Corporate tax residence issues arising from remote working

Corporate tax residence and remote working

Covid-19 related or not?

The negative impact of Covid-19 on many countries’ GDP means that Governments and their revenue authorities are considering how to both stimulate their economies to reinvigorate growth and protect tax revenue in the face of potentially costly Covid-19 rescue packages.

In view of these developments, now is a good time to revisit your businesses’ corporate tax residence to ensure that the company is subject to tax in the correct jurisdiction and its income is not taxed more than once.

What is corporate tax residence?

Corporate residence is typically governed by two factors: where a company is incorporated and where it is centrally managed and controlled. Where a company is tax resident is the basis for subjecting the company to tax on its profits in the majority of jurisdictions. A company may be dual resident under the local rules of two jurisdictions, which can often be settled by a tie-breaker clause in the relevant double tax treaty.

An overseas-incorporated company is UK tax resident if its central management and control (CMC) is located in the UK and there is no other tax treaty rule to override this. Similarly, a UK-incorporated company is prima facie UK tax resident, unless its CMC or place of effective management (POEM) is located outside the UK and a tax treaty overrides the principle of UK-incorporated companies being taxed in the UK. POEM would usually be located in the same country as CMC but may be located at the company’s true centre of operations, whilst CMC could be exercised elsewhere. The difference between the two does not impact the conclusions of this article.

In the UK, HMRC has indicated that the question of a company’s location of corporate residence is one of fact, and that in relation to UK tax residence, “…occasional UK board meetings, or participation in such meetings from the UK, does not necessarily result in central management and control abiding in the UK….”

As noted above, it is possible for CMC to be located in more than one jurisdiction, and many of the UK’s tax treaties contain a tie-breaker based on POEM, which can only be in one place at a time. There are a range of established tax cases in the UK dealing the determination of tax residence, and a number of jurisdictions are tightening their approach to corporate tax residence in their jurisdiction through more strict requirements concerning the presence of ‘economic substance’. Pre-Covid-19, there had been ever-increasing focus on this area due to the OECD’s initiative on Base Erosion and Profit Shifting (BEPS) in any case.

Even where there has been no change in corporate tax residence, it may also be necessary to consider whether a permanent establishment (PE), and hence a taxable presence, has been created in new locations due to the Covid-19 crisis. For example, board members, senior executives, sales staff and other workers may be stranded in a country where they do not usually work due to enforced travel restrictions or may be working from home in a country where they would not usually carry out aspects of their role. In the UK, as in many other jurisdictions, a PE exists if business is carried on through a fixed place of business in the UK, or an agent acting on behalf of the company has, and habitually exercises, authority to carry out the company’s business in the UK.

The UK Government has indicated that “…The presence of individuals in the UK as a consequence of Covid-19 raises questions about whether foreign companies could establish a taxable permanent establishment for UK corporation tax purposes…”.

But what exactly does “as a consequence of Covid-19” mean, and how far could this boundary be tested by Revenue Authorities seeking to protect tax revenue streams in the current climate?

Are current business arrangements temporary or are they the “new normal”?

Increased use of technology and changing lifestyles mean that business can be carried out in different locations, as is clearly demonstrated by the international effort to reform tax rules to cope with the digital economy. This could lead non-digital businesses to conduct business in jurisdictions in which they have not traditionally operated.Travel and movement restrictions arising from Covid-19 may have forced individuals, including senior business decision makers, to operate from non-traditional locations.

These changes may result in a gradual shift in the locations in which business is normally carried out. This may challenge the pre-existing view of established corporate tax residence. While Revenue Authorities, including the UK, have indicated they may adopt a sympathetic stance to exceptional changes arising from Covid-19 related causes (see our blog), the facts may indicate that something more than Covid-19 is causing business operations to be performed in different jurisdictions as companies move towards a “new normal”.

What can be done to manage or mitigate unexpected corporate tax residence risks?

Retaining good records which document the reasons for business decisions being taken in a particular jurisdiction will be key. However, the economic and general business disruption caused by Covid-19 may mean that traditional record-keeping tasks and processes are not keeping pace with developments.

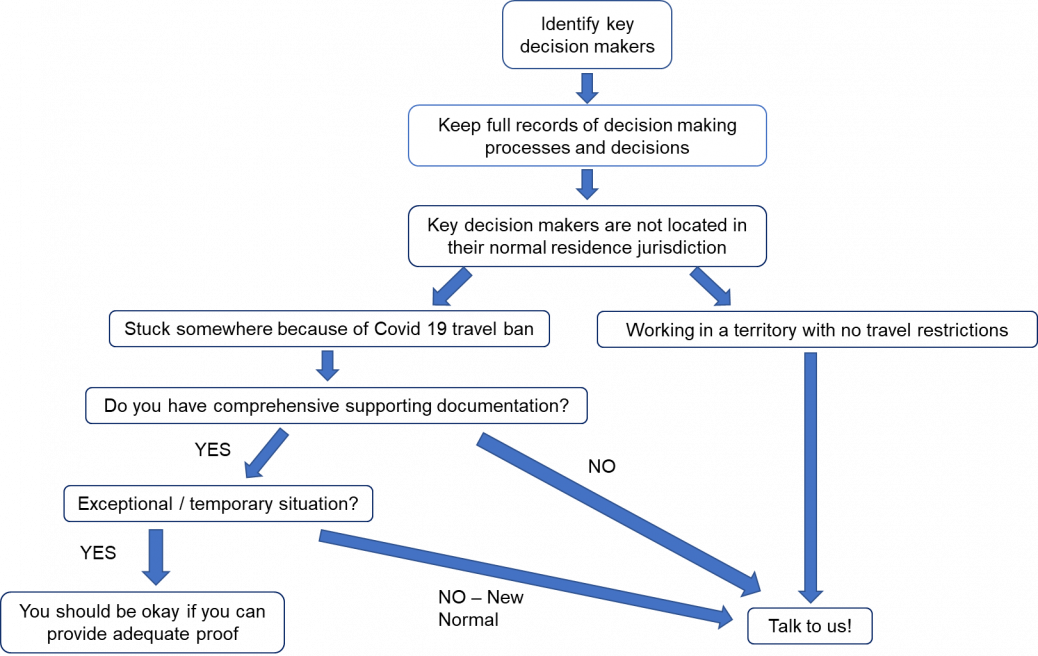

The flow chart below illustrates some of the outcomes for business arising from these circumstances.

In most cases, we recommend seeking advice on corporate tax residence issues. In the context of identifying corporate tax residence, Mazars has an international network that can help you:

- review current operational practices;

- review, collate and record information that demonstrates where your business functions are conducted;

- resolve corporate tax compliance and governance issues that arise from changes in corporate tax residence and business establishment in a new jurisdiction; and

- advise on areas where improvements could be made.

In contentious cases, we have a network of tax dispute resolution specialists who are experienced in settling corporate tax residence disputes through both international mutual agreement procedures (MAP) and/or domestic recourses. Adopting the right behaviour early on and collating the appropriate evidence in advance could expedite the resolution of subsequent disputes.