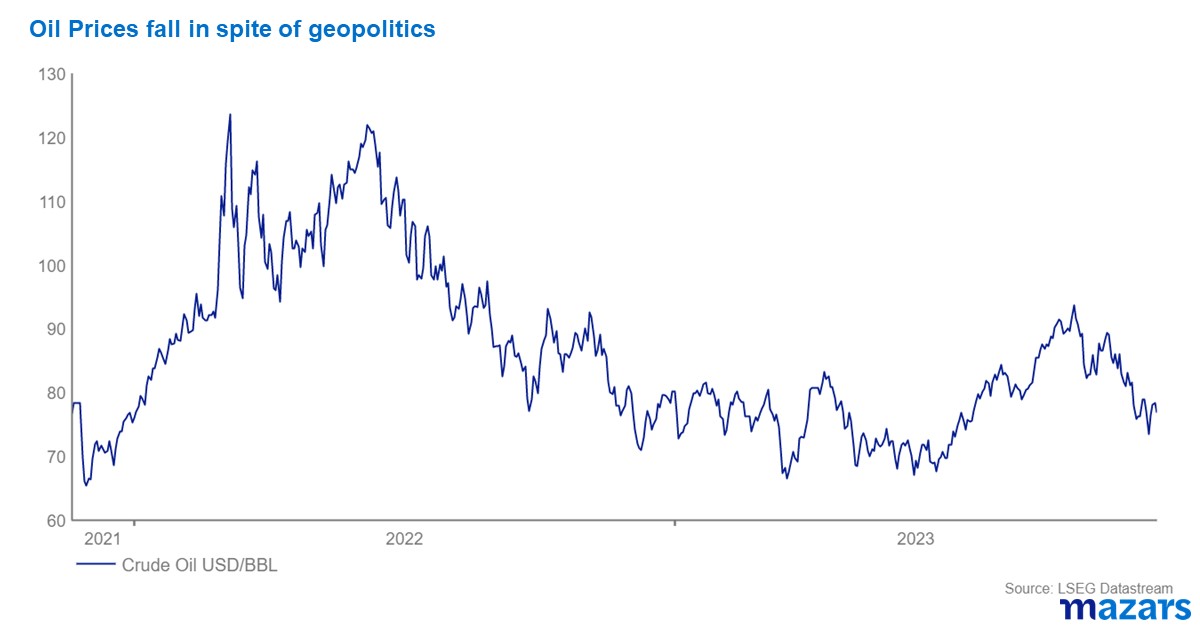

Oil prices fall despite geopolitics

Oil prices fall despite geopolitics

Having lived through this, one might be forgiven for expecting the same, after hearing of tensions in the Middle East. However, in many ways, the opposite has happened. Since October 7, oil prices have fallen by 8%, from $83 per barrel to $76 per barrel.

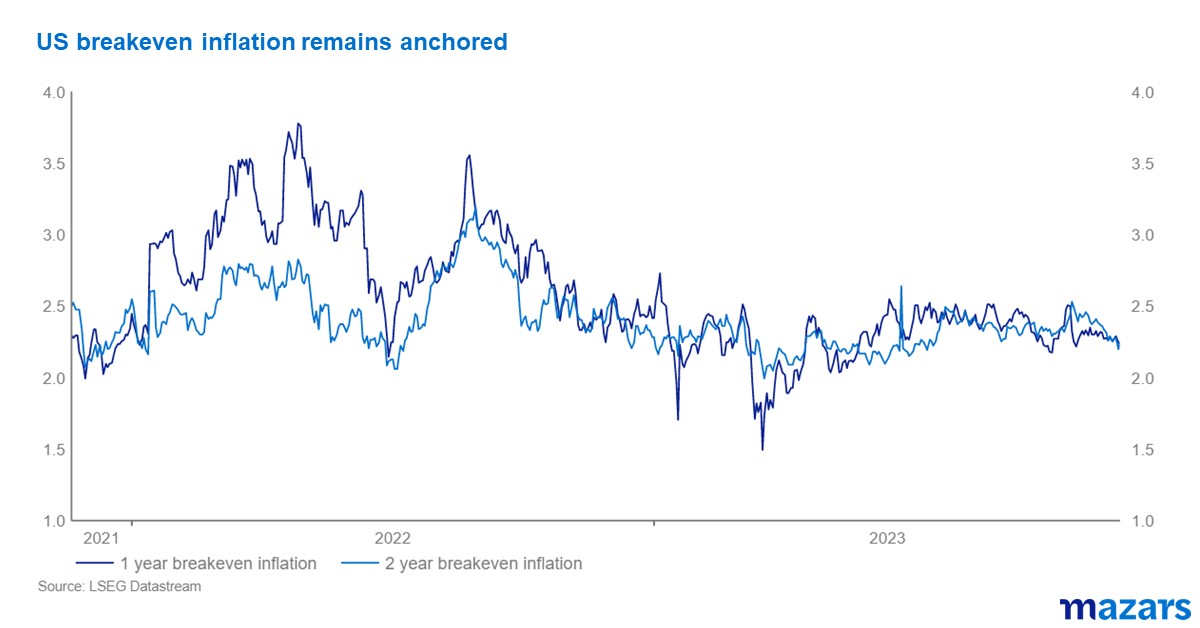

Moreover, breakeven inflation rates, which measure the difference between yields on regular bonds and inflation linked bonds barely budged, showing that bond markets were wholly unfazed by the prospect of current events leading to a spike in inflation.

So why are things different this time? It turns out that the situation is quite different from what we had in 2022.

One reason is the specifics of the actual war at hand. No two wars are the same, and many geopolitical analysts have argued that the further escalation of tensions in the Middle East could be a tail risk. For now, significant parties still retain powerful incentives to avoid the war spreading to a wider region. This appears to be the view of the oil markets so far.

The other side of it is that war is only one of many factors impacting oil prices. On the downside, factors include:

- Oil demand in China is facing headwinds, as post-covid ‘revenge travel’ is fading and profit margins at refiners wane

- With a disinversion of the US yield curve underway, a US recession in the near to medium term remains a distinct possibility which could cause a collapse in oil prices.

- The long term trend of peak oil remains

While the US has indicated that it is prepared to replenish its strategic petroleum reserve, which currently sits at historical lows, it sits comfortably above the informal target of 90 days of net import cover. As we enter an election year it may come into question whether such a margin is necessary. External supply shocks could well be met by selling off the reserve to alleviate gasoline prices.

On the upside, Opec+ and Saudi Arabia have obvious incentives to support the oil price. Estimates show that Saudi Arabia needs oil at above $91 per barrel to avoid a budget deficit in the second half of the year. This means that production is likely to remain constrained going forward.

The conclusion is that energy markets so far appear to have been correct in not overreacting to the war in the Middle East. However, that doesn’t mean that the risk hasn’t changed. The effect of the war is to increase the risk at the margins – the tail risk. A fatter-tailed distribution means that investors should exercise caution and hedge against the possibility of >3 standard deviation events.

Tao Yu, Quantitative Analyst