Which companies are in scope for reporting?

For accounting periods beginning on or after 1st January 2021, the FCA required UK premium listed companies to produce TCFD-aligned disclosures on a “comply or explain basis”. This was extended to standard listed companies, global depository receipts, asset managers and certain asset owners for accounting periods beginning on or after 1st January 2022.

For accounting periods beginning on or after 6th April 2022, the UK government (through the Companies Act 2006) brought in mandatory Climate-related Financial Disclosure Requirements (CFD) for companies meeting the following thresholds:

All UK companies that are currently required to produce a non-financial information statement, being UK companies that have more than 500 employees and have either transferable securities admitted to trading on a UK regulated market or are banking companies or insurance companies (Relevant Public Interest Entities (PIEs)); |

UK registered companies with securities admitted to AIM with more than 500 employees; |

UK registered companies not included in the categories above, which have more than 500 employees and a turnover of more than £500m; |

Large LLPs, which are not traded or banking LLPs, and have more than 500 employees and a turnover of more than £500m and; |

Traded or banking LLPs which have more than 500 employees. |

What is the CFD and how does it relate to the TCFD?

The CFD refers to the climate-related financial disclosures added by the UK government into the Companies Act 2006. The disclosures are based on the 11 recommendations of the TCFD, and so there is significant overlap and comparability between the reporting requirements.

Disclosing in line with the TCFD’s recommendations on best practice is highly likely to fulfil the requirements of the CFD, but it should be noted that disclosure with the CFD is not on a “comply or explain basis” and so organisations are advised to confirm that their disclosures meet the requirements.

My organisation is new to TCFD reporting and conducting scenario analysis – where do I start?

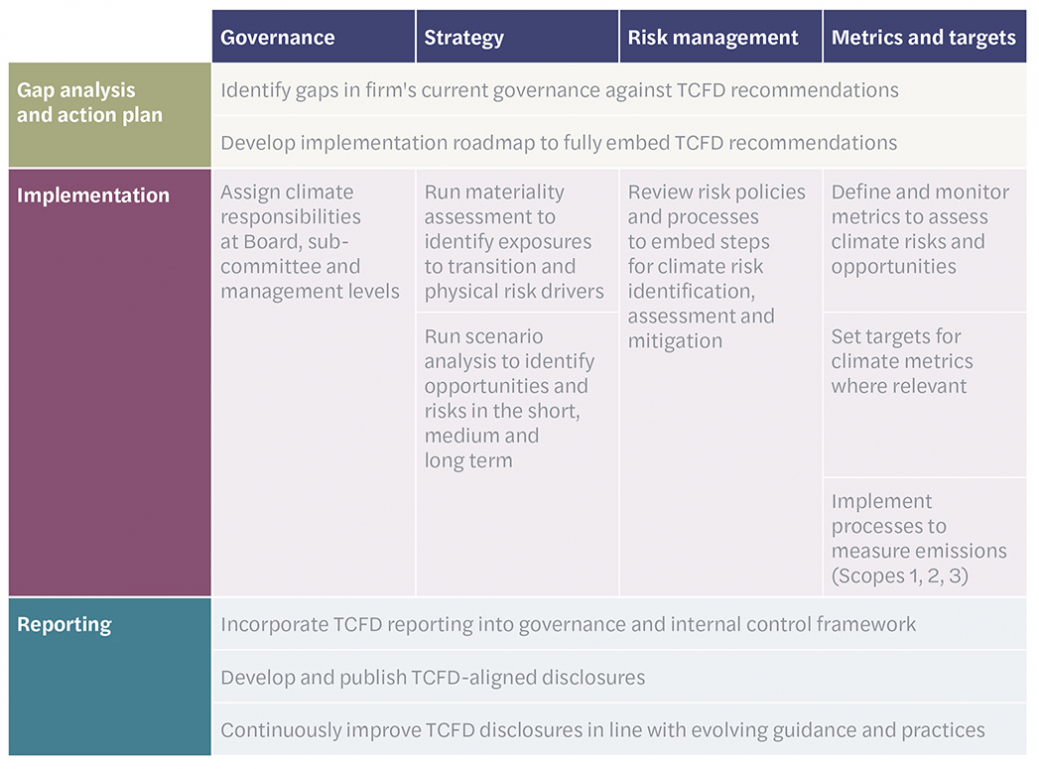

TCFD reporting is a journey and organisations are not expected to be perfect in the first year. The key is to be transparent about what you have not yet done, the assumptions or proxies that you have used, and the timebound improvements that you intend to implement for future reporting cycles.

Providing users with an understanding of the potential financial impacts of climate-related risk on your organisation is the crux of the TCFD. As such, the first step is to conduct a materiality assessment of the climate-related risks and opportunities which are likely to be the most disruptive to your organisation.

Conducting quantified scenario analysis will help to inform your assessment of the materiality of these risks. Even if you have not collected the full suite of required data in-house, you should look to add some quantification to your materiality assessment by relying on proxies and industry benchmarks in your first reporting year, which can be substituted with internal metrics in later reporting cycles.

For further information contact us today.

How does the TCFD relate to other reporting frameworks?

There is a high degree of alignment between the recommendations of the TCFD, international reporting requirements and potential future UK reporting requirements.

The climate change standard (E1) of the Corporate Sustainability Reporting Directive (CSRD), which applies to many organisations in Europe, is heavily based on the recommendations of the TCFD. As such, reporting in line with the TCFD will help UK organisations to fulfil the requirements of European parent companies or European companies that they supply to.

The International Sustainability Standards Board’s (ISSB) Sustainability Disclosure Standard S2 also exhibits strong alignment with the TCFD, and given the possibility of this being embedded into UK law in the coming years, reporting against the TCFD now will prepare organisations for what is to come.

This website uses cookies.

Some of these cookies are necessary, while others help us analyse our traffic, serve advertising and deliver customised experiences for you.

For more information on the cookies we use, please refer to our Privacy Policy.

-

This website cannot function properly without these cookies.

-

Analytical cookies help us enhance our website by collecting information on its usage.

-

We use marketing cookies to increase the relevancy of our advertising campaigns.