IFPR is applicable to all firms in scope of the Markets in Financial Instruments Directive 2 (‘MiFID 2’). This includes asset managers and investment firms carrying out activities such as transmission of orders in relation to financial instruments, execution of client orders, dealing on own account, managing portfolios, providing investment advice, underwriting financial instruments, and operating trading facilities. However, the most significant – designated - investment firms will remain under the same prudential framework as credit institutions, i.e. CRR/CRDV and future updates.

As the UK Regulators had a hand in developing the EU’s IFD/IFR, the intention was to retain their key principles for the UK regime and keep options open to reflect UK market specificities.

The FCA examined responses from both the industry to its Discussion Paper DP20/2, and European publications such as EBA’s Implementing Technical Standards and other guidelines in order to develop the IFPR.

IFPR video series

We have created some short, information videos outlining what you need to do to prepare for the introduction of IFPR.

View our video series here

The introduction of IFPR will see major changes in areas such as:

- Approach to risk and prudential assessment

- Capital requirements computation

- Minimum liquidity requirements

- Remuneration practices and policies

- Reporting and public disclosures

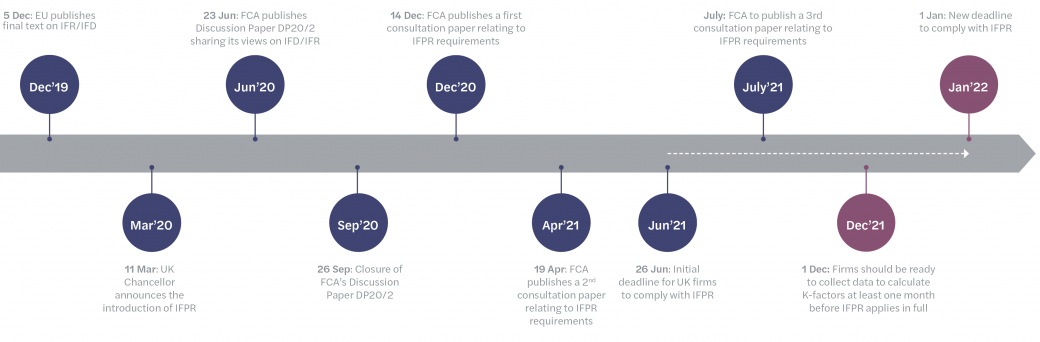

IFPR implementation timeline

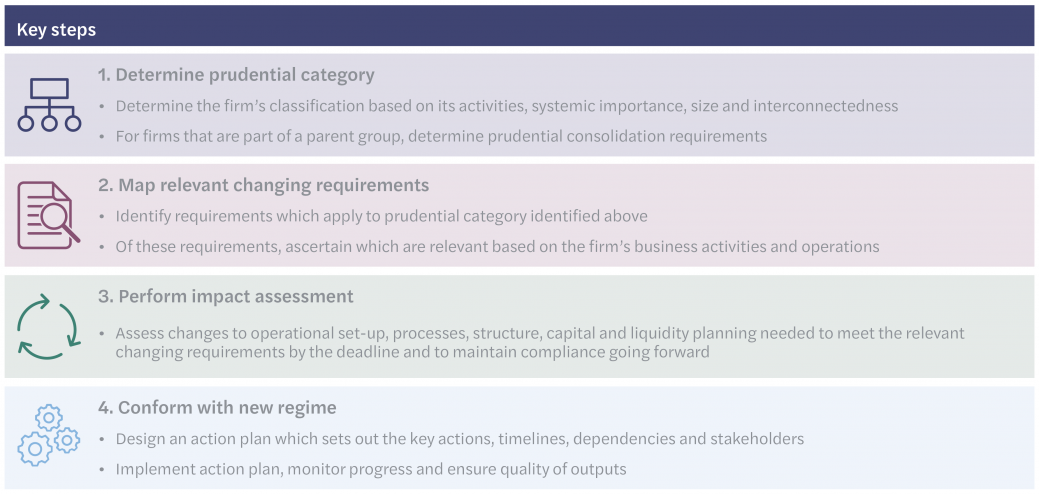

How MiFID Investment Firms should prepare

How Mazars can help

Our experienced prudential regulation and risk management specialists team draws upon their detailed understanding of prudential changes, regulatory expectations, and best practices to provide high-quality services tailored to support your transition to IFPR.

- Advice on a technical interpretation of the new prudential regime requirements

- Assess the impact and understand firm-wide opportunities, challenges and changes required

- Design and project manage an action plan

- Design and implement changes to processes, models, systems, and controls

- Post-implementation review of processes, reports, and documentation to assess and confirm compliance

- Deliver bespoke training to your teams to increase awareness around the new prudential regime

Get in touch