Super deductions – now available to Corporate Landlords

The reliefs are available for companies (including Landlords) within the charge to Corporation tax.

We will be running a series of articles covering:

- Super deduction - An Introduction

- Obtaining a super deduction in a “pre-trading” period (eg in a development phase)

- Disposal of assets where super deductions were claimed

In this article, we are introducing super deduction reliefs entitled to Landlord corporates.

Super deduction – Introduction

This is an enhanced first year allowance (130%) available for qualifying plant and machinery expenditure which would ordinarily have qualified for 18% main rate writing down allowances.

There is also an enhanced special rate (“SR”) allowance at 50% for expenditure which would have otherwise qualified for the 6% special rate pool.

Historically, general exclusion to the reliefs prevented property lessors from claiming first year allowances on expenditure on plant and machinery used for leasing.

The recent amendment to the finance bill will mean that this exclusion will no longer apply and will enable Background plant and machinery (“P&M”) in leased buildings to qualify for a super deduction or an SR allowance would otherwise have been prevented.

This is a generous scheme which could offer significant benefits to landlords who undertake expenditure on their assets as well as those who purchase assets held as stock from developers.

Background plant or machinery

Background P&M for a building is plant or machinery of a type that might reasonably be expected to be installed in various types of building, and whose sole or main purpose is to make the building usable.

There are, however, some specific anti-avoidance exceptions that already apply for the purposes of the long-funding lease rules which will also be applicable for these purposes (for example, see CAA 2001 s70R and s70S). This change should result in most property landlords now being able to claim the enhanced relief.

A few examples of background plant or machinery as set out in SI 2007/303 include:

- heating and air conditioning installations;

- ceilings which are part of an air conditioning system;

- hot water installations;

- electrical installations that provide power to a building, such as high and low voltage switchgear, all sub-mains distribution systems and standby generators;

- mechanisms, including automatic control systems, for opening and closing doors, windows and vents;

- escalators and passenger lifts;

- window cleaning installations;

- fittings such as fitted cupboards, blinds, curtains and associated mechanical equipment;

- demountable partitions;

- protective installations such as lightning protection, sprinkler and other equipment for containing or fighting fires, fire alarm systems and fire escapes; and

- building management systems.

Examples of Background plant or machinery

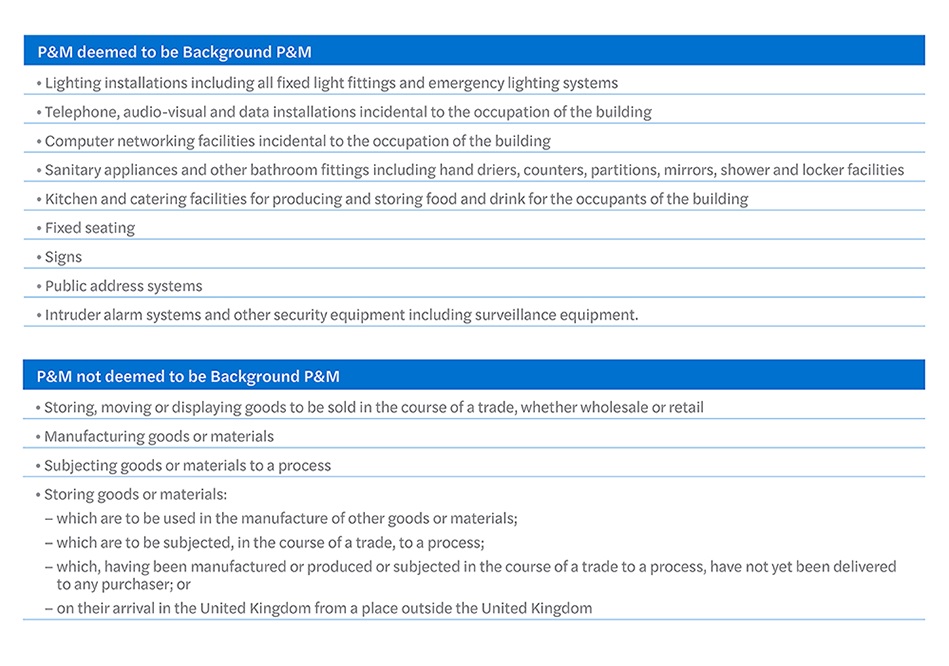

In accordance with guidance in SI 2007/303, we have briefly set out below a list as to what constitutes a deemed or not deemed background plant or machinery.

Get in touch

This can involve a complex analysis and planning to manage, so please do take further advice where necessary (please get in touch with Prasam Patel from our Real Estate Tax and Accounting team for further information).