As inflationary pressures mount, the Bank of England and the Fed made an about-turn and now pursue more aggressive strategies to combat inflation. The UK is experiencing the highest inflation in a decade. Global inflation momentum is akin to the early 70s. The confluence of rising prices, a possible ending of pandemic restrictions and accommodative fiscal policy suggest that we have entered a period of higher rates, and more rate uncertainty. Currently, markets are pricing in around six 0.25% interest rate hikes until the end of 2022. If it holds true, it will be the steepest (and in essence the first) rate hike cycle in nearly sixteen years. However, we also note the Bank’s stated intention to curb wage pressures by communicating rate hikes. It is possible, officials are using a more hawkish tone than perhaps the Bank’s underlying intentions.

When will inflation ease?

It has been nearly fifty years since developed markets experienced a similar inflation rise to that in 2021-22. It becomes apparent that only major global events can cause such sharp rises in price. The response by all nations to the pandemic, which essentially meant shutting production and curtailing movement, had about the same effect as wars of the past.

We believe that

- When inflation is concerned, everyone is a novice. Especially since such a fast build-up of prices hasn’t happened in fifty years. This means that central banks and policymakers are likely to get it wrong before they get it right.

- Inflation is everywhere and always different. Each major episode has significant differences from the past. It is really the first time that this event did not involve some sort of general conflict, in over one century of data.

- Supply disruptions historically cause much more inflation than demand surges. This sort of inflation is caused mainly by disruptions, a major departure from the status quo. When western governments closed borders and shut off production, they were responding to a crisis, but they never thought they would have to deal with such a disruption.

There’s a strong possibility we may see the end of the episode soon. We are already ten months into this event. Historically, all of the events described lasted about 11-14 months. The underlying infrastructure has not been destroyed, just hobbled from erratic demand and supply. We have evidence that supply chains are mending and adapting.

Vaccination levels are high in many parts of the world, and more cures are made available. One after another, western governments declare their intention to drop measures and movement limitations. In all probability, the “Great Lockdown” is well behind us.

As for demand? We don’t feel that demand conditions will persist over the longer term. The current propensity towards higher wages is a confluence of pandemic-related dwindling labour supply and panic from rising supply-side inflation. As the pandemic recedes, both of these two factors should ease. As for consumer demand? We don’t have any evidence that would suggest that the pre-pandemic “Secular Stagnation” backdrop of consumer behaviour has changed materially.

The larger question is whether there can be a global policy approach to repair damaged supply chains quickly. This would entail lifting travel bans, tariffs, taxes, barriers to facilitate a speedy recovery of goods and services in their pre-pandemic condition. We feel that, given the current geopolitical environment, this is a very low probability event. Thus, on the one hand, the rate by which prices rise could start to decline by the next quarter, if history is any guide. On the other, however, supply chains could take long to mend, and overall price levels could remain elevated versus pre-pandemic numbers.

How will rate hikes in 2022 affect the wider economy?

We feel that there will be a lot of policy uncertainty in the near future. If the underlying consumer psychology is one of secular stagnation, then once supply pressures are relieved inflation could drop as swiftly as it rose, certainly before a series of aggressive hikes is completed. Still, consumption should be impacted adversely, albeit marginally, because the impact on homeowners will be spread out over a period of twelve to eighteen months. Overall, rates of 1% in and by themselves will not present a great challenge. But if one adds inflation and higher taxes, we see higher rates as further exacerbating consumer sentiment and propensity to buy.

Who will be impacted the most?

There is likely going to be a measurable impact on consumers, especially homeowners with a mortgage. The impact will be spread out, because 80% of all mortgages in the UK are fixed rate. However, the bulk are refinanced every two to five years, so within the space of twelve months, possibly 35%-40% of mortgage holders will face the effect of higher rates. Lower consumption might have an impact on the top line (revenue) earnings of businesses and could further supress margins.

Conversely, the banking sector, which borrows over the short term and lends over the longer term, should benefit from rising rates.

In terms of bigger investments on the UK, higher rates ahead of the rest of the world would put upward pressure on the Pound. Institutional investors could become more apprehensive and choose other markets where rates are more predictable, and currency will be lower. This could impact support for Sterling assets, stocks, bonds, and cash holdings. Having said that, the impact will be marginal. We don’t believe international investors will give up on the UK after this. The country’s track record and G7-economy-status will probably redeem decision-makers in Threadneedle St.

Who will be impacted the least?

People and businesses which just refinanced for a period of five years should see the least impact in terms of debt. Also sectors where financing terms are fixed in general. Companies that have lower leverage (debt), like tech, should see only pressure from an earnings perspective, not interest payments. Other sectors that should experience lower impacts would include consumer staples, healthcare, utilities and generally sectors where demand is stable.

How about Brexit? Is it still important?

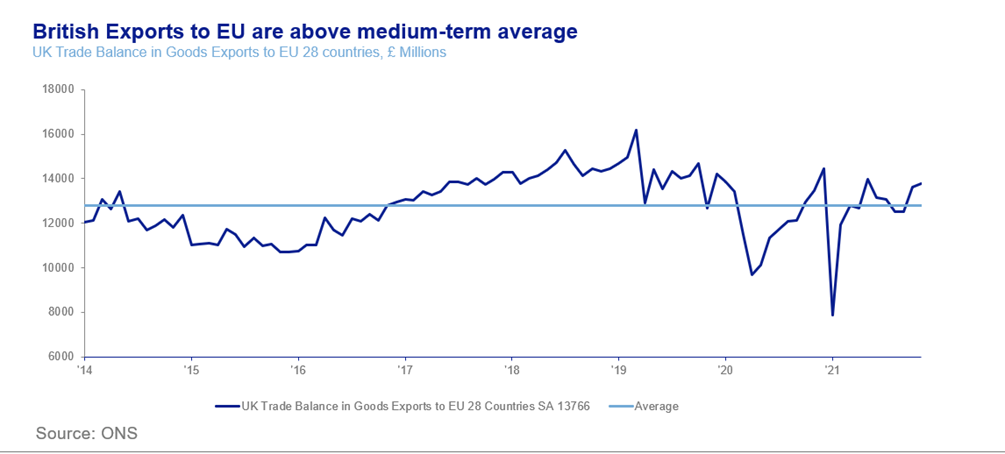

Brexit negotiations continue and the Financial sector’s fate is still hanging in the balance. Recently, EU commissioner McGuiness said that he should expect all Euro/Dollar transactions to be cleared in the continent and not London by the end of 2025. This should have a significant impact on the City. Having said that, however, moving jobs over the channel has proven, for many companies, more difficult than expected. Culture and infrastructure issues make experienced employees less willing to move. Additionally, we see that exports to the EU are back above pre-pandemic and pre-Brexit levels. This tells a story of supply chains, clients and businesses finding ways to overcome red tape and pandemic-induced supply/demand shocks. This makes us more optimistic, in the sense that the fate of business is not inextricably bound to policy decisions.

Get in touch

If you would like to get in touch about anything mentioned in the article above, please use the contact form below.

Get in touch