Flexible Furlough

Flexible Furlough

The Government has updated the rules of the CJRS to include flexible furlough to help employers bring staff back to work as their business requires and to help ease the support offered centrally from Government.

In summary, there will be two Furlough CJRS “arrangements” as of July 1st:

- Full Furlough (available since 1st March) where an individual does no work and is furloughed fully.

- Flexible Furlough – where the employee returns to work for a proportion of their contractual hours only.

This has made the CJRS process more complex as both wages and working hours need to be calculated when on Flexible Furlough.

Calculating a Flexible Furlough CJRS Wage claim

As a brief reminder, the calculation for employees on full furlough is based on:

- Calendar days;

- Their normal taxable pay as at 19th March 2020 (calculation dependent on whether the employee is considered a variable pay or salaried worker); and

- Capped at a maximum of 80% or £2,500 per month (whichever is lower).

For those moving to a Flexible Furlough arrangement from 1st July, the calculation will not just be based on calendar days, it will be based on actual working hours and the calculation will vary depending on whether the individual employee is contracted for a “fixed” or “variable” number of hours in a pay period. An employee will be a variable hours worker where:

- They are not contracted to a fixed number of hours; or

- Their pay depends on the number of hours they work.

If neither of these apply, they will be a Fixed Hours Flexible Furlough Worker.

Working out a Flexible Furlough workers' hours of work

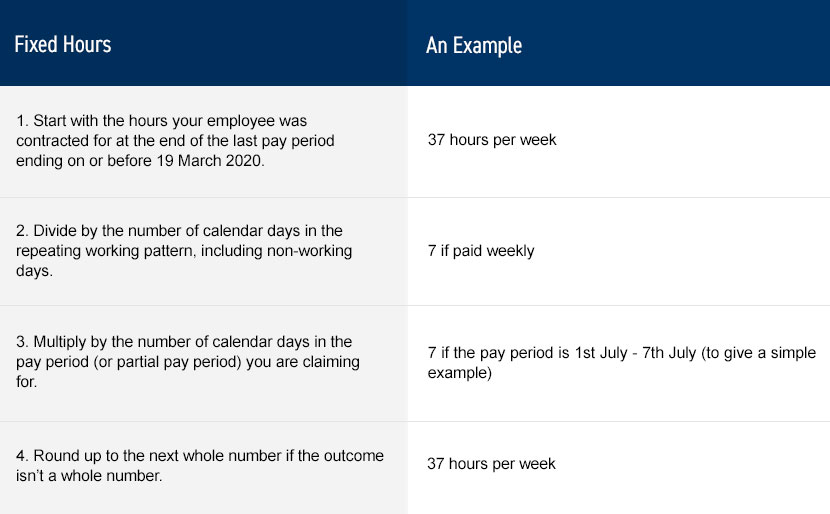

1. A Fixed Hours Flexible Furlough Worker

If an employee with fixed hours was on annual leave, off work sick or on family related statutory leave at any time during the last pay period ending on or before 19 March, the usual hours should be calculated as if the employee had not taken that leave.

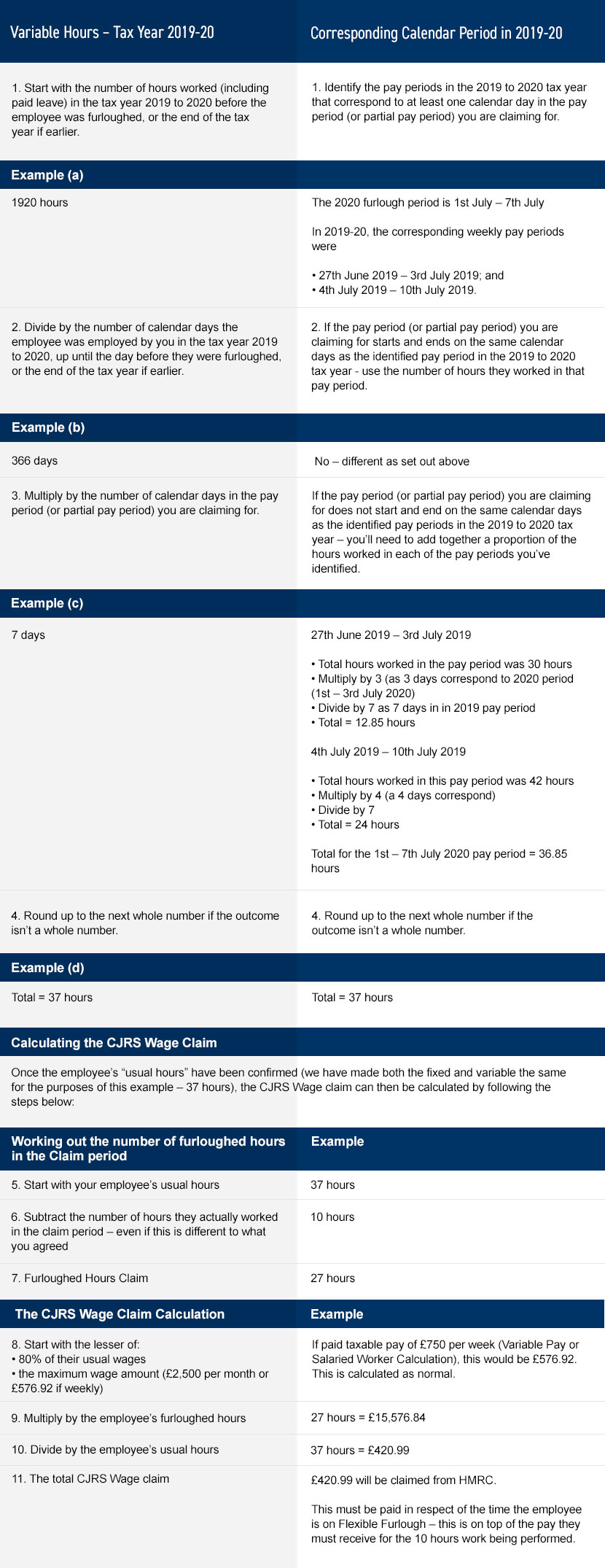

2. A Variable Hours Flexible Furlough Worker

The ‘usual hours’ for a variable hour worker will be calculated based on the higher of either:

- the average number of hours worked in the tax year 2019 to 2020; or

- the corresponding calendar period in the tax year 2019 to 2020

The usual hours should include any hours of leave for which the employee was paid their full contracted rate (such as annual leave) and any hours worked as ‘overtime’, but only if the pay for those hours was not discretionary.

Where an individual employee has been flexibly furloughed, the calculation will for CJRS NIC and Pension support is different to someone who has been fully furloughed.

The key differences are:

- The Class 1 Employer NIC threshold needs to be reduced by the hours on furlough before undertaking the calculation; and

- You use the Gross CJRS Wage Grant for the Employer NIC calculation rather than the Total Pay

- The Pension threshold needs to be reduced by the hours on furlough before undertaking the calculation.

An example of this would be as follows:

- Employer NIC Threshold for a weekly paid employee = £169

- Divide by 7 (the number of days in the pay period)

- Multiply by 7 (the number of days in the furlough claim)

- Divide by 37 (the employee’s usual hours in the claim period)

- Multiply by 27 (the hours the employee is furloughed in the claim period)

- The adjusted NIC threshold is £123.32

The employer’s CJRS NIC grant would then be calculated (using our example above) as follows:

- Start with £420.99 (the amount of the CJRS Wage Grant)

- Less £123.32 (the adjusted NIC threshold)

- Multiply by 13.8%

- The employer can make a CJRS NIC claim of £41.07

This would also work in the same manner for the CJRS Pension calculation too, albeit with different weekly and monthly thresholds.

What other changes are taking place?

As announced by the Government previously,

- From 1st August, employers will not be able to claim CJRS grants towards employer NIC and Pension costs;

- From 1st September, the CJRS wage claim support will reduce to 70%, or £2,187.50 (whichever is lower) – the employer will still need to pay the 80% (or £2,500); and

- From 1st October, the CJRS wage claim support will reduce to 60%, or £1,875 (whichever is lower) – the employer will still need to pay the 80% (or £2,500).

To work out the CJRS wage claim for September and October, the employer will therefore need to:

1. Start with the amount of minimum furlough pay (whether Flexible or Fully Furlough).

2. Divide by 80.

3. Depending on which month you’re claiming for, multiply by:

- 70 for September

- 60 for October

This will then leave the amount to be included on the CJRS Wage claim submission. It is important to remember that the furloughed employee must be paid the minimum (80% / £2,500) before the adjustment for the 70% and 60% amendment.

The Government has confirmed (as much as it possibly can) that the CJS arrangement will come to an end on 31 October 2020.

Other aspects to remember

As previously announced, the only employees that can be included in a CJRS claim from 1st July will be those who were employed and on a payroll submission for their employer on or before 19th March and who were furloughed prior to 11th June 2020 (unless they have returned from parental leave).

Additionally, the CJRS claim will be capped from 1st July. This means that if 100 employees were included in April’s CJRS claim, 80 in May’s and 95 in June, the maximum number of employees that can be included in a claim in July will be 100, even if more have been put on furlough that could have been included in the CJRS claim. Employers will therefore need to consider how this interacts with business decisions, who to put on furlough and who to claim for.

Finally, where employees go on Flexible Furlough, employers will need to ensure a Legal Flexible Furlough Agreement is entered into.

What should employers do now?

PLAN!

This is where Furlough and CJRS gets tactical, complex (even more so than before) and extremely detailed.

Employers need to model scenarios to manage costs in the most effective way as well as think how these potential scenarios interact with working practices and their employees:

- Can they flexibly furlough everyone?

- What would be the cost of this?

How we can help

If you would like more information regarding the above, please do not hesitate to get in touch: