Joint Audit: The Facts

The two most common criticisms of joint audit are in relation to their cost and the additional risks involved. We strongly believe that both criticisms are totally unfounded.

“Joint audit is too costly”…

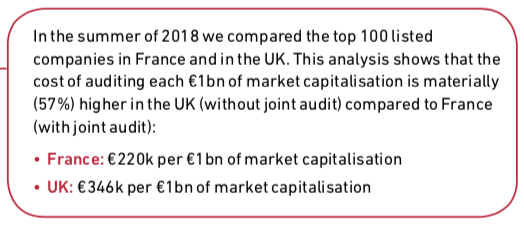

This provides a serious and factual rebuttal to the argument that joint audit may be more costly. In our opinion this is primarily due to the overall impact of greater competition in the market and the disappearance of at least part of the oligopoly premium observed where auditor concentration is highest.

We have also analysed the additional time costs incurred by the firms on joint audits. This analysis is provided as a download from this page. The evaluation of additional costs relating to joint audit (ranging from 2.5 to 5% of the total audit costs, was tested on two large listed groups ranking in the middle of the CAC40 index. This analysis was conducted from the actual fee budgets agreed upon for those two groups (by the joint auditors and the management and governance of each group), prepared from the global fee budget in hours, then valued in Euros, and finally translated in percentages terms for confidentiality reasons.

Certain work performed, and time spent, by the auditors are specifically brought about by the joint audit approach. Each auditor performs procedures specified in the standard of professional practice, including:

- Understanding its environment;

- Assessing whether there is a risk that the financial statements taken as a whole contain material misstatements;

- Determining the materiality threshold(s);

- Defining and documenting the audit approach in a concerted fashion;

- Conducting analytical procedures that allow the overall consistency of the financial statements to be reviewed;

- Reviewing the procedures performed by the other joint auditors;

- Most of the tasks brought about a joint audit situation add significant value, as they are dedicated to the “professional scepticism” necessary to express an audit opinion

- Ensuring that the information provided at the time the financial statements are approved, presents a true and fair view of the audited entity and is consistent with those financial statements; and

- Attendance of each joint audit firm at key audit meetings with management and those charged with governance.

Experience shows that the specific work described above ranges from 2.5 to 5% of the total audit cost for a large group, as joint audit adds about one quarter to one third to the coordination time required for a group audit, and group audit coordination itself represents about 10 to 15% of the total audit cost for a major group (the balance representing the audit time devoted to individual entities). This additional cost must be compared with the additional security provided by the “four eyes” principle and by the reciprocal review.

In practice the additional cost is borne by the audit firms involved rather than being passed on to the audited entity. Joint audit also creates a more competitive environment that is conducive to a reasonable price/volume balance for the market.

Even if there were an additional cost of joint audit if implemented in a new market it would be limited compared to alternative measures to diversify the audit market.

“Joint audit damages audit quality”...

In fact, and in our experience, joint audit increases audit quality:

- Joint audit is the application of the “two pair of eyes” principle to audits.

- It is when the two auditors compare notes and check each other’s work that real “auditor scepticism” occurs.

- Two auditors have more strength to challenge the management of an audited company on sensitive accounting treatments and, therefore, are more independent.

- In general, audited companies use the presence of the two auditors to take the best of each and to allocate the work in the best possible manner according to geographic coverage or technical expertise.

- IFRS are “principle-based” standards that require more judgment. Audited companies highly value having two experts’ opinions converging rather than only one on sensitive issues.

- Where joint audit is applicable, non-dominant audit firms have been able to invest in geographic coverage and expertise and become auditors of major global banks, insurers and high technology companies.