General insurance (GI) pricing practices and product value: FCA new rules

GI pricing practices and product value

What is the issue?

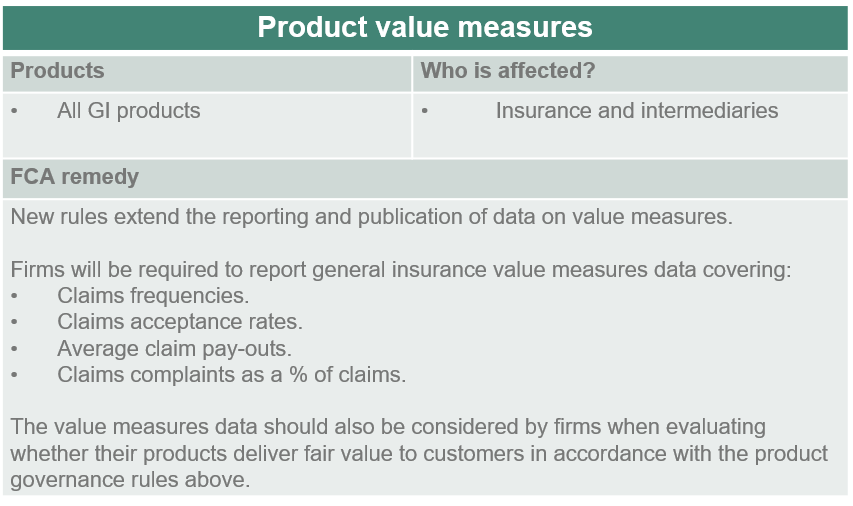

The FCA’s market study found that pricing practices are disadvantaging customers, particularly those who do not shop around for new deals. Poor product value was harming customers due to ineffective competition and a lack of common value measures.

New rules relating to pricing remedies are under consultation and the extended product value measures have been confirmed.

Who will come under the new rules?

Everyone involved in the manufacture and distribution of insurance products will have to comply. This includes Gibraltarian firms and those in the temporary permissions regime.

Likewise, all GI products, including add-ons and premium finance sold with them, are in some way affected.

When will the new rules come into force?

After the consultation ends on 25 January 2021, the FCA intends to publish a policy statement in Q2 2021. The new pricing rules will come into effect 4 months after the policy statement is published, so around September 2021.

The product governance requirements come into force from 1 January 2021. The new reporting rules for value measures data apply from 1 July 2021, with the first report due on 28 February 2022 for the period between 1 July 2021 and 31 December 2021.

This means firms really need to start preparing for these changes.