Joint Audit in the UK

Joint Audit is a tested and proven mechanism to facilitate the emergence of a diverse audit sector and, in the case of France, has already led to the creation of the least concentrated audit market of any major economy. If undertaken in the right spirit of collaboration, we believe joint audit reinforces governance arrangements on the conduct of audits and delivers real improvements in audit quality.

What is it?

A joint audit is where two separate audit firms are appointed by a company to express a joint opinion on its financial statements.

- It is fundamentally different from a ‘dual’ audit (or ‘shared’ audit) whereby one audit firm (or sometimes more) auditing parts of a group reports to another audit firm that ultimately signs off on the group audit.

- Statutory joint auditors MUST belong to separate audit firms. Joint audits usually involve two audit firms but a small number of companies have decided voluntarily to appoint three audit firms to perform their joint audit.

Why are we talking about it now?

The UK audit sector has been subject to close scrutiny over recent months, thanks in part to high profile failures such as Carillion, as well as an acknowledgement that the market is overwhelmingly concentrated among just four firms.

There are multiple reviews underway, each looking at particular elements which affect the industry. One such review is being conducted by the Competition and Markets Authority (CMA), which is responsible for ensuring that the UK business environment is fair and equitable. The CMA's initial recommendations identify Joint Audit as a potential solution to many of the problems which exist in the audit sector.

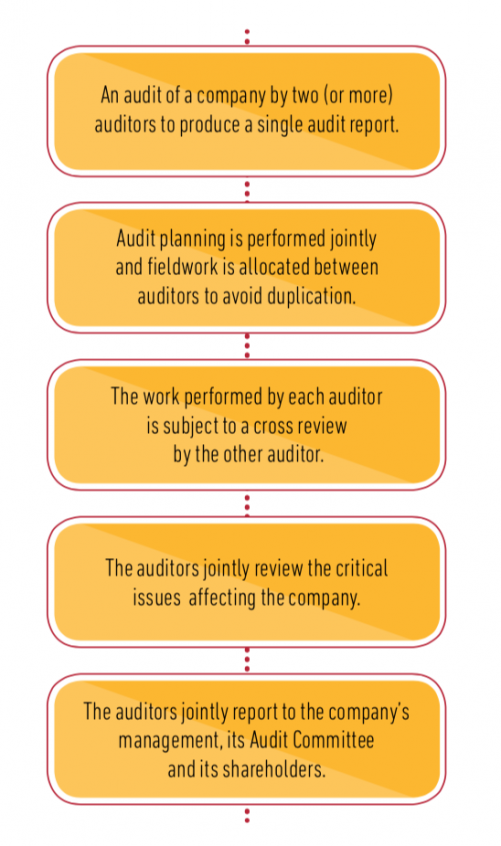

How does it work?

Who uses it?

Joint audit applies in a number of situations:

- Joint audit is mandated in France for all companies required to prepare and publish consolidated financial statements (with an exception for small groups), as well as for banking entities with total assets in excess of €450m. In France, within large groups, joint audit applies to, at least, the ultimate holding company (for the audit opinion in respect of both its individual entity and consolidated financial statements) and to all their French subsidiaries subject to a separate requirement to prepare a sub-consolidation. Within such groups, it is, however, possible for joint audit to be extended in practice to material subsidiaries in France and if felt appropriate abroad as well, even if they are not subject to any separate requirement for preparation of sub-consolidations.

- Joint audit is mandated in various countries for large banks or insurance companies, such as in South Africa for large banks.

- Joint audit can be (and is) performed as a voluntary arrangement for groups or even for individual companies, notably across Europe, including in the UK. Joint audit is fully compliant with ISA 600 (Revised), “The Work of Related Auditors and Other Auditors in the Audit of Group Financial Statements”.

Why is it being recommended for the UK?

In its latest report (18 December 2018), the CMA states that “competition, enabled by regulation, should ensure that firms and individuals succeed financially and reputationally if they produce the highest quality over and above the minimum standards. In order to create the strongest possible incentives for highly competent, professionally sceptical audits, competition must be focused on quality, and there must be sufficient choice of viable competitors over the long term”.

The CMA proposes that: "FTSE350 audits should be carried out jointly by two firms, at least one of which should be from outside the Big Four. This will give challenger firms access to the largest clients, while allowing for a cross-check on quality, as each auditor reviews the other’s work”.

From the perspective of companies in the market, joint audit:

- Enables companies to benefit from the technical expertise of more than one firm:

This is of particular value in the presence of complex reporting frameworks (such as IFRS or US GAAP), or in the case of complex businesses (such as banking, insurance, long-term contracts or businesses applying actuarial techniques), for which any one firm cannot necessarily provide the same auditing quality in all the countries in which the audited group is present;

- Serves “Coopetition” (cooperation + competition) between joint auditors:

This results in improved quality of service, i.e. the ability (1) to have recourse to each of 2 firms depending on their technical skills and geographical coverage, (2) to replace, during the course of an appointment, a firm for a particular group entity (e.g. in response to an issue of quality affecting a particular member of the firm’s network, or to the withdrawal of a firm’s licence for a particular country) without harming the consistency of a coordinated approach to the audit of the group, and (3) to obtain competitive tenders from each joint auditor in the event of increases in audit scope during the course of the group audit appointment (whether as a result of acquisition, new business creation or additional regulation);

- Leads to real debate on technical issues, in particular those resulting from regulatory changes, and offers additional scope for benchmarking; and

- Allows smooth and sequenced rotation of audit firms when deemed appropriate, so as to retain knowledge and understanding of group operations in a way that minimises the disruption caused when one of the audit firms is changed.