FCA Consultation Paper CP21/36 – A new Consumer Duty

As CP21/36 is close to 200 pages in length, we have summarised some of the key points below:

CP21/36 will be of interest to:

- regulated firms, including electronic money institutions, payment institutions and registered account information service providers

- consumer organisations and individual consumers

- industry groups/trade bodies

- policy makers and regulatory bodies

- industry experts and commentators, and

- academics and think tanks

Consumer Duty

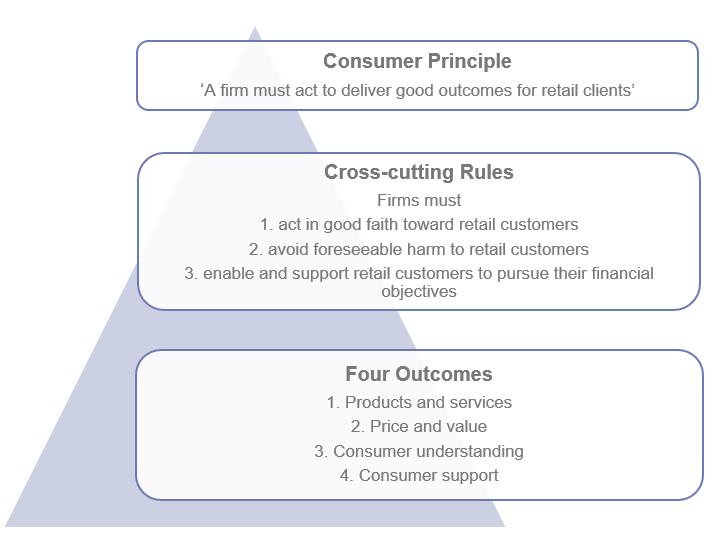

- The proposed structure of the Consumer Duty consists of 3 elements as per the diagram below:

Scope

- The Consumer Principle and the majority of rules and guidance relative to the Consumer Duty we be outlined within the FCA’s Principles for Businesses (PRIN) Sourcebook.

- Instead of applying the consumer duty to all retail clients, the FCA has decided that the scope of the Consumer Duty will be aligned to their existing Sourcebooks. In practice this will mean that the scope of the Consumer Duty for the Insurance sector will follow the position of the Insurance Conduct of Business Sourcebook (ICOBS) and the Consumer Credit Sourcebook (CONC) for Consumer Credit firms etc.

- It is proposed that the Consumer Duty should apply to prospective customers, such as those targeted by financial promotions.

- The Consumer Duty would be applied proportionately through the distribution chain, taking account of each firm’s role in relation to and the nature of the product or service itself. All Authorised firms that have an impact on consumer outcomes would need to comply with the Consumer Duty, but only in respect of their own retail business activities. Firms would not be required to oversee compliance by other firms in the distribution chain.

- The FCA is proposing to apply the Consumer Duty to firms doing regulated business in the UK – regardless of whether the firm has an establishment in the UK or is operating in the UK on a services basis. This will capture firms based in Gibraltar and those firms operating under the Temporary Permissions Regime.

Products and Services

- The Consumer Duty will not be applied retrospectively to firm’s past business activities.

- It will apply on a forward-looking basis to existing products and services that are either still being sold to customers or those that are now closed and no longer being sold or renewed.

- Firms will need to review their products and services to ensure these appropriately reflect all relevant aspects of the Consumer Duty before they can continue to offer these.

Consumer Principle

- The Consumer Principle seeks to impose a higher standard of conduct and the wording for the new Principle reflects the focus expected of firms on consumer outcomes: ‘A firm must act to deliver good outcomes for retail clients’.

- To manage the overlap between the new, higher standard set by the Consumer Duty the FCA will disapply both Principles 6 and 7 where the Consumer Duty applies.

- Principle 6 and 7 will therefore only continue to apply to conduct outside the scope of the Consumer Duty, for example certain SMEs and wholesale business.

Cross-cutting rules

- There are three cross-cutting rules:

- Act in good faith towards retail customers

- Avoid foreseeable harm to retail customers

- Enable and support retail customers to pursue their financial objectives

- These rules develop the FCA’s overarching expectations for behaviour through three common themes that apply across all areas of firm conduct. They set out how firms should act to deliver good outcomes, and inform and help firms interpret the four outcomes

Products and services outcome

The FCA requires products and services for retail customers to be fit for purpose. The proposals outline different requirements for firms in this regard, depending on their role in the distribution chain as either manufacturers or distributors.

Proposed rules for manufacturers:

- Develop an approval process for products or services

- Identify target market of consumers for whose needs, characteristics, and objectives the product or service is compatible

- Consider if there are any consumers with characteristics of vulnerability in the target market and take account of any additional or different needs of those consumers

- Test the product or service and ensure it is designed to meet the needs, characteristics and objectives of the target market

- Select distribution channels that are appropriate for the target market and provide adequate information to distributors to enable them to understand the product or service and the target market

- Regularly review the product or service and its distribution, and take appropriate action to mitigate the situation if they identify circumstances that may adversely affect their customers

Proposed requirements for distributors:

- Develop distribution arrangements for each product or service distributed

- Get information from the manufacturer to understand the product or service, its target market, and its intended distribution strategy

- Regularly review the distribution arrangements to ensure they are appropriate and if they identify issues, take appropriate action to mitigate the situation and prevent further harm

Price and value outcome

- The specific focus of the price and value outcome rules is on the relationship between the price the consumer pays to the overall benefits they can reasonably expect to obtain from a product.

- Manufacturers should assess fair value at the product or service design stage. This must include consideration at least of:

- The nature of the product or service, including the benefits that will be provided or that consumers may reasonably expect and their quality

- Any limitations that are part of the product/ service

- The expected total price that customers will pay

- Any characteristics of vulnerability in the target market for the product of service

- At the point of sale distributors should assess whether their own distribution charges represent fair value. Firms must not distribute a product or service unless they are satisfied that their distribution arrangements are consistent with the product or service offering providing fair value.

- Firms are expected to regularly review their value assessments to satisfy themselves that they provide fair value.

- Differential pricing between new and existing customers is allowed under the Consumer Duty if firms apply up-front discounting in a clear and transparent manner and firms can demonstrate they provide fair value for each group.

Consumer understanding outcome

- The FCA are not proposing to change the point at which a communication is regarded as providing advice. However, firms should take proportionate steps to communicate in such a way that is reasonably likely to be understood and that facilitates decision making.

- Firms should ensure their communications:

- Meet the information needs of customers

- Are likely to be understood by the average customer intended to receive the communication and

- Equip customers to make decisions that are effective, timely and properly informed

- Firms should also test their consumers understanding of the communications they send out and adapt where necessary to support understanding and good outcomes for retail customers.

Consumer support outcome

Firms’ customer service should enable consumers to realise the benefits of the products and services they buy and ensure they are supported when they want to pursue their financial objectives. To achieve this firms will need to ensure:

- They provide an appropriate standard of support to retail customers such that it meets the needs of customers, including those with characteristics of vulnerability

- Retail customers can use products as reasonably anticipated

- Retail customers do not face unreasonable barriers when they want to pursue their financial objectives, and

- Regularly monitor whether they are providing an appropriate standard of support that meets the needs of, and does not disadvantage, retail customers, including those with characteristics of vulnerability

Consumers in vulnerable circumstances

- The Consumer Duty rules reference consumers in vulnerable circumstances in a way that is consistent with the FCA’s guidance for firms on the fair treatment of vulnerable customers.

- Firms must take account of the diverse needs of their customers and consider whether their actions are likely to disadvantage a customer or group of customers, whether this relates to:

- customers that share protected characteristics under the Equality Act 2010

- discrimination under other anti-discrimination legislation, including in Northern Ireland, where the Equality Act 2010 does not apply, or

- the treatment of customers with characteristics, or in circumstances, which mean they are especially susceptible to harm, particularly when a firm is not acting with appropriate levels of care

Private right of action (PROA)

- The FCA has clarified that is has no plans to include this as part of the Consumer Duty as the existing redress framework involving the Financial Ombudsman is likely to be a more appropriate route for almost all consumers to seek redress.

Senior Managers and Certification Regime

- The FCA proposes amending the SM&CR rules by introducing a new rule applicable to all conduct rules staff where their firm’s activities are within the scope of the Consumer Duty.

- This new rule would replace the existing individual conduct Rule 4 to ‘pay due regard to the interests of customers and treat them fairly’ and will instead require all conduct rules staff within firms to ‘act to deliver good outcomes for retail customers’.

- Along with the new rule, obligations reflecting the Consumer Duty’s cross-cutting rules will be applied to conduct rules staff in a proportionate and reasonable manner based on an individual’s seniority and responsibilities within the firm in order to ensure that they:

- act in good faith towards retail customers

- avoid foreseeable harm to retail customers, and

- enable and support retail customers to pursue their financial objectives

Monitoring

- Firms will need to ensure that they are meeting their obligations under the Consumer Duty by:

- monitoring and regularly reviewing the outcomes that their customers are experiencing

- ensuring that the products and services they provide are delivering the outcomes that they expect in line with the Consumer Duty

- identifying and managing any risks to good outcomes for consumers

- Identifying where consumers are getting poor outcomes, and understanding the root cause

- having processes in place to adapt and change products/services or policies/ practices to address any risks or issues as appropriate, and

- being able to demonstrate how they have identified and addressed issues leading to poor outcomes

Next steps

- The FCA is seeking to receive feedback on CP21/13 by 15 February 2022 and expect to publish the policy statement summarising responses and to make any new rules by 31 July 2022. A shorter than usual deadline has been earmarked for 30 April 2023 for firms to ensure compliance with the Consumer Duty.

- The expectation is for the implementation to be iterative as the FCA will seek to learn from firms’ implementation and reviews of products and services and will consider providing regular updates on their views of implementation practices based on what they are seeing across the market.